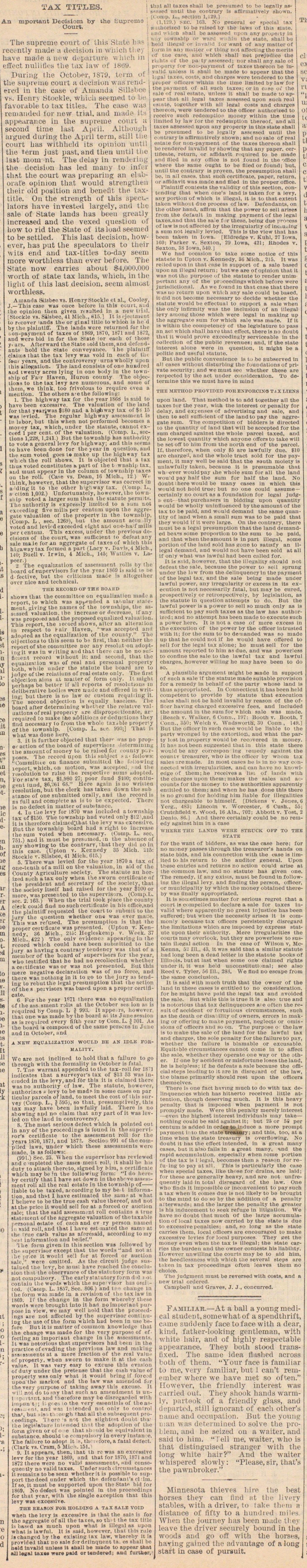

Tax Titles

Ttafi suprcme coturt of this recently made a decisión in wiiich have madeanew depaiture which in tlTect millifk-s tlie tax law of 18H8. jDuring the O'ctobnr, iS7'J, term of the Bupreme oourt r decisión was i cit-'l in the case of AmaiKla Sillsbee tb. Henrj Ötockle, Whicli Beetped to be favorable to tax titles. The case was cemauded ior now trial, and mad appAaxance in the supreme court ;i second time last April. Althpugh argued daring the April term, still tlie court has withhcUl its opinión until the term just past, and tuen untii ttie last mom nt. The delay in n i the decisión lias led many tu infer th,t the eourt was preparing an elabórate pinion that would Btrengthen their old position and beuefil the taxtitle. On the (rtrength of this BpecViIators have investid largely, and the sale of Sttkte lands has been greatlj increased and the vexed question of how to rid the State of Lts load seemed to be settled. ïhis last decisión, however, has put the speculators to their vrits enil and tax-titles tt-d:iy seem more worthless than ever befóte. TinState now carries about $-1,000,000 worth of state tax lands, whicli, in the Itglit of this last decisión, seem almost vvorthless. AmamJa Silabee ts. HenryStockle et al., Cooloy, J.- This casu was ouce bel'ore iit this ooori the opinión theu giveu resaltad in a dw trial, [Stockle va. Silabee, 41 Mich., 816.] It Ie piecunp1 to recover 'anda th or glual titlo to whicJi is he Ú by the plaiiitifl". The landa wcre relurned for the [.on-paynieiitof taxes of 1319, l70, 1871 and 1872, aud wcre bid In for the State íor each oí thosc y. urs. Aftorward the State ioldtbtin,ana defendants hold the State conveyance. 'Ihe plalntlff claitus that the tax levy was void in Men of Uu foui years, and the coiilrovcrsy urns wholly upon ibis 'Ihe iaud consista of onp huud ir 1 iiud twenty acres lylng ii one body in the toushipof Far JUavcn, Hu ron county The objeoIÍOB8 to the tax levy are numoious, and sonio of lhm. we think, too frivolous to requiro even a meution. The others a-e the followirj: 1. The highway Ux for the year ISOti is said to havo been exceBsive. The valuation of the land for ihat yariwas$180 and a hiiway t;ix of$i 15 was levitd. The regular highway aweasment is ii' Ifbor, but this when not perfornied beconjes a morey tax, which,under the statuUt, caunot excced 1 per cent. of the valuation. (Oomp. L., sccLions 122ÍJ, 1,241.) But the towDship has autln'í ity to TOtí a general levy for Mghway; and thla secms to have been done lor the year in qaertiOD, and tln !um Toied oes ! make un the high ay tax wh cli the roll shows. It Is objc-etcd thnt a tax Mius voted conftitutBS & part of the t wnship tax, and inuet appoar in the column of township taxcs ou the roll. (Cae vs. Dean, 16 Mich., 12) W, tbink, however, tbat the supervisor aa corrett in , ciiiij! ii to ihe othcr higïwmy tax. (Uomp L. a cl ion 1,002.) Ucfortunatfly, horeTr,the tcivvn sliip Tot.'tl a larger sum than Ihc statute y-orint1 In1, suthority ís expresly Imiittd lo a sum tol exceedlog five milis por centom upon the :j;Bregatc Taluation of the property in tlic townsüip (Comp. h . sec. 1269), nut the ainount aom ll vottd and levkdexceided eight ano one-hnf milla percentum. This exicss, uncier the previous de ciaions of ihe cuurr, was ufflcleDt t" dofeatanj sale made for u kogiegate of taxcscf irhlcb ihi hiüaway tax formeu a part (Lacy t. Dt1b,4 Mich. HO; Buell T. Irpin, 1 Mich., IJS; Wattles t. La poer.) 1 The equalization ol assefsment rous Dy me board of upervisors for the year ÏSK: I d fective, but the ciiticisin mace is altogether over nice and technictil. TUK RECOED OF TBK BOAKD shows that thecoioiuittie on equallzatlon niadi' n roport, to whlch j-j Rptffndvd a ia1 uiar Malenit-ut, virg the names of the townships, ;ississcd ïaluaiion. ihc increase or AecreBae. Ifany w?p propo-ed and the proposed equalized valualioD. This report, the lerord shows, altor an Rltei in respect to hair Haven, '"wws oocepted and ailiijitrd as the cqualization of the county." The oij.ciiouato thisseein tu be ttrst, thai neithir th rejiortof vbe couunittee nor auy rasolut ou adoptIngit was in writing and that there . au be DO sulftoient reoord wïtfiout it: and sccuiid, that the eiiualiza'ion n of real and personal proper! both, wlule undcr the statme the lioard :irt'. to imlge oftlK rcluliuns of real estáte on! y . The lii? ohjeciion aims st mauer of forni only. I'. migh iirhaps bo bi-lt. r f a!l rtports of rcsolutiuus l delibtrativc boiüis were u-aüe and uflVred in rit but there is un law of cutoui requiiing it Tni! second ohjccti-in is equally báseles. Ihe board afterdcteriniuini; whether the relativc Taluationsofreal propcny re diapropoitionate, ar required to niafee the aaditloua ordednctions ' li y flnd necessaiy to from the wliolc tai.ble propertï of the lowusbip. [tonip. L. sirv 9U:;;] 'lhai iwliat was done here. 3 It is furlhcr objecteJ tliat tlier was no prope act ion ofthe board of inperri u letermtning the atuountof money to be raiaed fui i ountj puriiosea. 'I he record upon this sabjeci safojlows: ' i'oiiMuititv on Aoaooe submltttd th rullowtug i-'ihüit, which. ou uiotion, was aocoptfid, iod the olatlon to r.iisc th respectivi' tun udopted. Vorsta'e tax, Í1.980 27; poor fund Si'iü; Contingent mud, Í6,;i)l 68." Hre a.úu la nu wriueo lesoluiion, bul theclerk lias taken down the sub nance of one submitted orally, and the record is na full and compkte as Is to be exrected. There in no defect in matter of eubetai 4. I Li llielevy for 1870 waa incii:drd atownsliii ax of $150. The townfchip had voted only 81ü ,unl It is theiefore c!ai:u(il;that the levy waa ixcossive. liutthr township board had a right to increase tlie gum Toted when necessary. ((!ouip. L. sec. 751.) and it must. be prcs..ni-il. :n the absence of my showing to the contrary, :hat tboy dul &o in tbla case. (Upton v. Kernrdy 35 Mich. 216: Stockle v. Silabee, 41 Mich. 616.) 5. There waa levied for tbs year 1870 a tax "Í one-tcuth ot'a mili on tlie valuation, in aid of the County Agriculture ocitty. The staiutc au horizcd such atax only when t'ie sworn oertlflcate oí the president and secretary of the society, thal the society itself had ruised lor the year SM) or more, was presented to the superrlsor. (Comp.L. sec. 2. 163.) Wht'n the trial took plaC6 the eounty clerk could fiml Doraebcertifloate in hisofflee.and the plaintitt'requcstcd tbecourtto rubniil lo the jury the qucstion whether one waa 8T9I ma B. This was refoaed. The presurnptioii is that the proper cextficate was presented. (Upton v. Kennedy S6 Mich.. 21i: HoKk'skeir.p v. Week. 37 Mich. .422) The onlT OTldenoe appearisglo the record which could have been submitted to the jury as havlng acoutraiy teudency waa thal "i B member of the buard of supera ii-ors for lio year, wuo lestifietl that he bad norecoliection whether aceitificate was or was not preseuted. Butthia mere neirative declaration was of no forcé, and there was notluug in it to uo to the jury aa t.'i.iinjr lo rebutthe legal presumptioo that the aetloi ofthe b peivisors was bated upun a proper certifícate. 6 For the year 1S71 there was uo equalizatiu of the a&s. sment rolls at the October BCfl Ion a i, qulrad iy Comp. L 993. lt apper, h o we Te thatoue was made by the board ai LU Junesesitio as is roqtiircd every flfth year üy Cum.L. 301. A the board la coinposid of the same persons lu Juu and in October, and A RXW EQÜAL1ZATION WOÜLD BE AN IDLE FOR MALITY. Wc are not inclined to hold that a fallare to g tbrotigh witb the formality in October is fetal. 7. T;te warrant appendcd to the lax-roll lor 18T inüicfttes that a surveyor's tax of $18 53 was in ciudcd in the levy, and f'ör tbis It is claimod thcr asno aiithority cf law. The statute, howere authorizts levy to be madp in som e cases on pa] tioular pareéis of land, to meet the cost of 1 lti bui vey (Coiup. L., öiiöj, so that, presumpiively, lh: lax may have bfen lawfully laid. There is o sliowing aul n claim that any part of it was lev ied on the land in coniroversy. 8. The most seriotts defect whlch is polnted ou in any of the proceedicgs is found in tne supervi por's certifícate to the assessment roll for th years 1870, 187J, aud 187 ?. Sectioi-991 of COIS plled laws, under which these assessments wert made, is as follows: (991.) 8Oc. 25. Vhen the Eupervisor bas reviewed and cmpleted tbc asst ment rolt, it ahall be hls duty to attach thertto, signed by h ira, a certifícate whifh inay bo 'n the lollowiug form: 'I dn hereby certify thatl have set down in yc u.y.-s ■- ment roll" all the real estáte in tho township of liabletobe taxed, a cordirn to rny be t information, and thit I have estimated ihe sum j :it whai I bi lieve to bethe true cash value thereof, ani pol atthe price H would sell for at aforecdor aoefioo sale; that the said assessm.nt roll contains a true statement of the aegregate valuaiion of thctaxable i.trsonal estáte of each aud ev ry person uainett in ssid roll, and that 1 have est marcd the Bun at i hi roe ca?h value as forttaid, accordiug to my heel inforination and belief." The form giren in thisBectíon was followed by ciipcrviijor exocpl that the words 'and not ai ibe price Itwoolri kc:1 for at (breed or auction Ukle, were omitted. As the circuit judge BOJ taiued tne lev-(be uins: have reached thu conelnsion thAt ihe (ibserranoe of the statu tory forn aot compulsory. The carlysiaiutory lorna d ■' i o contaiu the wonlK which the supe' visor has omi - tcd. (Coi.ip. L. is.1)". Sec. 806) and tne change In ibe íorm was made in a revisión of thttaxlawin 1869. lf the change in the form whweby these wonls were brougbt into it had do inu.oriaiit purpose in view, we may welt aold that the proi ei dings fcre not afl'ected by the supervisor contiiiuiog the uso of the foriu m bieb had been in u-.. h.-fow Bui ït is matter of common knowledgc that the change was made for the very purposo of ef l'ecting an iniporiaut change in ihe uaessments. II was uotorinus that supervisors had t.ecn in the practica of evading the previnus law and m aB-ssments at a mere fraction of the renl valuof pmperty, wben sworn to inake it al the ca li value. lt wm very asy to excuse this eTftsfon ot duty under the pretf-use that the oashvalueol property wasonly what it would bring lf fore d upOQth""1 iuark aud tho law vrus aúiendod i i thn very purpeso of takin away tbis exGOU. El wi ' nt do to ff y tb at such au anieudment i3 uni .fiit.ainJ i iio:efore nrty he disregarded wirh impun t ; U Z c o the very estentlils of theastes: . ■ at, and waa la tended not only to control tha, bui ilsothrogb fhat all tl1. o sabsequen! pro(ewlinfi. There 8 not the sllgbtest doubi tha' ihe leglriature Intendad thi t the adoptlon uf the form giveu or ofo o thfttab -nld be equivalent in Kiibstam e. sbould I e o. rupulsry in every instan c. The failure to adopt it B(th - lore.a fatal detect. (Clark vs. Cram.ö Mii m. 151, v 9. It appears, then, that lh re was an excosslve lew for the year 1869, und that for 187Ü, 1871 and 1872 there were no valid asscbsment', nd consequetitly no validtaxs, Uadersuchi trcumstncefl it remaics to be seen whethcr it in possible to support thedeed under whicb th defcuant's cl un. lf so, it must be supported upun theStat biil lor 1809. Nodoiect was pointcd in the prooeedlnga for thKt ycar, wlth the single exception tbat thh levy was excessive. THH BBA8ON FOR HOLDING A TAX SALE VOID when the levy Is eiceasive ia that the aal is for the aggregate of all the taies, so th t th tax title is 'unit d as much upon what is illegul as upon what is lawful. lt in said, howt-ver, thai tbls rule ischangcd by tho existing tax law, whereby lt Ís provldeJ that no sale fordriinquent ta. ea shall bo ji]d luvaltd uniese it sball be made to appeur töat aJJ logal Uim were pald orUndered; and furUir, tÏKit all taxcs shall be presumid to be leftnlly b1 HDtU the OODtnry ld afflruiatively shown. I '■;,:[. ],., MCUOD 1,129.] (1,129.) m: 'v:. S- general ur special lx ÍZQ4 t" bu iiiised by the laws of Ihis itate, r-ti sliall bo assessoil upon any propoity la ..nsMji or irard wltWti the state, ühall bo Ilegal "■ tnraild tor want of Hiiy matter of ■ tblng nut alTectiiigthe merit tf tuc cavo, aiid whteh sluil! nut Hmii h'í oí the pa ty asseuedj nur nhnll uny aalo ot iv fW nor.-imyineitt of tnxe tlicj-con be invalld unleu it sbull bc mado to appear that the vaú churscH were tcndered to the . offlcara Whhln the time llmited by law for tbepayment of all such taxes;orln c.:to of ihe pulo of roal estaie, nnless it shall bo marie to appsttr Ibat all k'jzal taxes assessed upon bucIi re;il estáte, toste thrr uith :ill leui costa and charges Chereon, wure tcndored to the officer authorlzed to receivo such redernptlon money wlthln the time ItUtted bj tairfortb.0 rcdemptlon tberaof. and ull a.ea assesst'il opon any property in thts state shall o presuiiied to be l-'Kally assessed until the mtrary ts aftirnmtivoly BbOWB; and DO salo of real state tor non-pa y ment of the laxes thcroon shall ironflered Inralid byshowing that any paper, ccrhcutc, rtíturn, or iiffirlavlt r guired to be made tul illuil in i;ny oñiue is nut íoiuicl In tho office vhere tho sanio ought to be flled or found; but, ntil tlio coiitiary ia proven, tho prosumption shall Kil oases, ihai sucii certilleate, paper, return, r iilidíivit ni utacïe and flled in the proper office. Plalntiff contesta the .ilidity of this sectton, oontendlDg tbat Whva one's land ts taken for a levy, Hity poxtlod of wbich is illegal, it is to thnt extent tnken withov.t due procesa of law. Defendants, on the otlior hand, alllrm that the power to sell arine trom the dcl'ault In maklng payment of the lek'al tazöcasd that the situ for these, beinji due proess of law is oot Ofleoted by the irn;tóuluriiy of LnÓiOAiiOg a sum DOt legally levled. This Is the view that hu been taken in Iowa. lËldredjie v. Kuhl, '7 Iuwa, 00; i'urker v. Hexton, 2'J lowa, 421; ithodes v. sexton, 88 IowftM0, We hiid occasion fco tnke porae notice of this tatdte In Upton v. Kennedy, 30 Midi., 215. It wns ■ i'-ii upnii i ti thnt oase tn support of a sale bastd Ipon :ni U legal return: butwe are of opinión thut lt ras nut purpose of the sta tute to ronder unimrttint :itiy OÍ fchë pr -ccedínga whtch before were urisüictlonal. As yve fuund In that case that there ras ao return apon wbh ii any suie oould be bused, t did nol becoine necesary to dectde whether the tutute wuuld be effectual to support a sale when he only intirmity was the inclusión of an illejial evy MQOOg tliose whtch were legal In makin up be aggreffttte sum for which sale was made. If lt s wltblo the OOmpeteuoy of the leKlslaturc to pasa nn act vrhicli ?hu I barotbat eiTect, there is nu doubt hut it would prove excoodlnfcly servlceablo in the n of the public revenuea; and, if the state atereat alone were in quention, lt might be a politie and useful Btittute. Butthe public convonlence 1 U bc subserved in ill cases without disturbing the foundations of private senurity; and we must sec whether these are efpccted by the act under cunsideration. To deermine this we must have in itiin.l ril E METHOD l'UOVIDKI) FOKENFORCIXO TáX MENS upon land. That ruethod ia to add tnjrethor all the nxe& tor the yenr, wiih the Interest or penalty for ielay, and exi 0BB68 f ulvertising uud salo, and then to aell suiil.iont of the laudtu pay the ngpregate sum. Tiie compctition of bidders is dlrected o the quantity of land ttaat will be acccpted for the Hum churged nainst the whole parcel taxed, uud .he lowest quantity which nnyone offers to take will ie set off to him froni the uorth end of tho parcol. Lf, therefore, when only $5 are lawfully due. $10 ire chnrye i, and the whole tract sold for the pnym'in, it raay well be said that the aouth motety is unlawfitlly taken, because lt is presumable that wh'ever wouldpay the whole aum for all the land woud piiy half the sum for half the land. No doubt thero wmild be many cases in which this would not hold true; but no one could atsume - ctMtuinly qo Oourt Ai a foundation for letfal judicd rn: that puröhasers tn biddln upon cjuantity sould be wholly unlnlluenccd by theamountof the taz to be pakl, and wm1d demaud the same quantity of land when u sniull sum was to be patd that thcy would it it WOW ltirie. On the contrary, there must be a legal presumption that the land demanded bea'-a aome proportion to tho sum to be pakl. :n. thut wiieii the aniuuut is in part illegal, aome portion of the land sold has ffoue to satisfy an 11legal dcmand, nnd wou Ui not have been sold at all if oniy what waa lawfnJ bad been c&lled for. It is b::u1, however, thut the llle'ality slumlü not detCMit the t-ale, because the power to suil sprung under the law from the dellnquency tn the payment of the legal tax, and the sale belaK nmde under lawful power, uny irregularity or exces in tte execution is not necessarily fatal, but nmy be ciirud, prospectWely or rettospectively, by lejiislatlon, aa the stutute in quostion nttempts to do. But the luwful power Is a power to aell so much only as i sufQcient to )ny such taxes as the law bas authorlzed; and no attempt has been made to execute such B power here. It is not a case of mere ex'es in theexecution of the power by the oflïcer intrusted wtth it; lor tlio sum to ba de'nanded was so nmdu up thut he could not lf he would have ofTered to sell for the ical tux alone; he mut sell for the amount rcporUïd to him aa duc, and was poweriess tu OODflne the sule to the lawful Uix and litwiul charges, however wilüng he may have been to do so. A plausible argument raight be wade in support of &ueh a sale if the statute made suttable provisión for a remedy in behalf of the party whose land is tluis appropriatod. In Connecticut it has been held competen! to provlde by statute that execution sales shítli not be hdld luvalid by reaaon of the ofii . i h;ivini chargcd excessive fees, and included the iniotint in the uui for vihich sale was made. [BO&Cb v. V;iik;r, t COJU)., 197: Buoth V. Booth, 7 Conn., 860; Weloli v. Wadewortff; 80 Conn , Uit.l Hut the offloer in such case would be linblo to the p!rtv WTöDged by the extortlou, and whut the party lost in propeny would be reenvered in money. Il bfli nut boon suüjiested thut in this state there wiuiiti be any correspoa hik remedy atr;iinst the countv treasurer, who Ui the offloer by wbom t;ix rï mudo, in ruost CftBM lie ni ni) wit y cnui;h irre;:u!iiritie!, and oan have no knowledge of thcm; he receives a list of tanda wltn t !ic obBIS6fl upuii thom; inakes the sales and ;t' - COuntn !■ r the rnuney to the autborlties apparenUy entltled to them; and when he luis done this tbere is do (round for holding him liable for IllOffflJlttBfl aot chargeablo to hinaself. fDickens v. Jones, (j ferg., 488; Unooin v. Worceater, 6 Cush., 55; Crutchtield v. Wood, lf Aln., TU2; Abbott v. Yost, 2 Donio. 80.] And there certainly could be no remeily itKitinstbim in it case wuehe Tin: ],.us wv.ur. sruuCK ofp to thk BTAT1 for the want of bidders, as was the case here; for no mona? passes ihrough tbe treHSurer's bandtt on state blds, and nis conncctlon wlth the case Is Ihnttcd to his reuirii to the auditor general. Upon these entriea and returns no action could arise at the common luw, and no statute has given one. The remedy, il :uiy ezlattf, must bfl found Ld íollowiiit' the illegal levy. uiul tlnding the person, ofiQccr, or muiiiclpaüty by which the money obtained thereby was Önally appropriated. It ia sou. etitues matter for erlous re'ret that a oourt ís onnpelled to declare a sale for tuxes invülut wiiere upparcntly no n?:it lnjustice has been Mitlcretl; Uut wi:en the necesölty arlises It is comEQonly oeeauae t;ix ofïicers persistently disregard the liinitations whicfi are imposed by express stutute apon their imlhority. Mere irreirularlties the courts raay overlook, butthcy are powiirlo-s tonttain ilictfid action ín the case of Wilson v, llcKenna, 62 III,, 43, it was sald that a similar stutute had long been a dead letter iu tho atatute books of Iilinui. butat lust when some one claimed riuhts ander it, II ma held unconstitutlnal; see alao Eteed v. Tyler. 66 III., 28.-Í. We find no escape from tlie sume coiicIum'mi. It is said with much truth that the owner of the land in thefü cases is entitled to no contMderation, for he miKht havo puld tho legal tax and avoided the sale. But while tuis is true it is also tiue and is notorious that t;t. detinquences are oí ten the resuit of accident orfortaitous circiimstnnces, such as tlic dc;iih ir dlBftl ility uf owners, errors in making or offerlng to matee p:iyiuent, neglects or omissions of ofñcors nd so on. The purpose o the luw is to niake the sale of tbe land for the lawful tax and chargep, the solé penalty forthefailuieto pafi whetber tho faUorO la blamable or excusable. Bqott ble uircumslanees cannot come in to affect the sale, whether ihey opérate one way or the othor. It" one by jicciileut or misfortune loses the lum!, he ia hfii!f-s ; if be defents a sale becciuse the oflicial steps leiidlnif to :t :tre in dlsreard of tbe law, i.i' hiüino primarily s hou ld rest upon the offleers UlClIK-t'lvt. Tbere la ne fnct hiving mueh to do with tax deürifiiicnr es wliicii lius hitherto received little afclontiun, UlOtlffb diiservinjf much. lt is this heavy penalty tbat is irnposed wheu payment is not promptly made. Were this pcnnlty merely in teros t - even the highest Interest Individúala muy take- nothing could be sald agatnet lt; but 'hor ÖS per centuni 1 ad deel in order toindiice a mure prompt payment i tu the t itr trnajilr; and this, too, ata timo when the state treasury is overliowing. No doubt it has the eflect intended. In a great many Oases, but it also fails in a great raany, mul the rupid accuniulution. especially rhen :;ome portion of the tax la i legal, becomes tüen re.ison lor refu-lng to p;iy il ülL This la particularly the 0H6 when ipeelaJ tnxes, like thu&e for dratns, are laid; for i bese are generalij heavy, and are not unfrequently laid In total disreKard of the law. One whu BndB it imponible or inconveniont topaysuch a tax when tt. comes due is not likely to bö brouht to the iniini to tin so by the addltlon of a penalty aiterwards; and the larger the penalty the greater s bli induoement to eelt rafoge in ltügatton. we have no doubt that much of the larpe accuniulation of local titxeK now carrled by the state is due to excesütve peoaltien; and, po long as the state citrries theni, local ofíieers are encouraged co make i'.Mrssive leyles for local purpoaea. They ret the nioney even when the tax ík illegal; the statu curre the barden mul the owner contesta his liability. ILowever unwllling the courts muy be to uid him, the heedlesaness with whlch the several steps ure taken in tax proceedtngs often leaves theni no cholee. The Judgment must bc reversedwith costa, and a new trial ordered. Campbell and Graves, J. J , concurred.

Article

Subjects

Old News

Ann Arbor Democrat