The theory of protection is to build up ...

The theory of protection is to build up one man's business by taxing all the people who use articles inanufactured by the man sought to be benefitted . This is very nice for the man benefitted but how about the fellows taxed ? The farmers are taxed to help manufacturers who are worth millions. The manufacturers contract to pay back part of that tax indirectly to the farmers. They don't do it, but if they should, wouldn't it be better tor the farmer to keep h'is money in his pocket in the first place? The New YorkTribune at last admits that "wages always have been higher in this comparatively new country than in older and more crowded countries." High wages then are not due to our protective tariffbut to our resources not yet being fully developed and the eountry not yet over populated. There are now452,577pensioners hl the United States. During the past year 60,252 new names have keen added to the pension rolls. Nearly one third of the entire expenses of the government consists in the pay ment of pensions to disabled soldiers. What soldier, in the light of these facts, can find any fault with Cleveland's administraron? Says the New York World; "The Tribune isengaged in the easy work of carrying New York for Harrison - 011 paper, in advance of the election. It has performed this feat regularly for the past six years. but when the votes were counted it was tound every time that the democrats were ahead. New York is a democratie state. Says the Pittsfield correspondent of the Hillsdale Democrat: "W:llard Stearns, our nominee for congress, was given a rousing reception at his meeting Monday night. He made friends by his manly, srraightforward way in dealing with the tariff question. As one prominent republican expressed it: "I can't help liking his way of talking; you know just what he believes and will do." If a dry goods merchant of this city should get laws passed requiring all the people who purchase dry goods of other merchants than himself to pay a tax of forty-seven per cent for doing so, how long would the people be in rising at the polls to have such laws repealed ? The argument that the tax so imposed permitted him to give employment to additional clerks would not save the tax a moment. The following apt illustration of the absurdity of the claims of our republican friends that the democratie party is a free trade party is going the rounds of the press. Says a red-faced man "I am a teetotaler, I used to take forty-seven drinks a day but now I only take forty drinks a day." "Yes, but how does that make you a teetotaler?" "Just the same as a man is a tree trader, who favors a reduction of taxes from forty -seven down to forty per cent. Do you see?" The democratie county ticket is a good, clean ticket. Being a ticket of that nature, no good democrat, we opine, can be found, to cut it for the repubhcan ticket. As we heard it remarked, when the men who asked democrats to vote for republicans are asked to vote ior a democrat, they reply, "he may be a good man but he is not on our ticket. The Argus does not advocate voting for poor men, but the denïöcratic ticket this vear is composed of good men and should be voted straight. A presidential year is not a good year to cut county tickets anyway. The democrats have renominated Senator James S. Gorman. Senator Gorman made a repiitation while in the legislatura the pasf two years. He was the actual leader of the ' ocratic minority and stood up ag linst J,.} Iiui.;.,tl-, l-jcst l'-"i..r. 'J. the repubiicans and did not come off second best. He it was who embarassed the repubiicans in passing the piohibitian amcndment lavv and furnished the argument, which probably influeqced enough votéis to defeat the amendment. He t is, whom the democrats of this district will delight to return by a good big majority. Gorman is á strong man m the senate. He is a man of influence. He is a man vvho has at heart the interests of his district, who attends to them faithfully and who possesses the requisite ability and experience to do so. The two greatest Irishmen who appeared in public life in the eventful peroid from 1775 to 1845, apcriod which embraces the change from ancient to modern industrial conditions, were Edmund Burke and Daniel O'Connel. Not only the two greatest Irishmen, but they were the two most accomplished orators in Great Britain during that time. Burke's keen intellect saw through the error of commercial restriction even before Adam Smith, and Smith said of him thatheunderstood the true principies of commerce better than any living man. O'Connell said that protection was robbery_, and in his magnifkent denunciation asked the Tories, "If protection is such a good thing for the people, why are Irish laborers starving?" Through the corn law repeal agitation he was one of the strongest supporters of Richard Cobden. - Kansas City Times. Many people are deterred from thinking about the tariff questionbecause they consider it a difficult one to understand. It is not. ' The principies are capable of being made so simple that anyone can understand it. The tariffis a tax imposed upon imports. It is imposed for the purpose of revenue and for protection. Protection to whom, wiiy to American manufacturéis. What manufacturer in VVashtenaw county is benefitted? Not one. Then why shcild Washtenaw voters, none of whom are protected, beasked tovote for a high tax? The tariff is a tax which is paid by the consumer of the article taxed. It forms part of the price of the article; that is, when a man pays a dollar for a "protected" article he pays on the average fortyseven cents tax. Then the simple question is, why pay a heavier tax than we need to? Let us ask again : Who ever got rich by being heavily taxed? Who ever heard of ruining a man by making his taxes lighter?

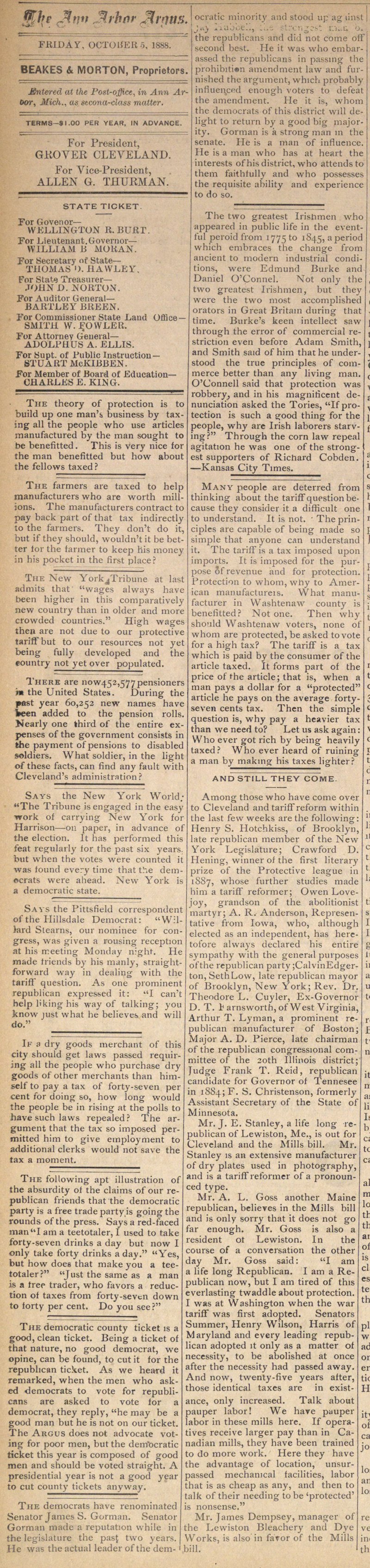

Article

Subjects

Ann Arbor Argus

Old News