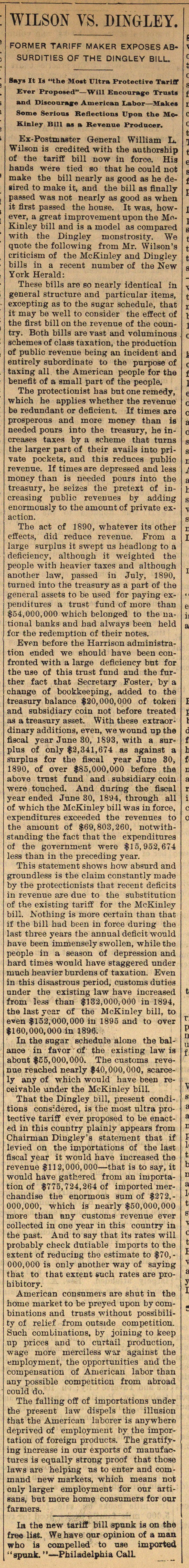

Wilson Vs. Dingley

Ex-Postm aster General William L. Wilson is credited with the authorship of the tariff bill iiow in force. Hig hands were tied so that he could not make the bill nearly as good as he degired to make it, and the bill as finally passed was not nearly as good as when it first passed the house. It was, however, a great improvementupon the MnKinley bill and is a model as compared with the Dingley monstrosity. We quote the following from Mr. Wilson's criticism of the McKinley and Dingley bilis in a recent number of the New York Herald: These bilis are so nearly identical in general structure and particular items, exceptiug as to the sugar schedule, that it may be well to consider the effect of the first bill on the revenue of the country. Both bilis are vast and volnminous schemes of class taxation, the productiou of public revenue being an incident and entirely subordínate to the purpose of taxing all the American people for the benefit of a small part of the people. The protectionist bas but one remedy, which he applies whether the revenue be redundant or deficiënt. If times are prosperous and more money than is needed pours into the treasury, he increases taxes by a scheme that turns the larger part of their avails into private pockets, and this reduces public revenue. If times are depressed and less money than is needed pours into the treasury, he seizes the pretext of increasing public revenues by adding enormously to the amount of private exaction. The act of 1890, whatever its other effects, did reduce revenue. From a large surplus it swept us headlong to a deficiency, although it weighted the people with heavier taxes and although another law, passed in July, 1890, turned into the treasury as a part of the general assets to be used for paying expenditures a trust fund of more than $54,000,000 which belonged to the national banks and had always been held for the redemption of their notes. Even before the Harrison administration ended we ehould have been confronted with a large deficiency but for the use of this trust fund and the further fact that Secretary Foster, by a chaage of bookkeeping, added to the treasury balance $20,000,000 of token and subsidiary coin not before treated as a treasury asset. With these extraordinary additions, even, we wound up the fiscal year June 80, 1893, with a surplus of only $3,341,674 as against a surplus for the fiscal year June 80, 1890, of over $85,000,000 before the above trust fund and subsidiary coin were touched. And during the fiscal year ended June 30, 1894, through all of which the McKinley bill was in force, expenditures exceeded the revenues to the amount of $69,803,260, notwithstanding the fact that the expenditures of the government were $15,952,674 less than in the preceding year. This statement shows how absurd and groundless is the claim constantly made by the protectionists that recent déficits in revenue are due to the substitution of the existing tarifif for the McKinley bill. .Nothing is more certain than that if the bill had been in force during the last three years the annual deficit woald have been immensely swollen, whilethe people in a season of depression and hard times would have staggered under ruuch heavier burdens of taxation. Even in this disastrous period, customs duties under the existing law have increased from le3S than $182,000,000 in 1894, the last year of the McKinley bill, to even $152,000,000 iii 1895 and to over $160,000,000 in 1896. In the sugar echedule alone the balance in favor of the existing law is about $55,000,000. The customs revenue reached nearly $40,000,000, scarcely any of which would have been receivable under the McKinley bill. That the Dingley bill, present conditions considered, is the most ultra protective tariff ever proposed to be enacted in this country plainly appears from Chainnan Dingley 's statement that if levied on the importations of the last fiscal year it would have iucreased the revenue $112,000,000 - that is to say, it would have gathered from an importation of $775,724,264 of imported merchandise the eaonnous sum of $272,000,000, which is nearly $50,000,000 more than any customs revenue ever collected in one year in this country in the past. And to say that its rates will probably check dutiable imports to the extent of reducing tho estimate to $70,000,000 is only another way of saying that to that extent such rates are prohibitory. American consuméis are shut in the home market to be preyed upon by combinations and trusts without possibility of relief from outside competition. Such combinations. by joining to keep up prices and to curtail production, wage more inerciless war against the employment, the opporhmities and the compensation of American labor than any possible competiticn from abroad could do. The f alling off of importations under the present law dispels the illusion that the American laborer is anywhero deprived of employmont by the importation of foreign products. The gratifying increase in our exports of manufactures is equally strong proof that those laws are helping as to enter and command new markets, which means not only larger employment for our artisans, but more home consumers for our farmers. In the new tariff bill spunk is on the frea liat. We have our opinión of a man who is compelled to use imported "spunk. "- Ptailadelphia Cali.

Article

Subjects

Ann Arbor Argus

Old News