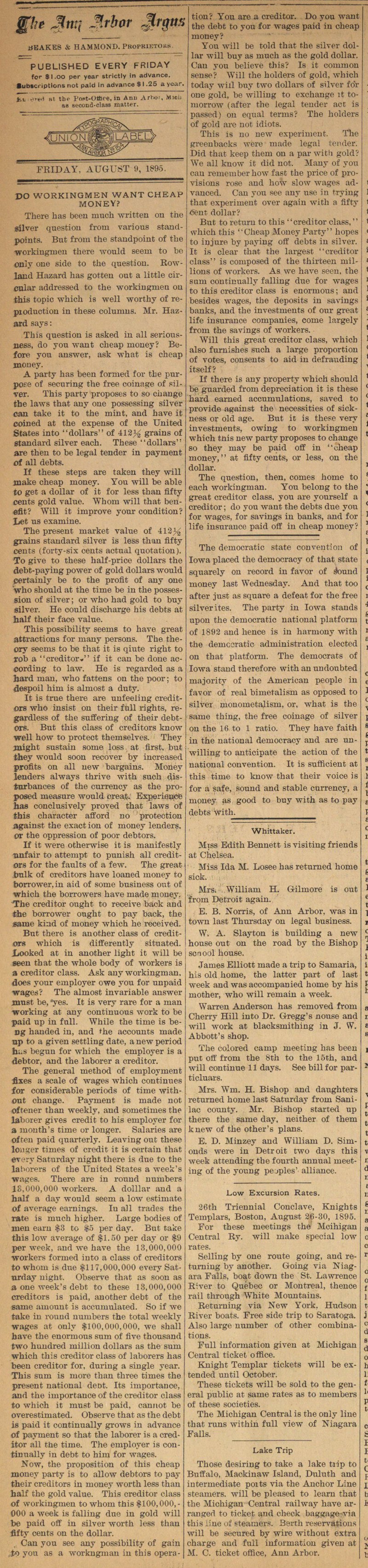

Do Workingmen Want Cheap Money?

There bas been rnuch written on the silver qnestion froni various standpoints. Bnt from the standpoint of the ■workingnien there would seem to be only one side to the question. Rowlaiid Hazard has gotten out a little circular addressed to the workingnien on this topic which is well worthy of repioduction in these columns. Mr. Hazard says : This question is asked in all seriousness, do yon want cheap rnoney? Before you answer, ask what is cheap money. A party has been formed for the pnrpo?e of secnring the f ree coinage of silver. This party proposes to so change the laws that any one possessing silver can take it to the mint, and have it coined at the expense of the United States into "dollars" of 412L grains of Standard silver each. These "dollars" are then to be legal tender in payment of all debts. If these steps are taken they will make cheap money. You will be able to get a dollar of it for less than fifty cents gold value. Whom will that benefit? Will it improve your condition? Jjet ns examine. The present market value of 412 grains Standard silver is less than fifty cents (forty-six cents actual quotation). To give to these half-price dollars the debt-paying power of gold dollars would certainly be to the profit of any one 'who should at the time be in the possession of silver ; or who had gold to buy silver. He could discharge his debts at half their face value. This possibility seems to have great attractions for inany persons. The theory seems to be that it is qiute right to rob a "creditor" if it can be done according to law. He is regarded as a hard man, who fattens on the poor ; to despoil him is almost a duty. It is trne there are unfeeling creditors who insist on their fnll rights, regardless of the suffering of their debtors. But this class of creditors know well how to proteot themselves. They uiight sustain some loss at flrst, but they would soon recover by increased proflts on all new bargains. Money lenders always thrive with such distnrbances of the currency as the proposed nieasure would oreat. Experienjce has conclusively proved that laws of this character afford no protection against the exact ion of money lenders, or the oppression of poor debtors. If it were otherwise it is manifestly unfair to attempt to punish all creditors for the faults of a few. The great tralk of creditors have loaned money to borrower,in aid of some business out of which the borrowers have made rnoney. ■The creditor ought to receive back and the borrower ought to pay back, the game kiad of money which he received. But there is another class of creditors which is differently situated. XiOoked at in another light it will be seen that the whole body of workers is a creditor class. Ask any workingman, does your employer owe you for unpaid wages? The almost invariable answer must be, "yes. It is very rare for a man working at any continuous work to be paid up in full. While the time is beDg handed in, and the accounts made np to a given settling date, a new period hi.s beguu for which the employer is a debtor, and the laborer a creditor. The general method of employraent flxes a scale of wages which continúes for considerable periods of time without change. Payment is made not of tener than weekly, and sometimes the laborer gives credit to his employer for a mouth's time or longer. Salaries are of ten paid quarterly. Leaving out these louter times of credit it is certain that er ry Saturday night there is due to the laborera of the United States a week's wages. There are in round numbers 18.000,000 workers. A dolllar and a half a day would seem a low estimate of average earnings. In all trades the rate is much higher. Large bodies of men earn $3 to $5 per day. But take this low average of $1.50 per day or $9 per week, and we have the 13,000,000 workers formed into a class of creditors to whom is due $117,000,000 every Satnrday uight. Observe that as soon as a one week's debt to these 13,000,000 creditors is paid, another debt of the same amount is accumulated. So if we take in round numbers the total weekly wages at only $100,000,000, we shall have the enormous sum of flve thousand two huudred million dollars as the sum which this creditor class of laborers has been creditor for, during a single year. This sum is more than three times the present national deot. lts importance, and the importance of the creditor class to which it must be paid, cannot be overestimated. Observe that as the debt is paid it continually grows in advance of payment so that the laborer is a creditor all the time. The employer is contiriually in debt to him for wages. Now, the proposition of this cheap money party is to allow debtors to pay their creditors in money worth less than half the gold value. This creditor class of workingmen to whom this $100,000,000 a week is falling due in gold will be paid off in silver worth less than fifty cents on the dollar. Can you see any possibility of gain ,to you as a workngman in this tion? You are a creditor. Do you want the debt to yon for wages paid in cheap money? You will be told that t.he silver dollar will buy as much as the gold dollar. Cau you believe this? ís it common sense? Will the holders of gold. which today will buy two dollars of silver fo'r one gold, be willing to exchange it tomorrow (after the legal tender act is passed) on equal terms? The holders of gold are not idiots. This is no new experiment. The greenbacks were made legal tender. Did that keep theni on a par with gold? We all know it did not. Many of you eau reinemberhow f ast the price of provisions rose and how slow wages advauced. Can you see any use in trying that experiment over again with a flfty 3ent dollar? But to return to this "creditor olass, " which this "Cheap Money Party" hopes to injure by paying off debts in silver. It is clear that the largest "creditor class" is composed of the thirteen rnillions of workers. As we have seen, the sum continually falling due for wages to this creditor class is euormous ; and besides wages, the deposits in savings banks, and the investrnents of erar great life iusurance companies, come largely from the savings of workers. Will this great creditor class, whicb also furnishes such a large proportion of votes, consents to aid in defrauding itself? If there is any property which should be guarded from depreciation it is these hard earned accumulations, saved to provide against the necessities of sickness or oíd age. But it is these very investments, owing to workingmen which tnis new party proposes to change so they may be paid off in "cheap money, ' ' at flfty cents, or less, on rhe dollar. The question, then, comes home to each workingman. You belong to the great creditor class. you are yourself a creditor ; do you want the debts due you for wages, for savings in banks, and for life insurance paid off in cheap money? The democratie state con ven ti on of Iowa placed the deinooracy of that state sqnarely on record in favor of sVrand raoney last Wednesday. And that too after just as square a defeat for the free silverites. The party in Iowa stands upon the democratie national platform of 1892 and henee is in harmony with the demesratic administration elected on that platform. The democrats of Iowa stand therefore with an undoubted majority of the American people in favor of real bimetalism as opposed to silver monometalism, or, what is the same thing, the free coinage of silver on the 16 to 1 ratio. They have faith in the national democracy and are unwilling to anticípate the action of the national convention. It is suffleient at this time to know that their voice is for a safe, sound and stable currency, a money as good to buy with as to pay debts with.

Article

Subjects

Ann Arbor Argus

Old News