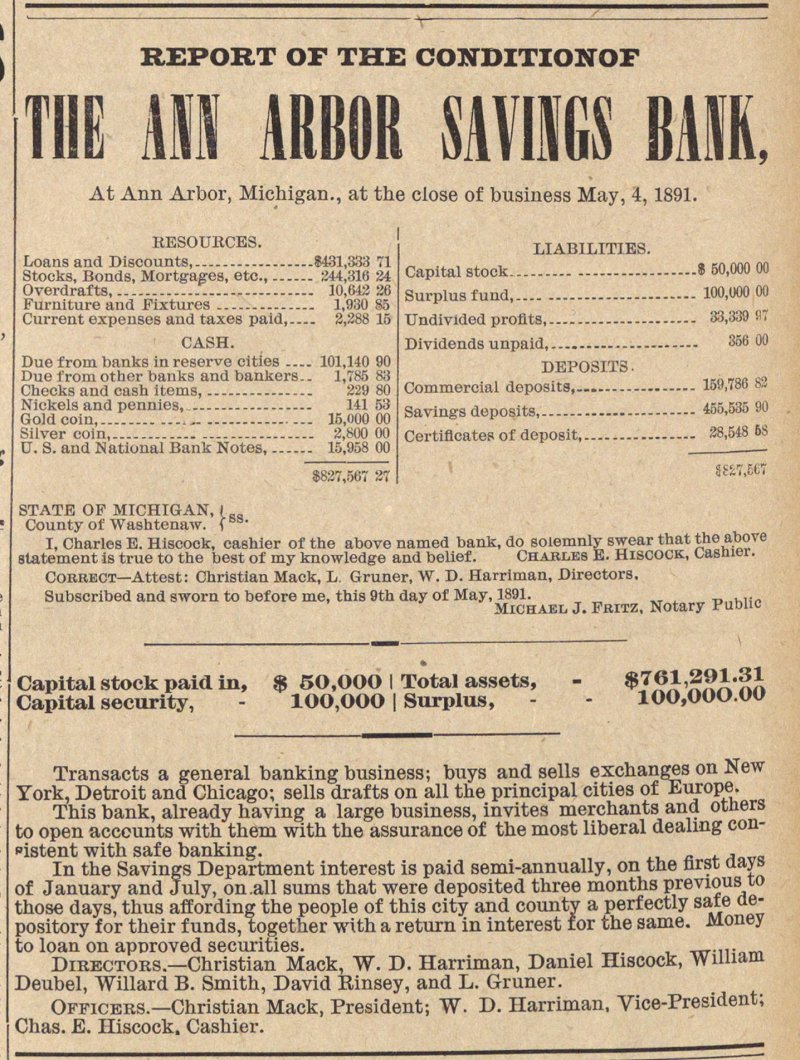

Report Of The Condition Of The Ann Arbor Savings Bank

At Aun Arbor, Michigan., at the close of business May, 4, 1891. RESOURCES. LIABILITIES. Loans and Discounts, 8431,333 71 „ .. , , , mnnnnn Stocks, Bonds, Mortg-ages, etc, 244,810 24 Capital stook ou,uuu uu Overdrafts, 10,042 26 urDlus fund 100,000 00 Furniture and Fixtures 1,930 85 ourPma luuu' Current expenses and taxes paid, 2,288 15 Undivided proflts, 33,339 il CASH. Dividends unpaid, 356 00 Due f rom banks in reserve cities 101,140 90 DEPOSIT3 Due trom otherbanks and bankers.. 1,785 83 . iso iran Cheeks and cash items, 229 80 Commercial deposits, 150,78 sGoidtta?ipe.nnie.s:. ;;::::::::::::::: iJ-Soo sa . 455,53590 Silver coin, 2,800 00 Certifleates of deposit 28,548 6S ü. S. and National Bank Notes, 15,958 00 ■ 887,867 27 ÍSCT.567 STATE OF MICHIGAN, I Ra County of Washtenaw. f B" I, Charles E. Hiscock, casuier of the above named bank, do soiemnly swear that the above statement is true to the best of my knowledge and belief. Charles E. Hiscock, Casmer. Correct- Attest: Christian Mack, L. Gruner, W. D. Harriman, Directora. Subscribed and sworn to before me, this 9th day of May. Mtt } NQtary pubUc Capital stock paid in, $ 50,000 I Total assets, - 7J&?A'nn Capital security, - 100,000 1 Surplus, - - 100,000.00 Transacts a general banking business; buys and sells exchanges on New York, Detroit and Chicago; sells drafts on all the principal cities of Europe. This bank, already having a large business, invites merchants and otners to open accounts with them with the assurance of the most liberal dealmg consistent with safe banking. __ j„m In the Savings Department interest is paid semi-annually, on the hrst aays of January and July, on .all sums that were deposited three months previous to those days, thus affording the people of this city and county a perf ectly saté aepository for their funds, together with a return in interest for the same. Money to loan on apüroved securities. m Directors.- Christian Mack, "W. D. Harriman, Daniel Hiscock, Wnnam Deubel, Willard B. Smith, David Einsey, and L. Gruner. Officers.- Christian Mack, President; W. D. Harriman, Vice-President; Chas. E. Hiscock, Cashier.