What State Tax Commission Will Find Out About Us

WHAT STATE TAX COMMISSION WILL FIND OUT ABOUT US

The Data for Washtenaw County has been _____ by the County Register and Treasurer

COUNTY ASSESSED AT 87% OF ITS TRUE CASH VALUE

There Was During The Year Ending July 1st 610 Transfers of Real Estate----The Considerations Amounted to $840,726---The Assessed Valuation of the Same for 1898 was $727,689.

From the Daily Argus

During the year ending July 1, 1899, there were 610 transfers in real estate in Washtenaw county, the consideration for which aggregated $840,726. The assessed value of the property thus transferred was in 1898, $727,689, indicating, if this class of figures are worth much, that Washtenaw county is assessed at 87 per cent. of its cash value, a fact, we take it, which will be equalled by but few counties in the state.

These figures were obtained for the commission by the register of deeds and the county treasurer, the register making out a description of the transfers and the consideration, and the treasurer inserting the assessed valuation of these descriptions in the years 1890, 1894 and 1898. These transfers are taken in order, and are not tabulated by cities and towns, that work being left for the tax commission office.

Before these returns were sent to Lansing the Argus was given an opportunity to make a tabulation from them and consequently is able to announce what the state tax commission will find in reference to Washtenaw county.

The announced purpose of the tax commission is to secure an equalization of taxes throughout the state as well as between township and township. It is fair to presume that they intend using these figures for that purpose. Consequently the publication of these figures can have no influence against the taxation of any community, as they will be given official promulgation by the state tax commission before the next annual session of the supervisors. They were compiled by the Argus reporters without any knowledge of where they struck or who would be hit by them.

It must be said of the figures that exact justice cannot be done without a knowledge of the circumstances of the transfer of each piece of property. For instance, a piece of property may have been built on after the assessment and the transfer. Another illustration noticed by the Argus compilers was in where a brewery property was sold for $1,000. It was down on the assessment roll at $8,000. If this transfer were to be eliminated from the Manchester list, instead of that township being assessed at 93 per cent. of its value, as shown in the table the percentage would drop to 78. Other illustrations of the same kind could be given, although only one other would have so marked an effect. That is a property in Scio, where the consideration for the transfer is given at $1,825 and the assessed valuation only $1,800. If this transfer were eliminated instead of its being shown by the table that Scio assessed at 83 per cent of its value, it would be shown that its percentage was 116. Another illustration may be given from Ypsilanti city as to the effect one single transfer has upon the percentage table. In this city a Mr. Rathfon bought some property assessed at $4,800 for $15,000. If this one transfer had not been made, Ypsilanti's percentage would have jumped from 77 to 83. How the tax commission, viewing the matter at a distance, could tell what property to eliminate from the tables to make them just, is beyond the Argus ken.

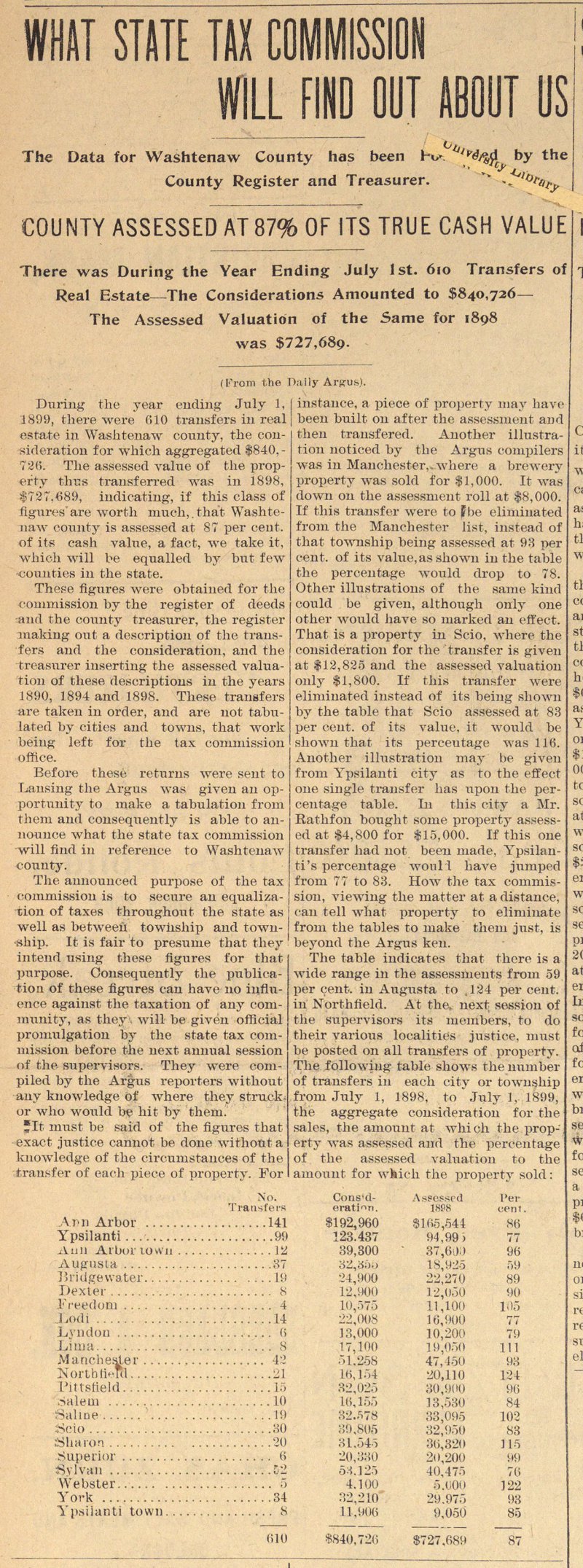

The table indicates that there is a wide range in the assessments from 59 per cent in Augusta to 134 per cent in Northfield. At the next session of the supervisors its members, to do their various localities justice, must be posted on all transfers of property. The following table shows the number of transfers in each city or township from July 1, 1898, to July 1, 1899, the aggregate consideration for the sales, the amount at which the property was assessed and the percentage of the assessed valuation to the amount for which the property sold :

# 0f Transfers Consideration Assessed 1898 Per Cent

Ann Arbor. 141 $192,960 $165,544 86

Ypsilanti 99 123,487 94,995 77

Ann Arbor Town. 12 39,300 37,600 96

Augusta 37 32,355 18,925 59

Bridgewater. 19 24,900 22,270 89

Dexter 8 12,900 12,050 90

Freedom 4 10,575 11,100 135

Lodi 14 22,008 16,900 77

Lyndon. 6. 13,000 10,200 79

Lima 8 17,100 19,050 111

Manchester 42 51,258 47,450 93

Northfield 21 16,154 20,110 124

Pittsfield 15 32,025 30,900 96

Salem 10 16,155 13,530 84

Saline 19 32,578 33,095 102

Scio 30 39,805 32,950 83

Sharon 20 31,545 36,320 115

Superior 6 20,330 20,200 99

Sylvan 52 53,125 40,475 76

Webster 5 4,100 5,000 122

York 34 32,210 29,975 93

Ypsilanti Twp. 8 11,906 9,050 85

______ _________ ________. __________

610 $840,726 $727,689 87

Article

Subjects

Old News

Ann Arbor Argus-Democrat