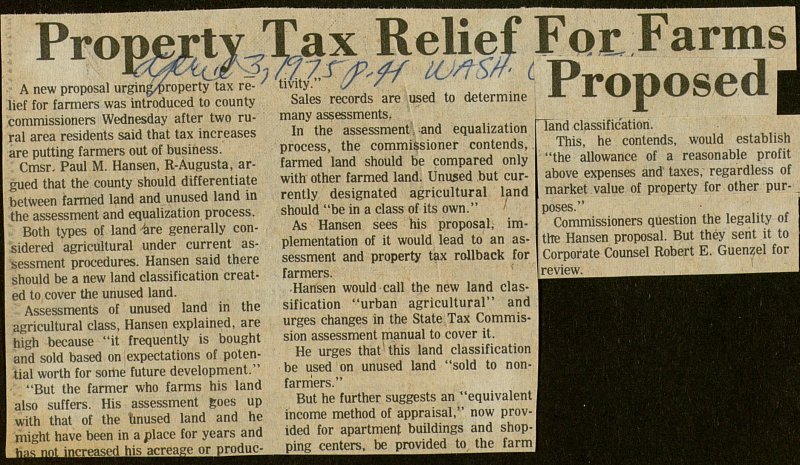

Property Tax Relief For Farms Proposed

A new proposal urgingfcroperty tax relief for farmers was introduced to county commissioners Wednesday after two rural área residents said that tax increases are putting farmers out of business. Cmsr, Paul M. Hansen, R-Augusta, argued that the county should differentiate between farmed land and unused land in the assessment and equalization process. Both types of land yare generally considered agricultural under current assessment procedures. Hansen said there should be a new land classification created to cover the unused land. Assessments of unused land in the agricultural class, Hansen explained, are high because "it frequently is bought and sold based on expectations of potential worth for some future development." "But the farmer who farms his land also suffers. His assessment goes up with that of the unused land and he might have been in a place for years and has not increased his acreage or tivity." ' ' Sales records are used to determine many assessments. In the assessment .. and equalization process, the commissioner contends, , farmed land should be compared only with other farmed land. Unused but currently designated agricultural land should "be in a class of its own." As Hansen sees nis proposal, implementation of it would lead to an assessment and property tax rollback for farmers. Hansen would cali the new land classification "urban agricultural" and urges changes in the State Tax Commission assessment manual to cover it. He urges thatthis land classification be used on unused land "sold to nonfarmers." But he further suggests an "equivalent income method of appraisal," now provided for apartment buildings and shopping centers, be provided to the farm land classification. This, he contends, would establish "the allowance of a reasonable profit above expenses and' taxes, regardless of market value of property for other purposes." Commissioners question the legality of the Hansen proposal. But théy sent it to Corporate Counsel Robert E. Guenzel for review. _______