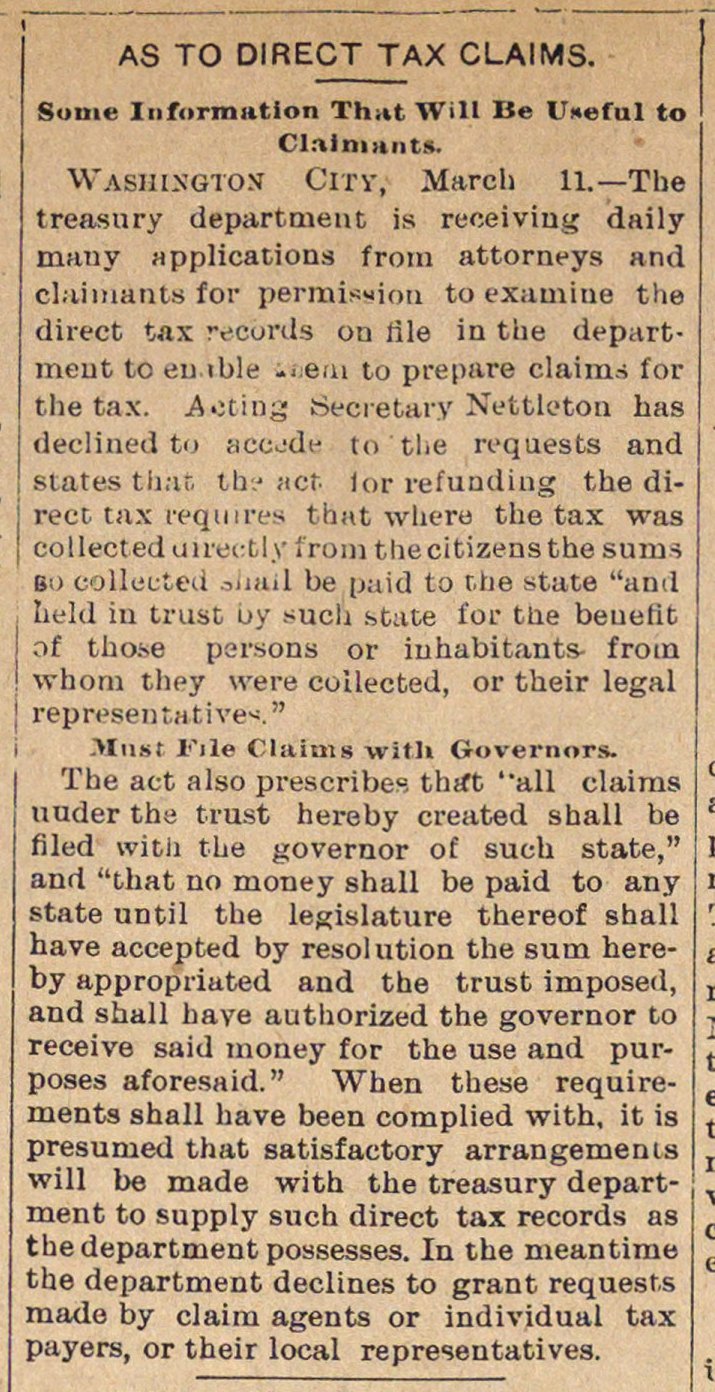

As To Direct Tax Claims

Washington ClTY; March 11.- The treasnry department is reoeiving daily many applications from attorneya and claimants for permimion to examine the direct tax records on file in the departmeut to eu ible ..ni to prepare claim.s for tlie tax. Acting Seoretary Nettleton has declíned to accddti to'tlie ívquests and states tli.-u. tb? act lor refunding the direct tax reqin res thut wlieru the tax was collected uiructty írom tliecitizensthesuius so colleuted sliall be paid to t.he state "and ie!d iu trust uy sucli stute íor tile beuetit of those persons or from wborn thpy were collected, or their legal represen talivei. " -Must File Claims with Governors. The act also prescribes thrft "all claims uuder the trust hereby created shall be filed witli the governor of such state," anii "that no money shall be paid to any state until the legislatura thereof shall have accepted by resol ution the sum hereby appropriated and the trust imposed, and shall have authorized the governor to receive said money for the use and purposes aforesaid. " When these requirements shall have been complied with, it is presumed that satisfactory arrangemenis will be made with the treasury department to supply such direct tax records as thedepartment possesses. In the meantime the department declines to grant request.s made by claim agents or individual tax payers, or their local representativea.

Article

Subjects

Income Taxes

Old News

Ann Arbor Argus

Washington D. C.