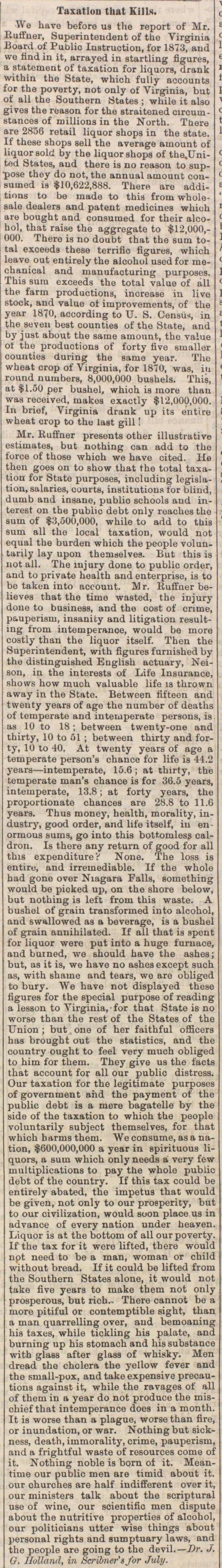

Taxation That Kills

We have before U9 the report of Mr. Ruffner, Superintendent of the Virginia Board of Public Instruction, tor 1873, and we find in it, arrayed in startling figures, a statement of taxation for liquora, drank within the State, which fully accounts for the poverty, not only of Virginia, but of all the Southern States ; while it alao gives the reason for the straitoned circuinstancos of millions in the North. Tuere are 2856 retail liquor shops in the state. If these shops sell the average amount of liquor aold by the liquor shops of the.Unitfld States, and there is no reason to suppose they do not, the annual amount cousumed is $10,622,888. There are additions to be made to this from wholesale dealers and patent medicines which are bought and consumed for their alcohol, that raÏ8e the aggregate to $12,000,000. There is no doubt that the sum total exceeds these terrific figures, which leave out entirely the alcohol used for mechanical and manufacturing purposes. This sum exceeds the total value of all the farm productions, inorease in live stock, and value oí improvements, of the year 1870, aceording to U. S. Census in the seven best counties of the State, and by just about the same amount, the value ot the produotiona of forty five smaller couutiea during the samo year. The wheat erop of Virginia, for 1870, was, in round numbers, 8,000,000 bushels. This, at $1.50 per bushei, which ia more than was received, makes exactly $12,000,000. In brief, Virginia drank up its entire wheat erop to the last gill ! Mr. Ruffner presents other illustrative estimatea, but nothing can add to the torce of those which we have cited. He then goea on to show that the total taxation for State purposes, including legislation, salaries, courts, institutiona for blind, dumb and insane, publio schools and interest on the public dobt only reaches the Slim of $3,500,000, while to add to this aum all the local taxation, would not equal the burden which the people voluntarily lay upon themaelvea. But this is not all. The mjury done to public order, and to private health and enterprise, is to be taken into account. M r. Ruffner believes that the time waated, the injury done to business, and the cost of crime, p&uperisui, insanity and litigation resulting from intemperance, would be more costly than the "liquor itself. Then the Superintendent, with figures furnished by the distinguished English actuary, Neison, in the interests of Life Insurance, shows how much valuable life is thrown away in the State. Between fifteon and tweuty years of age the number of deaths of températe and inteuiperate persons, is as 10 to 18 ; between twenty-one and thirty, 10 to 51 ; between thirty and forty, 10 to 40. At twenty years of age a températe person's chance for life ia 44.2 years - intemperate, 15.6 ; at thirty, the températe man's chance is for 36.5 years, intemperate, 13.8 ; at forty years, the proportionate chances are 28.8 to 11.6 yeara. Thus money, health, morality, indu8try, good order, and life itself, in enormous sums, go into this bottomless caldron. Is there any return of good for all this expenditure 'i None. The loss is entiru, and irremediable. If the whole had gone over Niágara Falls, something would be picked up, on the shore below, but nothing is lelt from this waste. A bushol of grain transformed into alcohol, and swallowed as a beverage, is a bushei of grain annihilated. If all that ia spent for liquor were put into a huge furnace, and buined, we should have the ashes; but, as it is, we have no ashes except such as, with 8haine and tears, we are obliged to bury. We have not displayed these figures for the special purpose of reading a lesson to Virginia, for that State is n o worse than the rest of the States of the Union ; but one of her faithful officers has brought out the statistics, and the country ought to feel very much obliged to him lor them. They give ua the facts that account for all our public distress. Our taxation for the legitímate purposes of government ahd the payment of the public debt is a mere bagatelle by the side of the taxation to which the people voluntarily subject themselves, for that which harms thera. "We consume, as a nation, $600,000,000 a year in spirituoua liquors, a suin which only needs a very few multiplications to pay the whole public debt of the country. If this tax could be entirely abated, the Ímpetus that would be given, not only to our proeperity, but to our civilization, would soon place us in advance of every nation under heaven. Liquor is at the bottoni of all our poverty. If the tax for it were lifted, there would npt need to be a man, woinan or child without bread. If it could be lifted from the Southern States alone, it would not take five years to make them not only prosperou8, but rich.. There cannot be a more pitiful or contemptible sight, than a man quarrelling over, and bemoaning his taxes, while tickling his palate, and burning up his stomach and his substance with glass after glass of whisky. Men dread the cholera the yellow fever and the sniall-pox, and take expensive precautiona against it, while the ravages of all of them in a year do not produce the mischief that intemperance does in a month. It is worse than a plague, worse than fire, or inundation, or war. Nothing but sickness, death.iinmorality, crime, pauperism, and a frightful waste of resources come of it. Nothing noble is born of it. Meantime our public men are timid about it. out ohurches are half indifferent over it, our ministers talk about the scriptural use of wine, our scientifio men dispute about the nutritive proporties of alcohol, our politicians utter wise things about iiersonal risrhts and sumptuary laws, and

Article

Subjects

Old News

Michigan Argus