A "corker" On Cleveland

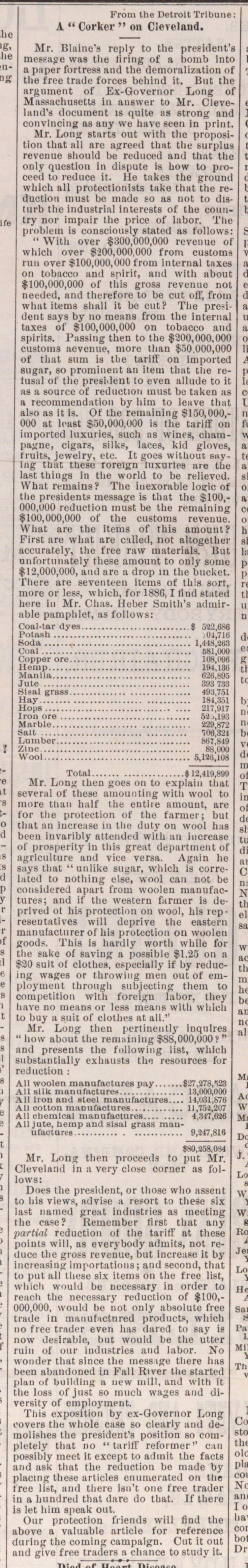

Mr. Blainc's reply to the preeident's messafie was tlie liring of a bomb into a paper fortress and tlu: detnoralization of the free trade forces bchind it. Uut tlie argument of Ex-Governor Long of Massachusetts Ín aimwer to Mr. Cleveland's document is quite as strong and convincing as any ve liave seen in print. Mr. Long starts out with ttie proposition that all are Igned tlmt the -urplus revenue sliould be reduced and that the only question in dispute is how to proceed to reduce it. lie takes the ground which all protectionlsts take that tlie reduction must bc made so as not to dislurb the industrial interests of the country nor mpair the price of labor. The problem is consciously stated as follows: " With over $300,000,000 revenue of which over $200,000,000 from customs run over $100,000,000 f rom Interna! taxes on tobáceo and spirit, and with about $100,000,000 of tliis gross revenue not needed, and therefore to be cut off, from wlmt items shall it be cut? The pre-ident says by no means from the internat taxes of $100,000,000 on tobáceo and spirits. Passing then to the $200,000,000 customs aevenue, more than $50.000,000 of that sum is the tariff on imported sugar, so prominent an item tliat Uie retural of the president lo even allude to it as a source of reductiou must be taken as a recominendation by him to leave that also as it is. Of the remaining $150,000,000 at least S50,000,000 is the tariff ou imported luxuries, sucli as wines, champagne, cigars, silks, laces, kid gloves, tniits, jewelry, etc. It goes without snying that these torelin'luxurtes are the last things in the world to be relieveü. What remains? The inexorable logic of the president? message is that the $100,000,000 reduction must be the remaining $100,000,000 of the customs revenue. What are the items of ihis amount? First are what are callad, not altogelher accurately, the free raw uiaterials. JJut unfoitunately these amount to only some $12,000,000, and are a drop m the bucket. l'liere are seventeen items of this sort, more or les-, whlch, for 188C, I lind tuted here in Mr. Chaa. lleber Sniith's admirable pamphlet, as follows: Coal-tar Uyes $ 522.0S6 I'otash 04,718 Soda 1,448,383 Coal Nil.UOU Copper ore L0 Hemp 194,130 Manila 6 Jute -: Si-al grass 4ÍI1 7-51 Hay 184,861 Hops 217,'J17 Iron ore 52 ,19:i Marble 229,872 Salt 1;iK,;!Ji Lumber 647,848 Zlno 83.000 Wool 5,120,108 Total $ 12,419,89? Mr. Long then goes 011 to explain that several of these amountlng with wool to more tban half the entile mnounl, are tor the prutection of the farmer; bul thiit an increase in ibe ilutv on wool has been invaribly alteuded with an increa8e of prosperlty In this great department ol agricultura and vite versa. Again he says that "unlike sugar, which is correlated to notliing else, wool can not be considered apart from woolen manufactures; and f the western farmer is deprlved ot his protection on wool, his representatives will deprive the eastern manufacturer of his protection ou woolen ifoods. This is liardly worth while for tlie sake of saving a possible $1.25 on a $20 suit of clothes, especial!}' if by reducing wages or throwlllg men out of employnient througli subjecting them to competition with foreign labor, they have no means or less means with wliieh to buy a suit of clothes at all.'1 Air. Long then pertinently inqulres " how about the remaining $88,000,000 " and presents the following list, which substtiniially exhausta th: resources for reduction : All woolen manufactures pay 827,278, 123 AU slik manufactures 13,1100,000 All lron and sleet manufactures.... 14,081,876 All cotton manufactures.. 11,75207 All chemlcal manufactures 4,-!l7,i:i(i All Jute, bemp aml sisal grass manufactures 9,247,818 ÍS0.358.0S4 Mr. Long then procceds to put Mr. Cleveland in a very close corner as folio ws: Doel the president, or those wlio nssent to his views, Hdvise a resort to these six last named grent industries as meeting the case? Remember tirst that any partvd reduction of the tarill" at these polntl will, as everybody admits, not reduce the gross reveDue, but increado it bj' increasin Importatloiil ; and seconil, that to ])iit all these six items on the free list, which would be neeesary in order to rcKCh the necessary reduction of $100,000,000, would be not only absolute free traile iu tnanufactnred product, which no free trader even lias dared to say is now de&Irable, but would be the ulter ruin of our industries and labor. No wonder that since the mess ijre tliere bas been abandoned in Fall Kiver the started plan of building a new rnill, aml with it the loss of just so mucli waes and diversity of employmeut. This exposition by cx-Governor Long covers the whole case so clearly and demolishes the president's position so completely that no " tarilF reformer" can possibly meet It except to adinit the facts and ask that the reduction be made by placmg these articles enuinerated on the free list, and tliere isn't one free trader in a hundred that dare do that. If there is let hini speak out. Our protection friends will find the above a valuable article for reference during the coming campalgn. Cut it out and give free traders a chance to study it.

Article

Subjects

Ann Arbor Courier

Old News