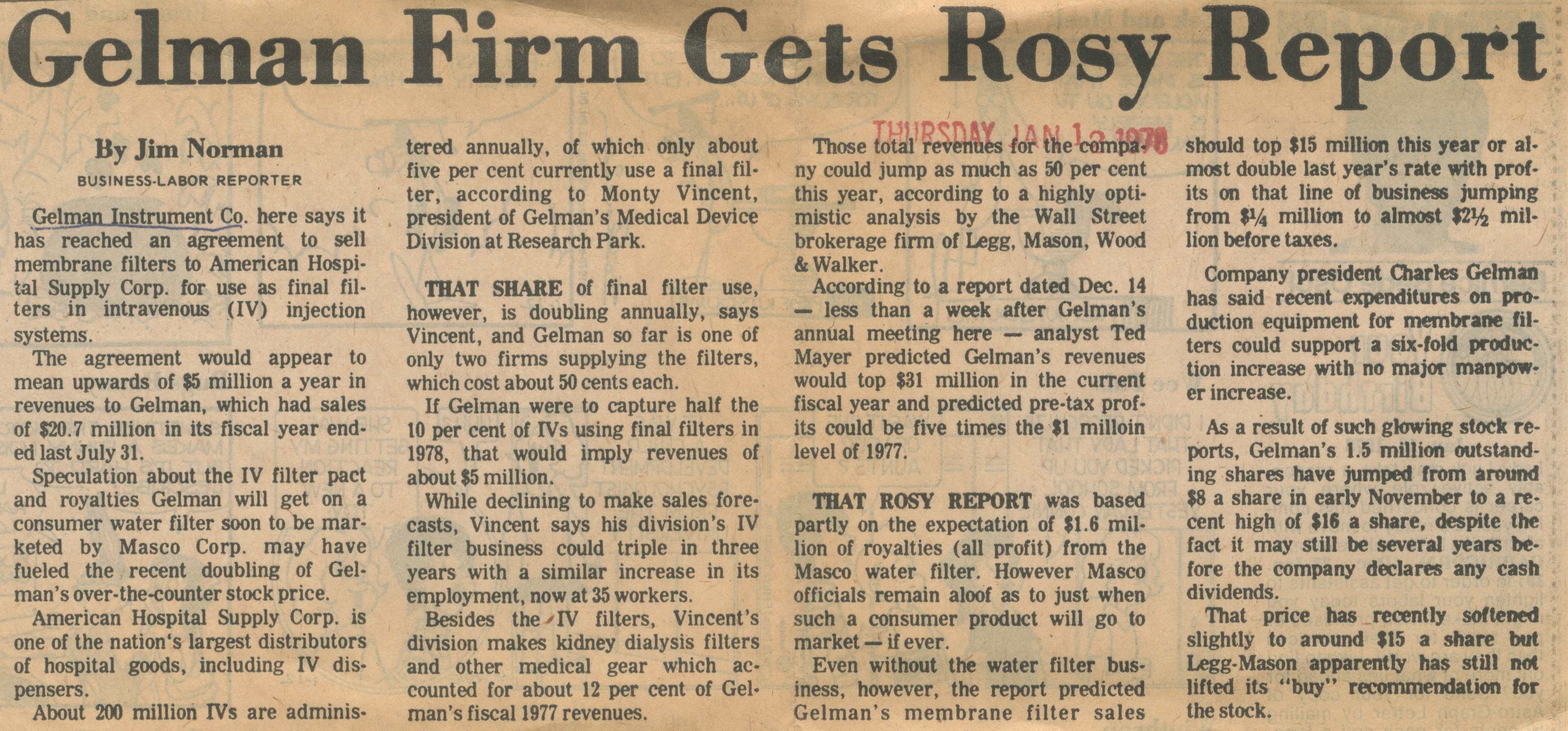

Gelman Firm Gets Rosy Report

Gelman Firm Gets Rosy Report

By Jim Norman

BUSINESS-LABOR REPORTER

Gelman Instrument Co. here says it has reached an agreement to sell membrane filters to American Hospital Supply Corp. for use as final filters in intravenous (IV) injection systems.

The agreement would appear to mean upwards of $5 million a year in revenues to Gelman, which had sales of $20.7 million in its fiscal year ended last July 31.

Speculation about the IV filter pact and royalties Gelman will get on a consumer water filter soon to be marketed by Masco Corp. may have fueled the recent doubling of Gelman’s over-the-counter stock price.

American Hospital Supply Corp. is one of the nation's largest distributors of hospital goods, including IV dispensers.

About 200 million IVs are administered annually, of which only about five per cent currently use a final filter, according to Monty Vincent, president of Gelman’s Medical Device Division at Research Park.

THAT SHARE of final filter use, however, is doubling annually, says Vincent, and Gelman so far is one of only two firms supplying the filters, which cost about 50 cents each.

If Gelman were to capture half the 10 per cent of IVs using final filters in 1978, that would imply revenues of about $5 million.

While declining to make sales forecasts, Vincent says his division’s IV filter business could triple in three years with a similar increase in its employment, now at 35 workers.

Besides the IV filters, Vincent’s division makes kidney dialysis filters and other medical gear which accounted for about 12 per cent of Gelman's fiscal 1977 revenues.

Those total revenues for the company could jump as much as 50 per cent this year, according to a highly optimistic analysis by the Wall Street brokerage firm of Legg, Mason, Wood & Walker.

According to a report dated Dec. 14 — less than a week after Gelman’s annual meeting here — analyst Ted Mayer predicted Gelman's revenues would top $31 million in the current fiscal year and predicted pre-tax profits could be five times the $1 million level of 1977.

THAT ROSY REPORT was based partly on the expectation of $1.6 million of royalties (all profit) from the Masco water filter. However Masco officials remain aloof as to just when such a consumer product will go to market — if ever.

Even without the water filter business, however, the report predicted Gelman's membrane filter sales should top $15 million this year or almost double last year's rate with profits on that line of business jumping from $ 1/4 million to almost $2 1/2 million before taxes.

Company president Charles Gelman has said recent expenditures on production equipment for membrane filters could support a six-fold production increase with no major manpower increase.

As a result of such glowing stock reports, Gelman’s 1.5 million outstanding shares have jumped from around $8 a share in early November to a recent high of $16 a share, despite the fact it may still be several years before the company declares any cash dividends.

That price has recently softened slightly to around $15 a share but Legg-Mason apparently has still not lifted its "buy” recommendation for the stock.