Does The Family Farm Have To Go?

DOES THE FAMILY FARM HAVE TO GO?

"Well, it's too late. And the owner men explained the workings and the thinkings of the monster that was stronger than they were. A man can hold land if he can just eat and pay taxes; he can do that.

Yes, he can do that until his crops fail one day and he has to borrow money from the bank.

But-you see, a bank or a company can't do that, because those creatures don't breathe air, don't eat side-meat. They breathe profits; they eat the interest on money. If 'they don't get it, they die the way you die without air, without side-meat. It is a sad thing, it is so. It is just so." by John Steinbeck, The Grapes of Wrath

Compiled by Lisa Huberty and Dan Detweiler

One out of every three family farmers have been driven off their land in the last ten years. Here's how the government and big business have orchestrated this crisis and what can be done to turn it around.

Why should we care about the farm crisis?

Impact on the national economy: Almost 21 percent of our entire workforce is directly linked to agriculture, including 55,000 jobs in our steel mills.

Each time a farm is sold it means fewer customers for the products of our factories; it also means many used tractors, trucks, and other equipment will be put on the market, further depressing these industries. Every farm liquidated means the loss of 5-7 jobs. Every 3 farms liquidated destroys another rural business.

In addition to the millions of jobs at stake, agriculture provides 70 percent of the nation's raw material wealth - new wealth that is needed to fuel our national economy. Every dollar earned by a farmer (or other raw material producer) circulates and multiplies throughout the economy, creating at least 5 additional dollars in goods and services.

Farmers and businesses losing money don't pay any taxes. Neither do unemployed workers. This sharp reduction in tax revenues is occurring at the very moment when the demands on government by bankrupt farmers, unemployed workers, and failing banks and businesses are increasing.

Environmental impact: Low farm prices always force farmers to increase their production. Like any worker whose wages are cut in half, farmers faced with falling prices must work twice as hard and sell twice as much just to cover bills. This has lead to an abandonment of careful soil and water conservation practices and to the tilling of marginal, highly erodible land. In addition, the destruction of the the cattle industry by cheap grain and corporate feedlots has virtually wiped out grazing on hillsides, leaving the farmer no choice but to put corn or soybeans on those fragile lands. After a few years the hills are deeply eroded, with all the topsoil destroyed.

The forcing of families off the land results in the control of a great deal of farmland being passed into the hands of large corporations and absentee investors. They have generally treated the irreplaceable soil and water resources with the same narrow, short-term profit orientation that has characterized their treatment of other capital resources, like factories and railroads. The earth is used and abused as long as it can show a high enough profit or serve as a tax shelter for other profits. Once depleted, land is abandoned or covered over for "development" purposes. Groundwater is pumped dry and rivers diverted.

Social costs: The social costs of the crisis are also extremely high. Alarming rates of spouse and child abuse, alcoholism, and the highest suicide rate among all professions are examples of the social and personal crisis growing out of the economic crisis.

The recent rash of murders by farmers and lenders who snapped under the extreme pressure is unfortunately only the tip of the iceberg.

Impact on world hunger: Another devastating impact of our low grain prices is on the poor farmers of the Third World. Since the U.S. is the dominant exporter of major grains and oilseeds - controlling over 70 percent of the world's corn and soybean exports - our prices set world prices. By forcing down U.S. prices, grain corporations can underprice local farmers in the domestic markets of many Third World countries, robbing them of any chance to sell their products at a profit.

Political implications: The loss of 50 percent of our family farmers over the next few years has long-term political implications that are seldom considered. It would mean that assets worth up to $500 billion in farmland, livestock, machinery, and buildings would be transferred from farm families to banks, insurance companies, and wealthy individuals.

Haven't there been farm crises before?

This isn't the first time farmers have been threatened with extinction. For almost a decade before the Stock Market Crash of 1929, rural America suffered a terrible economic depression. Some economists argue that the 1920's farm depression was a major cause of the 1929 collapse, leading to the popular slogan, "Depressions are farm led, and farm fed." The 1920's and early 30's posed a serious threat to the survival of family farm agriculture. There were extreme hardships, including hunger and bitter cold, especially in those regions without electricity, phones, or other services.

The severity of this crisis spawned a resurgence of militant farmer organizing. At the national level, farmers lobbied for emergency assistance and federal legislation to provide long-term relief from the recurring nightmare of farm depressions. This legislation, often referred to as the Parity Farm Programs, had three central features.

First, the Commodity Credit Corporation (CCC) was created to set a minimum floor under farm prices. The CCC was authorized to make loans to farmers whenever the prices offered by the grain corporations fell below the cost of production. The farmer's crops were pledged as collateral against these loans. Once prices returned to normal levels, farmers repaid the loans with interest By allowing farmers to control their marketing, the CCC made it possible for farmers to receive a fair price from the marketplace. Second, farm production was managed to balance supply with demand in order to prevent surpluses. This feature was needed to reduce the cost to the federal government of purchasing and storing surpluses. Third, a national grain reserve was created to prevent consumer prices from skyrocketing in times of drought or other natural disasters.

From 1933 to 1953 this legislation was extremely successful. Farmers received fair prices for their crops, production was managed to prevent costly surpluses, and consumer prices remained low and stable. At the same time the number of new farmers increased, soil and water conservation practices flourished, and overall farm debt declined dramatically. Most important, these Parity Farm Programs were not a burden to the taxpayers. The Commodity Credit Corporation, by charging interest on the marketing loans made to farmers, actually made nearly $13 million between 1933 and 1952.

The legislative victories by farmers in the 1930's prevented, for the moment, the elimination of family farm agriculture in the United States.

If the parity programs were so successful, why was farm policy changed after 1952 and who formulated the new policy?

These parity programs, which were real victories for farmers, small businesses, and labor, were in direct conflict with the economic interests of some powerful corporations and banks. Farmers with a fair, secure income were not forced to borrow large amounts from banks; laws which stabilized grain prices hurt grain monopolies who profited greatly from huge swings in market prices; and effective supply management programs meant that fewer acres were planted, reducing sales of chemicals and fertilizer.

Near the end of World War II, powerful corporations and banks teamed up with economists and other academics to wage an all-out political war against the supply management and price floor programs of the Parity legislation. They used many of the same tactics made popular by Joe McCarthy, including the labeling of soil conservation and supply management programs as "central-planning socialism" and "contrary to our free market way of life."

Their efforts to discredit the parity legislation led to a fierce national debate over the direction of farm policy. Grain companies argued that they needed lower prices in order to sell more overseas, while agri-chemical companies attacked the supply management provisions.

In 1953 President Eisenhower and Agriculture Secretary Ezra Taft Benson defeated the Parity Farm Programs won by farmers in the 1930's. Price floors and supply management were replaced by "flexible parity." The Agriculture Secretary was given the discretionary power to lower farm prices to "market-clearing" levels in order to get "government out of agriculture." Rational supply management was replaced by instability. These lower prices forced farmers to produce even more in order to maintain their cashflow, creating even greater surpluses.

A number of corporation-controlled "think tanks" issued reports and recommendations on how to solve this "farm problem." One of these, the Committee for Economic Development (CED), is an excellent example of one of the many groups who issued policy statements on agriculture. Their 1962 report, "An Adaptive Program For Agriculture" recognized that there were only two possible solutions to recurring agriculture depressions. Quoting directly from their report "The Choices Before Us: (a) leakproof control of farm production or (b) a program, such as we are recommending here, to induce excess resources (primarily people) to move rapidly out of agriculture."

The first option recognized by the CED, "control of farm production," was rejected out of hand as too much "government in agriculture," and contrary to the so-called "free market."

Instead, the CED recommended the second option, the forced removal of a number of families from the land. Quoting again from their text: "Our program would involve moving off the farm about two million of the present labor force, plus a number equal to a large part of the new entrants who would otherwise join the farm labor force in the next five years." To accomplish this forced removal, they recommended that: "Price supports for wheat, cotton, rice, feed grains and related crops now under price supports be reduced immediately."

The CED argued that the farmers who were liquidated could be more productively used in other sectors of the economy. In addition, employing them elsewhere would open the way for greater capital investment in agriculture. This would require an increased use of energy-intensive methods - like more mechanization and greater reliance on chemicals - in order to replace the farmers being pushed off their farms.

In addition, they cited other "real benefits" of enforced lower prices: "The lower prices would induce some of the increased sales of these products both at home and abroad. Some of these crops are heavily dependent upon export markets."

The CED report proposed the elimination of approximately one-third of our farm families - primarily moderate-sized operations. Their strategy was to replace family farmers with a small number of super-farms (both large corporate-owned and a few large family-managed operations), and several million "small farms" to be financed primarily by off-farm income or welfare. The large farms would identify and politically align themselves with lenders and corporations investing in agribusiness; the small farmers' dependency on government and on the non-farm economy would weaken them politically and tend to diminish their traditional affiliation with progressive movements.

There were dozens of similar policy reports on the "farm problem." Groups ranging form the U.S. Chamber of Commerce to the American Bankers Association all made the same recommendations. This is not surprising since many of the same people served as authors, researchers, and advisors on a number of different reports.

Are farmers in trouble because they are poor business managers?

In 1974, after a decade of silence, the CED published another report on agriculture, "Toward a New Farm Policy." In this 1974 report, the CED recommended that farmers who had been able to survive be maintained on a "direct income subsidy program" from the federal government. This concept of "direct income subsidy" became the cornerstone of the new federal farm legislation passed in the early 1970's; it was called a "deficiency payment" and was linked to a "target price" set by Congress.

In addition to the recently created deficiency payment program, the government also maintained the original Commodity Credit Corporation price support program. However, the price floor has been set at extremely low levels, roughly 50 percent of parity at present, using the same justification for low prices used in the 1950's - the need to boost exports. Although this program is often promoted as a "farm program", it primarily benefits the grain traders and their foreign customers. Farmers don't export grain; grain companies do.

Here's how our current farm program works. A target price is a price level set by Congress and the Secretary of Agriculture. If the prices received fall below this level, participating farmers receive a check directly from the government to make up the difference. This check is called a deficiency payment.

Let's look at corn. The CCC loan rate set by Agriculture Secretary John Block for 1986 will be $1.92 per bushel. As always, this will effectively establish a floor price at this level. The target price is now $3.03. Since the market price is always roughly the CCC loan rate, taxpayers will be forced to make deficiency payments for the difference between the target price and the loan rate - about $1.10/bushel on com. On a [national] com crop of over 7 billion bushels, this will require almost 8 billion dollars to subsidize a crop, a significant proportion of which, is exported to other countries.

But it costs more than $3.03 to grow corn. In 1983 the USDA said it cost over $3.20/bushel. This means that farmers are losing money on every bushel harvested, forcing them to borrow even more money to cover their losses. Over the past 15 years this has created an enormous drain on the credit systems of our country, adding to the high interest rates already being charged by the banks.

The end result of this deficiency payment system is that grain corporations and foreign buyers are allowed to buy our grain at prices over $1.00 below cost of production. We spend huge sums of taxpayers' money to compensate farmers for part of their loss caused by this subsidy to the grain trade; then we suffer the effects of forcing farmers to borrow enormous sums of money to cover the rest of their losses.

How will the farm crisis ever be resolved?

There are three central elements to our current farm policy debate. First and foremost, what prices for their crops and livestock should farmers ultimately receive? Second, what is the amount, if any, of public financial support that is necessary or appropriate? And third, what is the role of food exports and imports in creating and potentially solving the current rural economic crisis?

Two conflicting positions emerged during the 1985 Farm Bill debate. The first is often referred to as the "Free Market" position. In hopes of boosting exports, supporters wanted to modify the current program by lowering prices; but they would have increased subsidies a small amount to cover some of the losses farmers would suffer because of these lower prices.

The other position, sometimes referred to as the "Supply Management" proposal, would have given the farmers the right to vote in a national referendum, as they did in the 1940's, to approve effective supply management programs based on bushel quotas. Under this proposal, all deficiency payment subsidies would be eliminated, and CCC loan rates would be raised to fully cover production costs.

The real debate over farm policy comes down to this: Should farm prices be set below cost of production in an effort to increase export sales, with the farmers' losses partially offset by taxpayer subsidies? Or should farmers be given the right to vote on a program that would combine higher CCC loan rates with effective production controls?

Did the best farm bill get passed in 1985?

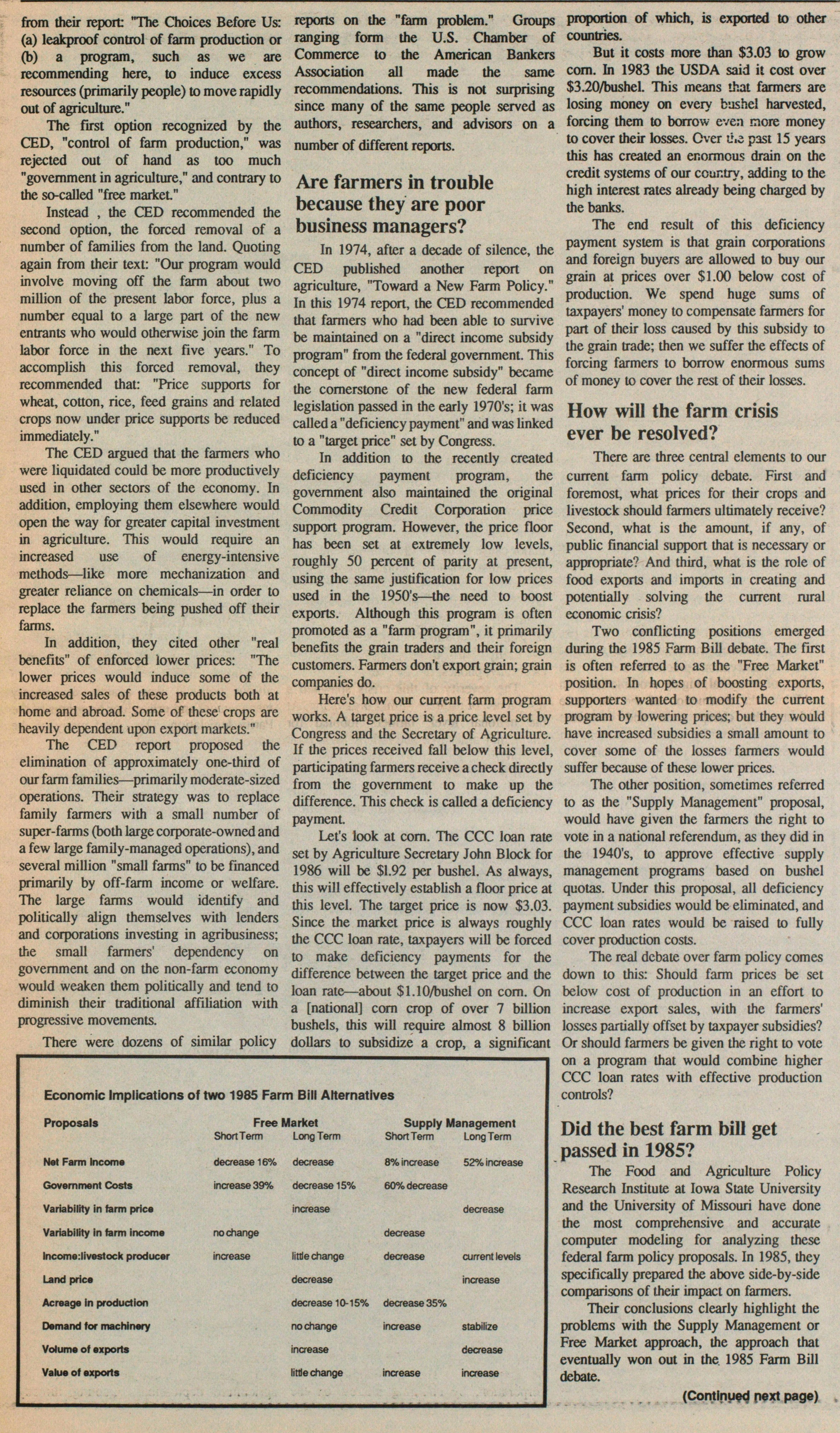

The Food and Agriculture Policy Research Institute at Iowa State University and the University of Missouri have done the most comprehensive and accurate computer modeling for analyzing these federal farm policy proposals. In 1985, they specifically prepared the above side-by-side comparisons of their impact on farmers.

Their conclusions clearly highlight the problems with the Supply Management or Free Market approach, the approach that eventually won out in the 1985 Farm Bill debate.

Economic Implications of two 1985 Farm Bill Alternatives

Proposals

Free Market:

Net Farm Income: decrease 16% short term, decrease long term

Government Costs: increase 39% short term, decrease 15% long term

Variability in farm price: no change short term,

Income: livestock producer: increase short term, little change long term

Land price: decrease long term

Acreage In production: decrease 10-15% long term

Demand for machinery: no change long term

Volume of exports: increase long term

Value of exports: little change long term.

Supply Management:

Net Farm Income: 8% increase short term, 52% increase long term

Government Costs 60% decrease short term

Variability in farm price: decease long term

Income: livestock producer: decrease short term, current levels long term

Land price: increase long term

Acreage in production: decrease 35% short term

Demand for machinery: increase short term, stabilize long term

Volume of exports: decrease long term

Value of exports: increase short term, increase long term