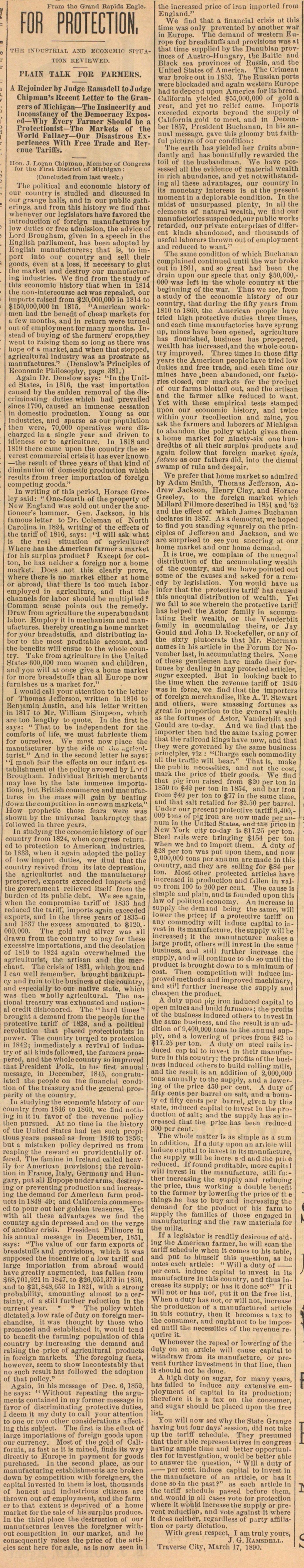

For Protection

Ilon. J. Lo&an Chipman, Member of Congres for Uie First District of Michigan: (Concluded from last week.) The j)olitical and economie history o our country is studied and discussed li our grange halls, and in our public gath erinjis. and from this history we find that whenever our leglslators have favored the introduction of foreign manufactures by low duties or free admission, the adyice of Lord Iirougham, given In a speech in the English parliament, has been adopted by English manufacturers; that is, to import lnto our country and sell their goocls, even at a losa, if necessary to glut the market and destroy our nianufacturiüg industries. We flnd from thestudyof tli is economie history that when in 1S14 the non-intercourse act was repealcd, our importe r.dsed from $20,000,000 in 1814 to $150,000,000 in 1815. "American workrnrii had the benefit of cheap markets for a few montlis, and in return were turned out of employment formany months. Instead of buying of the farmers' crops.they went to raising them so long as tuere was hope of a market, and when that stopped, agricultural ndustry was as prostrate as manufactures.'' (Denslow's Principies of Economie Philosophy, page 381.) Again Dr. Denslowsays: "In the United States, in 1816, the vast importation cuused by the sudden removal of the discriminnting duties which had prevailed since 1790, caused an immense cessation in domestic production. Young as our industries, and 3parse as our population tlieu were, 70,000 operatives were dis cbarged in a single year and driven to idlrness or to agriculture. In 1818 ane 1819 there carne upon the country the se verest commercial crisis it has ever known - the result of three years of that kind o diminution of domestic produclion whicl results from freer importation of foreign competiug goods." In wiitlng of tliis period, Horace Qree ley said: " One-fourth of the property of Xew Engiand was sold out under the auc tioneer's hammer. Gen. Jackson, in his famous letter to Dr. Coleman of Nortl Carolina in 1824, writin? of the effect3 o: the tariff of 1816, says: "I will ask wha is the real situation of agriculture Where lias the American farmer a marke for his surplus product? Except for cottoii, he has neiilier a foreign nor a home market. Does not this clearly prove, where there is no market cither at liome or abroad, that there is too much labor employed in aj;riculture, and tliat the channels for labor should be multiplied? Common sense points out the remedy. Draw from agr leal tare the superabundan! labor. Employ it in mechanism and manufactures, thereby creating a home maikei for your breadstuffs, and distributing labor to the most profitable account, and the benefils will ensue to the whole country. Take from agriculture in the United States 600,000 rneu women and cliildren, and you will at once give a home market for more breadstuils than all Europe uow furnishes us a market for." I would cali your attention to the letter of Thomas Jefferson, writtcn in 1816 to Benjamin Austin, and li is letter written In 1817 to Mr. William Simpson, which are too lengthy to quote. In the first lie says: "Thatto be independent for the comforts of life, we must fabrícate ttiem for ourselves. We must now place the manufacturer by the side oí Uo i.grïci!turlst." And in the second letter lie says: "I mucli fear the eftects on our infant establishment of the policy avowed by Liril Brougham. Individual British mercliants ma y lose by the late immense importations, but IJritish commerce and manufactures in the mass will gain by beatinir down thecompetition in ourown markets." How prophetic those fears were was shown by the universal bankruptcy that followed in three years. In studying the economie h story of our country from 1824, when congress returned to protection to American industries, to 1833, when it ijrain adopted the policy of low import duties, we flnd that the country revived from its late depression, the agriculturist and the mauufacturer prospered, exports exceeded imports and the government relieved itself from the buiden of its public debt. We see again, when the compromise tarifï'of 1833 had reduced tlie tarill', imports again exceeded exports, and in the three ycars of 1833-6 and 1837 the excess amounted to $120,000,000. The gold and silver was all drawu from the country to pay for these excessive importatlons, and the desolation of 1619 to 1824 again overwhelnied the agriculturist, the artisan and the merchant. The crisis of 1831, wliich you and I can well remember, brought bankrtiptcy and ruin to the business of the country, and especial!}' to our native state, whicli was tben wholly agricultural. The national treasury was exhausted and national credit dishonored. The "hard Unies1' brought a demand from the people for tlie protoctive tariff of 1828, and a political revolution that placed protectionists in power. The country turrjcd to protection in 1842; iinmediatcly a revival of indusIry of all kinds followed, the farmers proBpereil, and the wliole country soimpioved that President Polk, in his flrst atinual message, in December, 1845, congratulated the people on the flnancial condition of the treasury atid the general proeperity or the counti3'. In studying the economie history of our country from 184G to 18G0, we ünd uotliing in it in favor of the revenue policy Uien pursued. At no time in the liistory of the United States had ten such propiUousyean passedas lrom 184G to 185G; bat a mistaken policy deprived us from reaping the reward so providentlally offered. The famine in lreland called heavily for American provlsions; the revolution in France, Italy, Germany and Himifary, put all Eupope underarms, destroying or preventing production and increasing the deraand lor American farm products in 1848-40; and California comruenced to pour out her golden treasures. Yet with all these advantages we find the country agnin depreased and on the verge of another crisis. President Fillmore in his animal message in December, 1851, says: "The value of our farm exports of breadgtufte and provisions, wbich it was supposed the incentive of a low tariff and large importation from abroad would have greatly augmented, lias fallen from $68,701,921 in 1817, to $26,051,373 in 1850, and to Í2l,848,G53 lo 1881, with a strong probability, amounting almost to a certainty, of a still further reduction In the current year. The policy wblcb dictated.a low rate of duty on foreign merchandise, it was thought by those wlio promoted and establislicd It, would tend to benefit tho farming population of this country by increasing the demand and raising the i)rice of agricultural producís in foreign markets. The foregoing facts, however, seem to show incontestably that no such result has followed the adoption of that policy." Again, in his message of Dec. G, 1852, he says: "Without repeating the arguments contained iu my former message in favor of discriminating protective duties, I deern it my duty to cali your attention to oue or two other considerations affecting this subject. The first is the tflect of large importations of foreign goods upon our currency. Most of the gold of California, as fast as it is mincd, finds ts wny direclly to Europe in payment for goods purcliased. In the second place, as our mamifacturing establishments are broken down by competition with foreigners, the capital invested in them is lost, thousands of honest and industrious clti.ens ore thrown out of employtnent, and the farm er to that extent is deprived of a home market for the sale of his surplus produce. In the third place the destruetion of our manufactures leaves the forelgner without competition in our market, and he consequently raises the price of the articles sent liere for sale, as is now seen In the incrcascd pricc of ron iwpurtcd from England." We find that a flnanoial crisis at this time was only preventcd by another war in Europe. The demand of western Europe for breadstufïs and provisions was at that time gnpplied by the Danubian provinces of Austro-llungary, the Baltic aml Black sea provinces of Russia, and the United States of America. The Crimea war brokeout in 1853. The Russian ports were blockaded and agaln western Europe had to depend upon America for its bread. California yielded $55,000,000 of gold a year, and yet no relief carne. lm ports exceeded exports beyond the supply ol California gold to meet, and in December 1857, President Buchiinan, In liis annual messajfe, gave this ftloomy Uut falthful picture of our condition: The eartli lias yielded her fmits abundantly and lias bountifully rewarded the toil of the husbandman. We have possessed all the evidencc of material wealth in ric:h abandalice, and yet notwithstar.ding all these advantages, our country in its monetary lntcrests is at the ]resent moment in a deplorable condition. In the midst of uusurpassed pleuty, in all the elements of natural vrealth, we find our maiHifactoriessuspended,onr public works retarded, our private enterprises of different kinds abandoned, and thousunds of useful laborers throxvn out of euiployment and reduced to want." The same conditlon of whloh Buohanan complained continued until the war broke out in 1801, and so great had been the drain upon our specie that only $50,000,000 was left in the whole country at the beginuing of the war. Thus we see, from a study of the economie history of our country, thatdurinir the llfty years from 1810 to 1860, the American people have trled high protective duties three times, and each time manufactories have spruns: up, mines have been opened, agricultura has llourished, business has prospered, wealth has Increased,and the whole country improved. Three times in those lifty years the American people have tried low duties and free trade, and each time our mines have .been abandoned, our factories closed, our markets for the product of our farms blotted out, and the artisan and the farmer alike reduced to want. Yet with these empiriciil tests stamped upon our economie history, and twice within your recollection and mine, you ask the farmers and laborers of Michigan to abandon the policy wliich gives them a home market for jiinetv-six one bundredths of all their surplus products and again follow tbat foreign market ignis, fatuus as our fathers did, into the dismal swamp of ruin and despair. We prefer that home market so adniired by Adam Smith, Thomas Jefterson, Andrew Jackson, Henry Clay, and Horace Greeley, to the foreign market tvhich Millard Fillmoredescribed In 1851 and '52 and the effect of whleh James Bachanan declares in 1857. As a democrat, we liopcd to flnd you standing squarely on the principies of Jeiïerson and Jackson, and we are surprised to see you sneering at our home market and our home demaiid. It is true, we coinplam of the uncqual distribution of the accumulating wealth of the country, and we have pointed out sonie oi the causes and asked for a remedy by legislalion. You would have us Infer that the protective tari ft' bas Cnused this uneqital distribution of weaith. Yet we fail to see wherein the protective tariff bas helped the Astor famlly in accumulating their Wealth, or the Vanderbilt family in accumulaling theirs, or Jay Gould and John D. Rockefeller, or any of the sixiy plutocrats that Mr. Sherman names In bis article in the Forum for Noveuiber last, in accumulating theirs. None of these gentlemen have made their fortunes by dealing in any protected article?, silgar excepted. But in looking back to the time when the revenue tariff of 18-16 was in foree, we find that the importers of foreign merchandise, llke A.T. Stewart and others, werc amassing fortunes as great In proportion to the gvneral wealtli as the fortunes of Astor, Vanderbilt and Gould are to-day. And we flnd that the mporter then had the same taxing power that the railroad kings have now, and that they were governed by the same business piiuciple?, viz : "Charge cacb commodity til the tn.itio will bear." That is, niake the public necoesitles, and not the coat, mark the price of their goods. We flnd tliat pig iron raised from $21) per ton in 1850 to $42 per ton in 1854, and bar iron trom $4u per ton to $77 in the same time and that salt retailed for $2.50 per barrel. Undcr our present protective tariff 9,400,000 tona of pig iron are now made per aiïum in the United States, nd the price in few York city to-day is $17.25 per ton. Steel rails were bringing $154 per ton vhen we had to import them. A duty of 5:28 per ton was put upon them, and now ,000,000 tons peranuum are made in thi3 country, and they are selling for $84 per on. lost other protected articles have ncreased in production and fallen in valU3 from 100 to 200 per cent. The cause is imple and piala, and te founded upon this aw of political economy. An increase in upply tbe demand being the same, will ower the price; if a protective tariff on ny comniodity will induce capital to invest in its manufacture, the supply will be ncreased; if the mauutacturcr makes a arge prolit, others will nvest in the same jusiness, and still further increase the upply, and will continue to do so until the iruduct is brought down to a minimum of ost. Then competición will induce imroved methods and improved machintry, nd sti'l furtber iucrease tlie supply añd heupen, the product. A duty upon pijj iron iuduced capital to open mines and biiiki furnaces; the prolits oí the business iuduced otliers to inve&t in the same business, and the result is an addltion of 9,400,000 (ons tu the animal supply, nnd a lowering oí prices from $42 to 17.25 per ton. A duty on sleel rails induced cap tal to inve-t in tlieir manufacture in this country; the profits of the business Indnced otherato build rolling milis, and the íesult is an addition of 2,000,000 tons annually to tfie supply, and a lowering of the price 400 per cent. A duty of flfty cenls per buriel on sult, and a bonnty of flfty cents per barrel, given by this State, indnced capital toinvest in the production of salt; and the supply lus so increased that the price has been reduci-d 300 por cent. The vyhole matter s as simple ís a sum in addition. If aduty upon un article will Induce o ipital to invest in its manufacture, the supply will be incre. s d ai.d the pri e reduced. If tound profitable, inore capital will invest in the manufacture, still fu:ther increasing the supply and reducing the price, tlius working a doublé benefit to the farmer by lowering the price of tl. e tilinga he lias to buy and increasing the demand for the product of hls farm to supply the families of those engaged in luanufacturing and the raw materials for the milis. If a legislator is readily desirous of aiding the American farmer, lie will scan the tariff schcdule when it comes to hls tuble, and put to himself this qut-stion, as be notes each article: " Will a duty of per cent, induce capital to invest in its manufacture in this country, and thus increase its supply; or has it done so?" If it will not or has not, put it on the free list. When a duty has not, or will not, increase the production of a manufacturad article in this country, then it becomes a tax to the consumer, and oujrhtnot to bc Imposed until the necessities of the revenue requrire it. Whenever the repeal or lowering of the duty on an article will cause capital to witüdraw from its manufacture, or prevent further investment In that line, then it should not be done. A high duty on sugar, for many years, has failed to induce any extensive employment of capital in its productiou; therefore it is a tax on the consumer, and sugar should be placed upon the free list. You will now sec why the State Grange having but four days' ses3ion, did not take up the tarifl" schedule. ïhey presumed tliat their able representatives in congress having ampie time and better opportunitles for investigation, would be bettor able to answer the question, " Will a duty of per cent, induce capital to Invest In the manufacture of an article, or bas it done so in the past?" as eacb article In the tariff schedule pasped beforo them, and would in all cases vote for protection where it would increaee the supply or prevent reduction, and vote against it where it dees neither, regardless of party affiliation or party dictation. With great respect, I am truly yours, Traverse City, March 17, 1890.

Article

Subjects

Old News

Ann Arbor Courier