"more Money" Cry

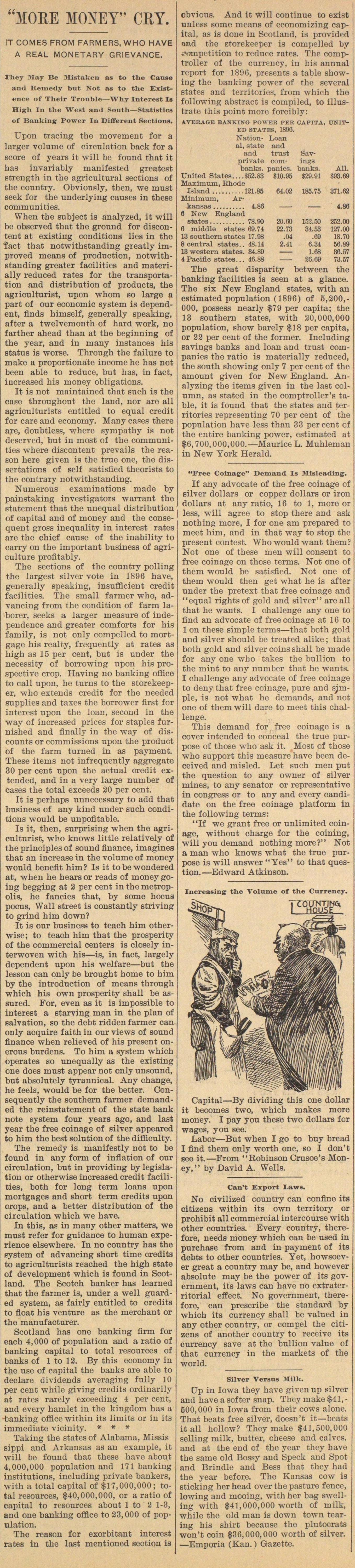

Upon tracing the movement for a larger volume of circulation back for a score of years it will be found that it has invariably manifested greatest gtrength in the agricultural sections of the country. Obviously, then, we must seek for the underlying causes in these communities. When the subject is analyzed, it will be observed that the ground for discontent at existing conditions lies in the fact that notwithetanding gieatly improved means of production, notwithstanding greater facilities and materially reduced rates for the transportation and distribution of products, the agriculturist, upon wbom so large a part of our economie system is dependent, finds himself, generally speaking, after a twelvemonth of hard work, no farther ahead than at the beginning of the year, and in many instances bis status is worse. Through the failure to make a proportionate income he has not been able to reduce, but has, in fact, iacreased his money obligations. It is not maintained that such is the case throughout the land, nor are all agriculturists entitled to equal credit for care and economy. Many cases there are, doubtless, where sympathy is not deserved, but in most of the communities where discontent prevails the reason here given is the true one, the dissertations of self satisfied theorists to the contrary notwithstanding. Numerous examinations made by painstaking investigators warrant the statement that the unequal distribution of capital and of money and the consequent gross inequality in interest rates are the chief cause of the inability to carry on the important business of agriculture profitably. The sections of the country polling the largest silver vote in 1896 have, generally speaking, insufficient credit facilities. The small farmer wbo, advancing from the condition of farm laborer, seeks a larger measure of independence and greater comforts for his farnily, is not only compelled to mortgage his realty, frequently at rates as high as 15 per cent, but is under the necessity of borrowing upon his prospective erop. Having no banking office to cali upon, he turns to the storekeeper, who extends credit for the needed supplies and taxes the borrower first for interest upon the loan, second in the way of increased prices for Staples furnished and finally in the way of discounts or conimissions upon the product of the farm turned in as payment. These items not infrequently aggregate 30 per cent upon the actual credit extended, and in a very large number of cases the total exceeds 20 per cent. It is perhaps unnecessary to add that business of any kind under such conditions would be unpofitable. Is it, then, surprising when the agriculturist, who knows little relatively of the principies of sound finance, imagines that an increase in the volume of money would benefit him? Is it tobewondered at, when he hears or reads of money going begging at 8 per cent in the metropolis, he fancies that, by some hocus pocus, Wall street is constantly striving to grind him down? It is our business to teach him otherwise; to teach him that the prosperity of the commercial centers is closely interwoven with his - is, in fact, largely dependent upon his welfare - but the lesson can only be brought home to him by the introduction of means through which his own prosperity shall be asBured. For, even as it is impossible to interest a starving man in the plan of salvation, so the debt ridden farmer can only acquire f aith in our views of sound finance when relieved of his present onerous burdens. To him a system which operates so unequally as the existing one does must appear not only unsound, but absolutely tyrannical. Any change, he feels, would be for the better. Consequently the southern farmer demanded the reinstatement of the state bank note system four years ago, and last year the free coinage of silver appeared to him the best solution of the difficulty. The remedy is manifestly not to be found in any form of inflation of our circulation, but in providing by legislation or otherwise increased credit facilities, both for long term loans upon mortgages and short term credits upon crops, and a better distribution of the circulation which we have. In this, as in many other matters, we must refer for guidance to human experience elsewhere. In no country has the system of advancing short time credits to agriculturists reached the high state of development which is found in Scotland. The Scotch banker has learned that the farmer is, under a well guarded system, as fairly entitled to credits to float his venture as the merchant or the manufacturer. Scotland has one banking firm for each 4,000 of population and a ratio of banking capital to total resources of banks of 1 to 12. By this economy in the use of capital the banks are able to declare dividends averaging fnlly 10 per cent while giving credits ordinarily at rates rarely exceeding 4 per cent, and every hamlet in the kingdoru has a -banking office within its limits or in its immediate vicinity. Taking the states of Alabania, Missis sippi and Arkansas as an example, it will be found that these have about 4,000,000 population and 171 banking institutions, including private bankers, with a total capital of $17,000,000; total resources, 40,000,000, or a ratio of capital to resources about 1 to 2 1-3, and one banking office to 23, 000 of population. The reason for exorbitant interest rates in the last mentioned section is ebvious. And it will continue to exist tinless some means of economizing capital, as is done in Scotland, is provided and the storekeeper is compelled by omnpetition to rednce rates. The comptroller of the currency, in bis annual report for 1896, presen ts a table sbowing the banking power of the several states and territories, from wbich the following abstract is cornpiled, to illustrate this point more forcibly: AVERAGE BANKING POWER PER CAPITA, UNITED STATES, 1896. NationLoan al, state and and trust Savprivate comins banks. panies. banks. All. United States.... $52.83 $10.95 $29.91 $93.69 Maximum, Ehode Island 121.85 64.02 185.75 871.62 Minimum, Arkansas 4.86 4.88 6 New England stotes 78.90 20.60 152.50 252.00 8 middlo states 69.74 22.73 84.53 127.00 13 Southern statea 17.98 .04 .69 18.70 8 central states.. 48.14 2.41 6.34 56.89 13 western states. 34.89 1.68 36.57 4 Pacific states... 46.88 26.69 73.57 The great disparity between the banking facilities is seen at a glance. The six New England states, with an estimated population (1896) of 5,200,000, possess nearly $79 per capita; the 18 soutbern states, with 20,000,000 population, show barely $18 per capita, or 22 per cent of the former. Including eavings banks and loan and trust companies the ratio is materially reduced, the south showing only 7 per cent of the amount given for New England. Analyzing the items given in the last column, as stated in the comptroller's table, it is found that the states and territories representing 70 per cent of the population have less than 33 percent of the entire banking power, estimated at $6,700,000,000. - Maurice L. Muhleman in New York Herald.

Article

Subjects

Old News

Ann Arbor Courier