The Banking Law

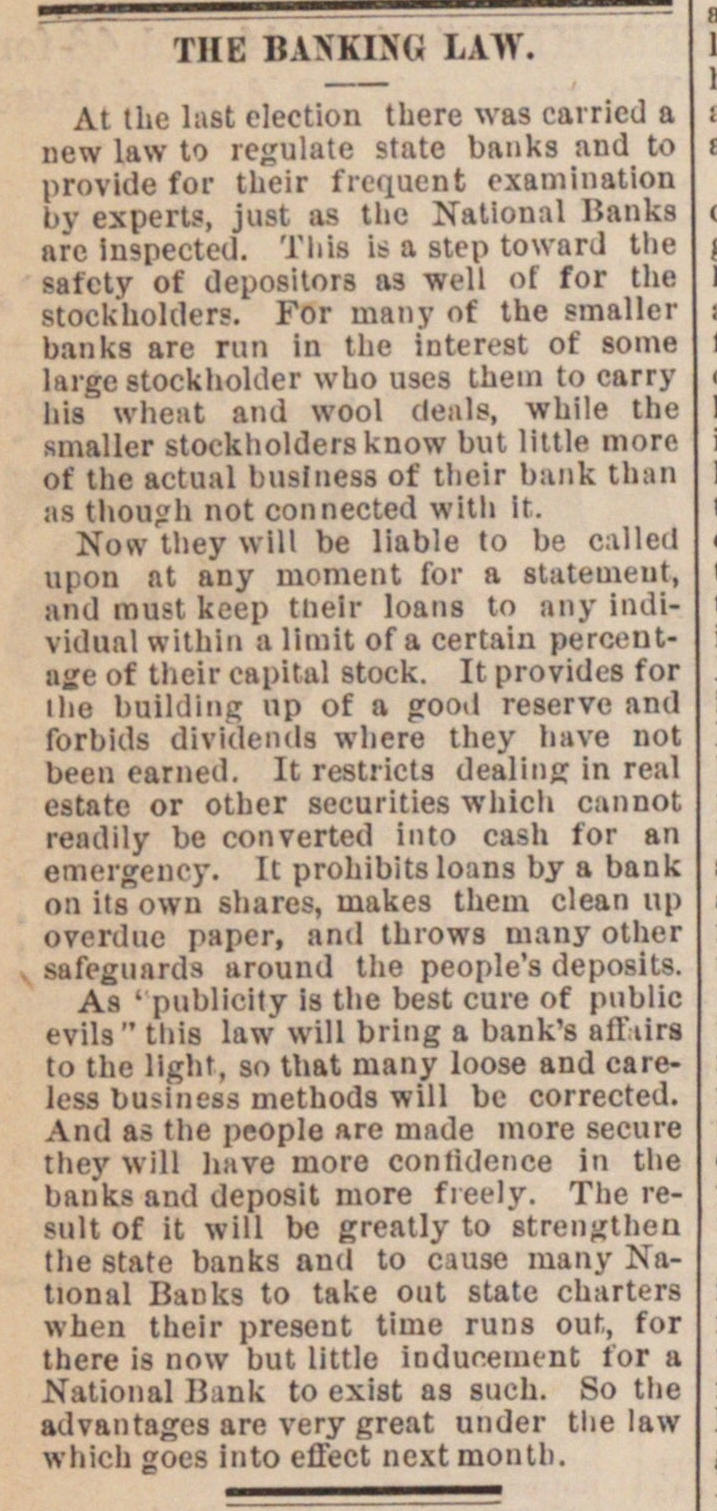

At the last cleetion there was carnea a new law to regúlate state baiiks and to provide for their frequent cxaniination ty expert?, lust as the National Banks are Inspectcil. Thta is a stop toward ttie safcty of depositors as well of for the stockholders. For many of the smaller banks are run in the interest of some large stockholder who uses thein to earry his wheat and wool deals, while the smaller stockholders know but little more of the actual business of their bank than as though not connected witli t. Now tliey will be liable to be called upon at any moment for a statement, aml maat keep tlieir loans to any individual withiri a limit of a certain percentase of their capital stock. It provides for the building np of a gooil reserve and forbids dlvlaend wbere they have nol been earned. It restricts dealiiijr In real estáte or other securities which cannot readily be converted iuto cash lor an emergeney. It prohibits loans by a bank on its own shares, makes them clean np overdue paper, and throws many other Mfeguards around the people's deposits As ' publlclty is the best cure of public evils" thi8 law will briug a bank's afl'iirs to the light, so tbat many loose and careless business methods will be corrected. And as the people are made more secure they will have more conlidence in the baiiks and deposit more fieely. The result of it will be greatly to streiiKthen the state banks and to cause many Nationul Bauks to take out state charters when their present time runs out, for there is now but little indurenunt for a National Bank to exist as such. So the advantages are very great under the law which oes into effect next month.

Article

Subjects

General Banking Law

Old News

Ann Arbor Courier