The Old Income Tax

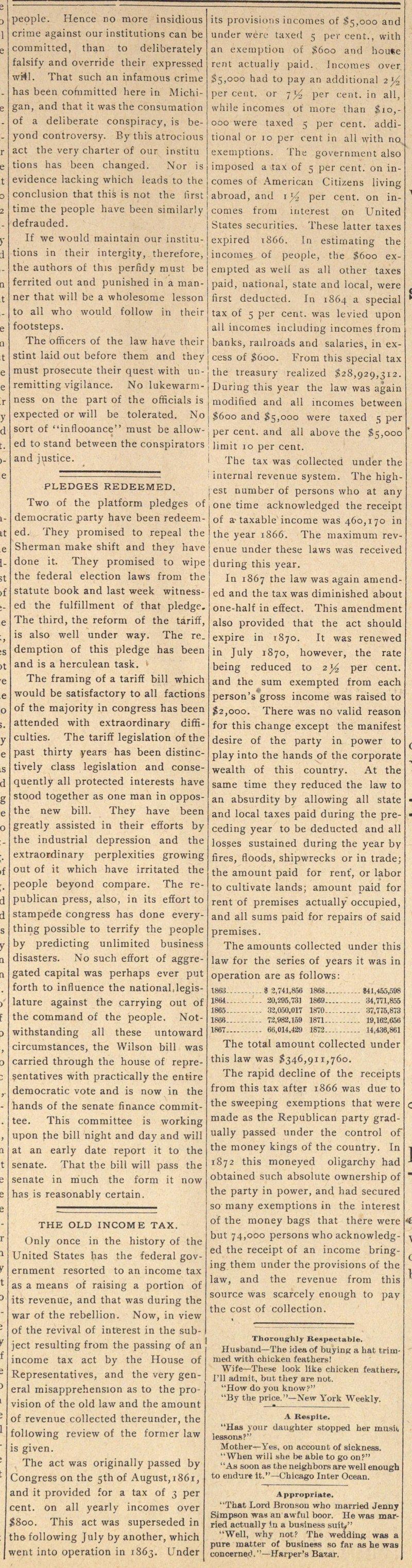

Only once in the history of the United States has the federal government resorted to an income tax as a means of raising a portion of its revenue, and that was during the war of the rebellion. Now, in view of the revival of interest in the subject resulting from the passing of an income tax act by the House of Representatives, and the very general misapprehension as to the provisión of the old lavv and the amount of revenue collected thereunder, the following review of the former law is given. The act was originally passed by Congress on the 5th of August, 1861, and it provided for a tax of 3 per cent. on all yearly incomes over $800. This act was superseded in following July by another, which went into operation in 1863. Under its provisioris incoraes of $5,000 and under taxed 5 per cent., with an éxémption of $600 and home rent actual iy paid. Incoraes over $5,000 had to pay an additional 2)4 percent, or ;}4 per cent. in all, vvhile inconies of more than $10,000 were taxed 5 per cent. additional or 10 per cent in all with no exetnptions. The government also imposed a tax of 5 per cent. on incomes of American Citizens living abroad, and 1 )z per cent. on incomes trom interest on United States securities. These latter taxes expired 1866. In estimating the incomes of people, the $600 exempted as wel! as all other taxes paid, national, state and local, were iïrst deducted. In 1864 a special tax of 5 per cent. was levied upon all incomes including incomes from banks, railroads and salaries in ex cess of $600. From this special tax the treasury reaüzed $28,929,312. During this year the law was again niodiiied and all incomes between $600 and $5,000 were taxed 5 per 1 per cent. and all above the $5,000 ' limit 10 per cent. The tax was collected under the i internal revenue system. The high; est number of persons who at any one time acknowledged the receipt of a taxable income was 460,170 in the year 1866. The maximum revenue under these laws was received during this year. In 1867 the law was again amended and the tax was diminished about one-half in effect. This amendment also provided that the act should expire in 1870. It was renewed in July 1870, however, the rate being reduced to 23 per cent. and the sum exempted from each person's gross income was raised to #2,000. There was no valid reason for this change except the manifest desire of the party in power to play into the hands of the corporate wealth of this country. At the same time they reduced the law to an absurdity by allowing all state and local taxes paid during the preceding year to be deducted and all losses sustained during the year by fires, floods, shipwrecks or in trade; the amount paid for rent', or labor to cultívate lands; amount paid for rent of premises actually occupied, and all sums paid for repairs of said premises. The amounts collected under this law for the series of years it was in operation are as follows: 1863 t 2,741,a56 1888 $41,455,598 1884.. 20,295,731 1869 34,771,855 1865 32,050,017 1870 37,775,873 1866 72,982,159 1871 19,162,656 1867 66,014,429 1872 14,436,861 The total amount collected under this law was $346,911,760. The rapid decline of the receipts from this tax after 1866 was due to the sweeping exemptions that were made as the Republican party gradually passed under the control of the money kings of the country. In 1872 this moneyed oligarchy had obtained such absolute ownership of the party in power, and had secured so many exemptions in the interest of the money bags that there were but 74,000 persons who acknowledged the receipt of an income bringing them under the provisions of the law, and the revenue from this source was scarcely enough to pay the cost of collection.

Article

Subjects

Ann Arbor Argus

Old News