Unequal Taxation

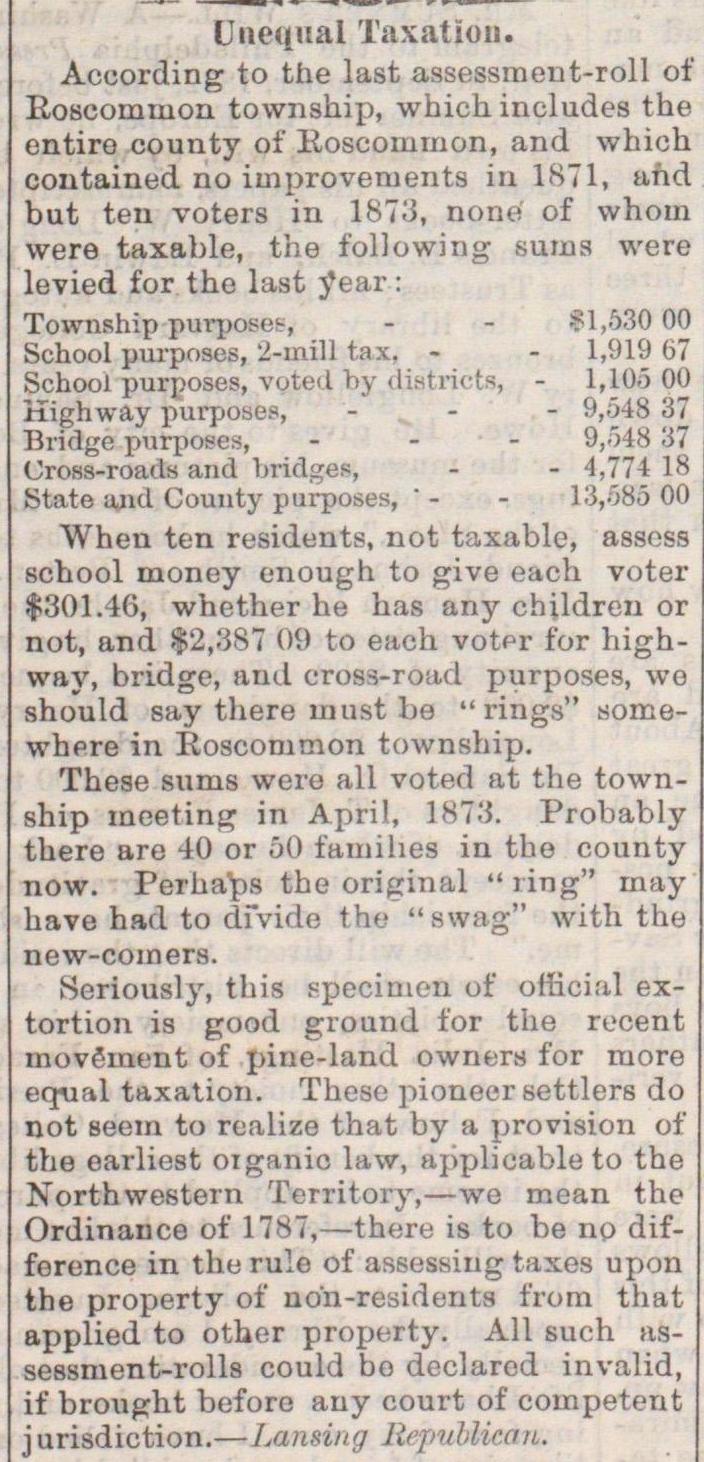

According to the last assessment-roll ot Rosconiuion township, whichincludes the entiro county of Roscommon, and which coutained no iinprovements in 1871, ahd but ten voters in 1873, none' of whom were taxable, the following suma were levied for the last year : Township purpose1-, - - 11,630 00 School purposes, 2-mill t.ax, - - 1,919 67 School purposes, voteil by diatricts, - l,10ó 00 Highway purposes, - 9,548 37 Bridge purpose, - 9,ö48 37 CroKa-roads and bridget, - - 4,774 18 State ujul County purposes, "- - 13,083 00 When ten residents, not taxable, assess school money enough to give each Toter $301.46, whether he has any childreu or not, and $2,387 09 to each voter for highway, bridge, and Cross-rOod purposes, we should say tliere must be "rings" somewhpre in Eoscommon township. These sums were all voted at the township meeting in April, 187.'i. Probably there are 40 or 50 families in the county now. Perhas the original " ring" may have had to divide the "swag" with the new-coiners. Seriously, this BpecimeH of official extortion is good ground for the recent tnovêmont of pine-land owners for more equal taxation. These pioneer settlers do not seem to realizo that by a provisión of the earliest oiganio law, applieable to the Xorthwestern Territory, - we mean the Ordinauce of 1787, - there is to be no difference in the rule of assessing taxes upon the property of non-residents from that applied to other property. All such assessment-rolls could bo declared invalid, if brought before any court of competent

Article

Subjects

Old News

Michigan Argus