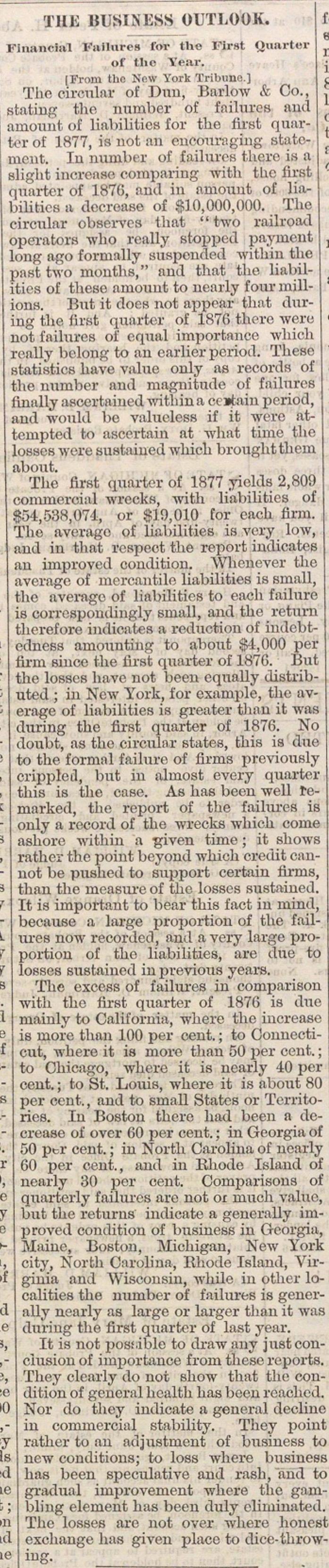

The Business Outlook

[From IIm' Nw York Tribuno.] The circular of Dnu, Barlow & Co., stating the number of feiluree mul amount of liabilities for the fiist quarter of 1877, is ïiot an enoournging statement. Iu number of failures there is a slighl inorease oomparing with tlic lirst quarter of 1876, and in nmount of liabilities a decrease of $10,000,000. ïlie circular observes tliat " two railroad operators who really stoppcd payinent long bro formally suspended within the past two months," and that tlio Iiililfties of these amouut to nearly foui-millions. But it doen not appoar that during the iirst quartcr of 1876 there weru not failures of cqual importance wllioh really belong to an earlicr pcriod. These statistics have valué only as records of the number and magnitude of failures linally ascertiiined witninaoeijiajn period, and woula bc valueless if it were attempted to ascertain at whaï time the losses were sustained which broughtthem about. The first quartor of 1877 yiclds 2,809 conuneroial wreckH, ■■ith liabilities of 854,538,074, or $19,010 for each fimi. The average of liabilities is very low, and in that íwpeet the report indicates m improved condition. Whcnever the iveróge of mercantile liabilities is small, the average of liabilities to each failnre is correspondingly small, and the return therefore indicates a reduotion of indebt?dncss ainounting to about $4,000 per Srm since the tírst qiuirter of 1876. But the losses have not been cqually distributed ; in New York, for example, the average of liabilities is greatei thau it was during the flrst quarter of 1876. No doubt, as the circular stiltes, this ia due to the formal failure of firms previously crippletl, but in aluiost every quarter this is the case. As has been well remarked, the report of the failures is only a record of the wrecks which come ashore within a given time ; it shows rather the point beyond which credit ennnot be pushed to support certain firms, than the ineasureof the losses sustained. It ia important to bear this fact in mind, becauee a largo proportion of the failures now recorded, anti a very large proportion of the liabilities, are duo to losses sustmnod in provious years. The excess of failures in comparison with the first quarter of 1876 is due mainly to California, where the increase is more than 100 per cent. ; to Counecticut, where it is more than 50 per cent. ; to Chicago, where it is nearly 40 per cent. ; to St. Louis, where it is about 80 per cent., and to small States or Territories. In Boston thcro had been a dccrease of over 60 per cent. ; in Georgia of 50 per cent. ; in North Carolina of nearly 60 per cent., and in Khode Island of nearly 30 per cent. Comparisous of quarterly failures tire not or niuch valtu-, but the returns indícate a generally improved condition of business in Georgia, Maiue, Boston, Michigan, New York city_, North Carolina, Ehode Island, Virginia and Wisconsin, while in other localities tlie number of failures is generally nearly as large or larger than it was dnring the first quarter of last year. It is not posf.ible to draw auy justconciusion of importance from these repoi"ts. ïhey clearly do not show that the condition of general hcalth has been rcachcd. Nor do they indicate a general decline in commercial stability. ïhey point rather to an adjiistment of business to new conditions; to loss where business has been speculative and rash, "and to gradual improvement where the g;nnbling element has been duly eliminated. The losses are not over where honest exchange has given place to dicc-throwiug.

Article

Subjects

Old News

Michigan Argus