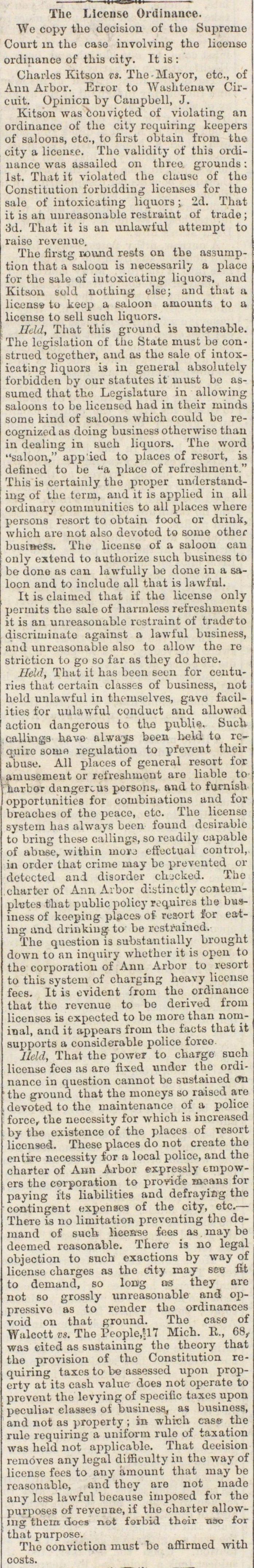

The License Ordinance

We copy tlio decisión of the bupreme Court in the oase involving tho license ordinance of tliis city. It is : Charles Kitsou ïs. Tho Mayor, etc., of Aim Arbor. Error to AVashtenaw Circuit, üpinicn by Campbell, J. Kitson was couvigted of violating an ordinance of the city requiring keepers of saloons, etc, to first obtain frora the city a liceiiF.e. Tho validity of this ordinanco was assailed on thrco. grouuds : lst. That it violated the clause of the Constitution forbidding licenses for tbo sale of intoxicating liquors ; 2d. That it is an unreasonuble restraint of trado ; 3d. That it is an unltLwful uttempt to raiso revenue, Tho firstg rovuid rests on the asaumption that a saloon is necessarily a place for the sale of iutoiicatiug liquors, and Kitson sold nothing else; and that a licens to keep a saloon amounts to a liccnse to sell such liquors. lldd, Tliat this ground is tmtenable. The legislation of the State must be construod togethcr, and as the sale of intoxicating liquors Í3 in general absolutely forbiddea by our statuten it must bo assumed that the Legislatura in allowing saloons to be lioensed had in their minds somo kind of saloons which could be recognized as doing business othorwise than in dealing in such liquors. The word "saloon," appied to places of resort, is defined to be "a placo of refreshrnent." This is certainly the proper understanding of tho term, and it is appliod in all ordinary eouamuiiities to all places where persons resort to obtain food or drink, which are nat also devoted to sonie other busiess. ThO liceuse of a saloon can only extond to authorize such business to be dono as eau lawfully be done in a saloon and to include all that is lawfnl. It is claimed that if tho license only permits the sale of harmless refreshinents it is an uiireasonablo restraint of tradffto discrimínate against a lawful business, and unreasonable also to allow tho re stricticn to go so far as they do hcre. Held, That it has been seun for centuries that certain classes of business, not held unlawful in themselves, gave facilities for uulawful eonduot and allownd actiou dangcrous to tho publie. Such. callings havo alwas boen held ta rcouiro somo regulation to prevent their abuse. All places of general resort for amusement or refreshniont aro Hable to "iiarbor dangercus persons, and to furnish opportunities for combinatious and for breaches of the peaco, etc. The license systom has always been found desirablc to bring these callings, so roadily capable of abuse, within moïj effoetual control, in order that crime may bo prevented or detected and disorder cujeked. The charter of Aim Arbor distinctly contcmplutcs that public policy roquires the business of koeping places of resort for eating und drinking to be restiained. The question is substantially brought down to nn inquiry whether it is opeu to the corporation of Ann Arbor tu resort to this system of charging heavy lieense fecs. It is evident frorn the otdinauce that the revenue to be derived from licensos is expocted to bo moro than nominal, and it sppears from the facts that it supports a considerable pólice foreo. Held, That the power to charge such license feos as are fixed under the ordinanco in question cannot be suslained om tho ground that the rnoneya so raisod are devoted to tho maintenance of a pólice forcé, the necessity for which is increased by tbe existence of the places of resort licensod. These places do not créate tho en tire necessity for a local pólice, and the charter of Aun Arbor expressly empowers the Corporation to provide mcians for paying its liabilities and defrayiiig the contingent expenses of the city, etc. - Thcre is 110 limitation preventing tho demand of sucb, licease foes as . may bo deemed roasonable. Thero is no legal objection to such exactions by way of liconso charges as the city may ssb fit to demand, so loag os they are not so grossly unreasonable and oppressivo as to render tho ordinances void on that ground. The case of Wulcott ts. The People,U7 Mich. E., 68, was citcd as sustaining the theory that the provisión of the Constitution requiring taxes to bO assessed upon property at its cash valuo does not operato to prevent tho levying of specific ttixes upon peculiar classes oi business, as business, and not as property ; in -w-hrcli case the rulo requiring a uniform rule of taxation was held not applicable. That decisión removes any legal difficulty in the way of liconse fees to any ámount that may be rcasonablo, and thoy aro not mado any less lawful because iinposed for the purposes of revenue, if the charter allowing theirt does not lorbid tlioir nao for that purpose. Tho conviction must bo aflirmed with costs.

Article

Subjects

Old News

Michigan Argus