Ann Arbor Savings Bank

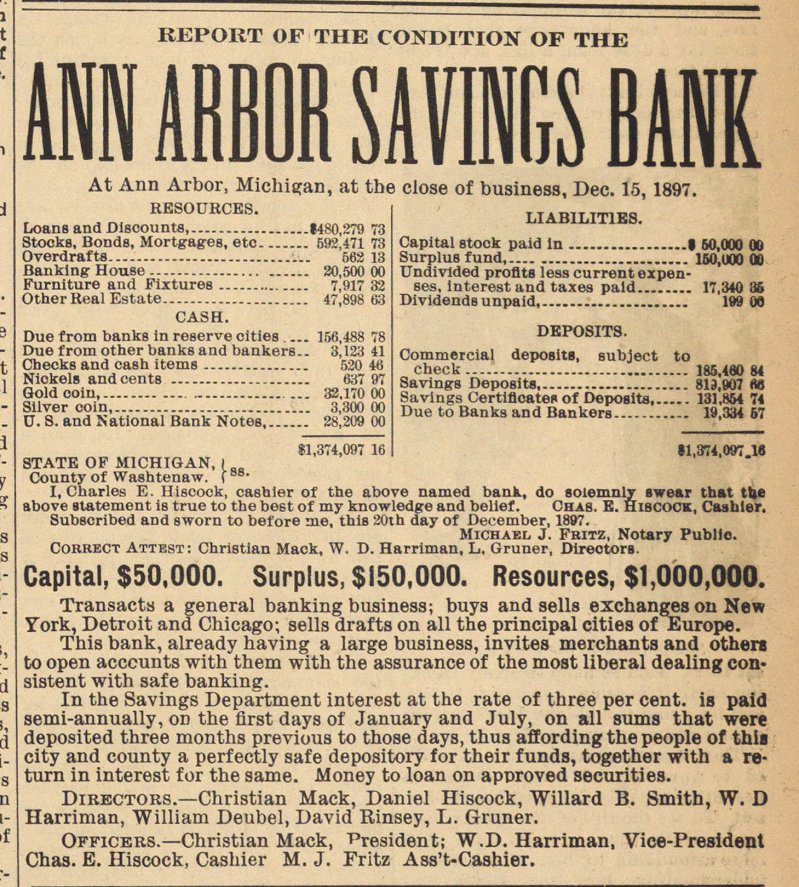

REPORT OF THE CONDITION OF THE

Ann Arbor savings bank

At Ann Arbor, Michigan, at the close of business, Dec. 15, 1897.

RESOURCES.

Loans and Discounts, $480,279.73

Stocks, Bonds, Mortgages, etc 592,471.73

Overdrafts 562,471.73

Banking House 20,500.00

Furniture and Fixtures 7,917.32

Other Real Estate 47,898.63

CASH.

Due from banks in reserve cities 156,488.78

Due from other banks and bankers 3,123.41

Checks and cash items 520.46

Nickes and cents 637.97

Gold coin 32,170

Silver coin 3,300

U.S. and National Bank Notes 28,209

= 1,374,097.16

LIABILITIES.

Capital stock paid in $50,000

Surplus fun 150,000

Undivided profits less current expenses, interest and taxes paid 17,340.35

Dividends unpaid 199

DEPOSITS.

Commercial deposits, subject to check 185,480.84

Savings Deposits 819,907.66

Savings Certificates of Deposits 131,854.74

Due to Banks and Bankers 19,334.57

= $1,374,097.16

State of Michigan

County of Washtenaw.

I, Charles E. Hiscock, cashier of the above named bank, do solemnly swear that the above statement is true to the best of my knowledge and belief. Cas. E. Hiscock, Cashier. Subscribed and sworn to before me, this 20th day of December, 1897.

Michael J. Fritz, Notary Public

Correct Attest: Christian Mack, W. D. Harriman, L. Gruner, Directors.

Capital, $50,000. Surplus, $150,000. Resources, $1,000,000.

Transacts a general banking business; buys and sells exchanges in New York, Detroit and Chicago; sells drafts on all the principal cities of Europe.

This bank, already having a large business, invites merchants and others to open accounts with them with the assurance of the most liberal dealing consistent with safe banking.

In the Savings Department interest at the rate of three per cent. is paid semi-annually, on the first days of January and July, on all sums that were deposited three months previous to those days, thus affording the people of this city and county a perfectly safe depository for their funds, together with a return in interest for the same. Money to loan on approved securities.

Directors.- Christian Mack, President; W. D. Harriman, Vice-President

Chas. E. Hiscock, Cashier M.J. Fritz Ass't-Cashier

Article

Subjects

Old News

Ann Arbor Argus-Democrat