It Is Law

It Is Law.

Yesterday afternoon the Atkinson bill became a law by receiving the Governor's signature. By vote of both houses it was given immediate effect and is now the law of the State. It is practically the first and only important piece of legislation his excellency has set down to his credit. At last he may be said to have accomplished something tangible as a result of all the clamor for reform which he has raised during the past two years. No doubt there are imperfections in the measure, and it has yet to run the gauntlet of the supreme court, but the principles of the measure are right, and in the direction of equalization of taxation. If it is sustained by the supreme court, its application will relieve the people of a heavy burden which the powerful corporations have heretofore been influential enough in the legislature to prevent being placed where it properly belongs. The railroads of this State have never borne their just share of the burden of taxation. These corporations in various other States pay vastly more into the State treasury, that is to say, the per cent. of taxation is much higher, but the railroads has not been ruined thereby. The people need borrow no trouble on that score. The rail roads and other corporations brought under the provisions of the Atkinson law, are abundantly able to care for their own interests. No good citizen desires to see them crippled, but they should be compelled to pay their share of tax the same as are individuals, and they should be taxed upon the same basis.

The governor has appointed the State Board of assessors under the provisions of the Atkinson bill. They are members of his immediate political family as is the case with all his appointments. They are men of good standing, but it is doubtful if they have any special qualifications for their places outside of the governor's O. K. Robert Oakman has had experience as a member of the Detroit rd of assessors, and this will be of value -to the state should he be confirmed It is probable, however, that his confirmation by the senate, on account of his uncompromising Pingreeism, may meet with opposition. General Irish is an admirable soldier. George B. Horton is a well-known and prominent farmer, the head of the state grange. Not one word can be said against either of them, and they will perform their duties with thorough conscientiousness. So far as is known to the public, however, no one of the board has special, expert fitness for their positions. Their appointments were due chiefly to their unquestioned fealty to the governor's political fortunes.

Senator Graham, of Kent county, has introduced into the senate an inheritance tax bill. It is similar to laws in force in several eastern states and from which large revenues have been derived. It is right in principal and should become law. The tax is only on net legacies after all debts have been paid. It excludes from taxation beneficiaries having direct relationship unless the personal property exceeds $5000, in which case the 'tax is one per cent. Outside of such relationships, the tax is 5 per cent.

It is right that the government which protects property and provides safe transfer from one person who is through with it to another should have an heirship in the estate.

In this day of expansion and exploration of the constitution for the purpose of finding a warrant for anything which it is desired to do, why not expand the good old document so as to cover the taxation of surpluses? There need be no fear that the people would be divided on such an interpretation. They are for it with a greater degree of unanimity than for the other kinds of expansion proposed. Why not remove the war stamp taxes which the great corporations refuse to pay their share of, shouldering it off onto to the struggling poor, and lay the taxes upon surplus incomes? Unconstitutional? Expand it a little. It would not test its power to resist a tearing force nearly so much as some of the tests it has undergone in the past. But if there is too much danger in this, why not increase the membership of the supreme court, as has been done in the past, and thereby overcome that majority of one by which an income tax was declared unconstitutional? But if this is impracticable, why not amend the constitution so as to bring an income tax within the purview of the constitution? Why should not the surplus hoards of the enormously wealthy be taxed? Would not such a tax be more equitable than bond issues and stamp taxes? A government of the people, by the people, and for the people is supposed to return value received for its exactions. The citizen is protected by government in person and property. It costs man to protect a George M. Pullman than it does the ordinary citizen. The possessors of vast hoards of surplus wealth should be taxed, therefore, upon that surplus directly. The indirect method of taxation does not reach it all. It can only be reached by an income tax. Such a tax is the most equitable of all taxes.

Article

Subjects

Old News

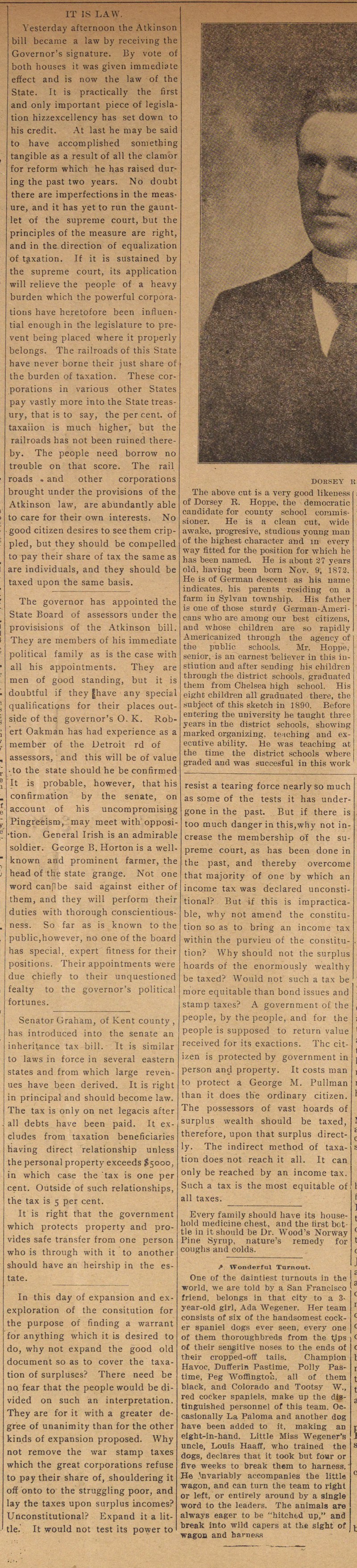

Ann Arbor Argus-Democrat