State Tax Commission May Raise Cain With Us

Figures Showing What the Equalization of the Several Town-

ships and cities Would Be.

__________________

THE DATA FURNISHED THEM IS TO BE ACTED

__________________

The present Equalization Throughout the County Would Be

Knocked Galley West - Fourteen Townships Would

be Lowered and Six Would Be Raised - Ann Arbor

and Ypsilanti Would Be Increased.

__________________

(From the Daily Argus).

The state tax commission will "raise Cain" in various parts of the state if its figures on which it proposes to work are worth anything. The publication of the tabulation of the figures as was obtained in yesterday s Argus has excited widespread interest. That they were faulty in certain instances was clearly shown here.

That the assessments are unequal or there are some peculiar circumstances connected with certain transfers in any one locality, may easily be demonstrated.

In Ann Arbor, for instance, the assessment was 86 per cent. of the consideration made in the deeds, vet here one piece of property assessed at $6,600 sold for $2,000, while one piece assessed at $900 sold for $4,000.

In Ypsilanti, where the per cent. was 77, one piece assessed at $4,800 sold for $15,000, while another assessed at $5,000 sold for $2,000.

In Ann Arbor town while property assessed at $4,800 sold for $500, other property assessed at $700 sold for $1,200.

In Augusta, while one property assessed at $300 sold for $2,400, another assessed at $225 sold for $100.

In Lyndon, property assessed at $4,100 sold for $3,000. while another piece assessed at $ 1,000 sold for $2,100.

In Lima, property assessed at $2,400 sold for $1,000, while property assessed at $500 sold for $1,200.

In Manchester, property assessed at $1,600 sold for $3,000, while property assessed at $8,000 sold for $1,000.

In Northfield an assessment of $900 sold for $150, while one of $700 sold for $1.000.

In Pittsfield two pieces of property assessed at $800 each sold for $1,600 and $340.

In Salem, property assessed at $3,000 sold for $5,000, while another piece assessed at $1,100 brought $750.

In Scio property assessed at $1,800 .brought $12,825, While property assessed at $2,300 sold for $1,200.

In Sharon, property assessed at $2,750 sold for $1,200, while a $200 tract sold for $450.

In Sylvan, property assessed for $1,300 sold for $6,000, while property assessed $900 brought $200.

These differences are undoubtedly not due so much to error of judgment on the part of assessors, as the consideration named do not always represent the real consideration or the real cash value of the property.

If such unusual assessments could be eliminated from the tables - and they exist in every township - the number of transfers being small, a far different table of percentages would be arrived at than is represented by the tax commission's figures.

Assuming, however, that these figures were acted upon in preparing a report of a committee on equalization just as they stand, 14 townships of the county would be lowered and six raised. And it would be no small $10,000 or $15,000 addition or reduction.

While Lima would be lowered $226,000, Augusta would be raised $326,000.

While Ann Arbor town would be lowered $115,000, the sand hills of Lyndon would be raised $82,000.

To put it in another way, while Lima's share of the state and county tax would be lowered a third, Augusta would be increased three-fifths.

While Ann Arbor town would save an eighth of its state and county tax. Lyndon would have to pay nearly a quarter more.

While the city of Ann Arbor would have to pay a tenth more state and county tax and Ypsilanti a sixth more, Webster's would be a third less.

According to the figures sent the tax commission, the property in Lodi is worth twice that in Northfield. Who believes it ?

According to these figures, Lodi is worth $170,000 more than Saline. Who believes that ?

While doubting the value of these figures, the Argus believes the figures of the board of supervisors also radically wrong.

The whole system of equalization is unjust, and a county commission which should look up these sales and assessments, and eliminate such as were of an unusual character and had no relation to the relative value of property, would arrive at an equalization radically different from either the figures obtained from using the tax commission figures without elimination or the equalization of the board of supervisors.

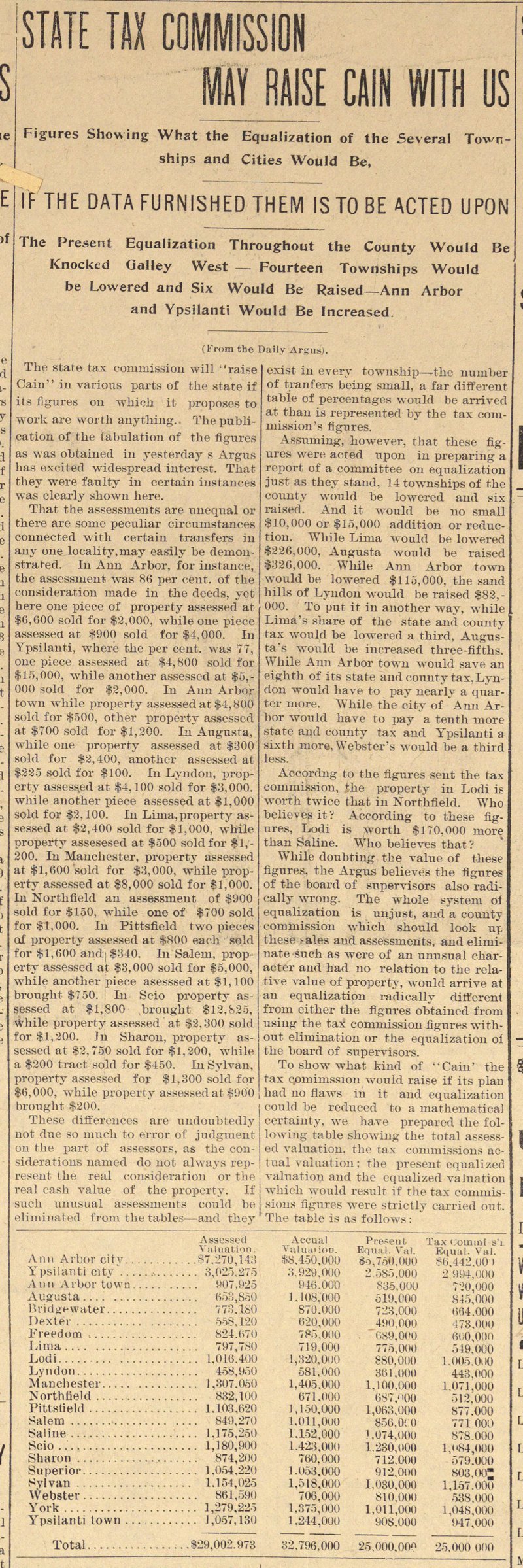

To show what kind of "Cain' the tax commission would raise if its plan had no flaws in it and equalization could be reduced to a mathematical certainty, we. have prepared the following table showing the total assessed valuation, the tax commissions actual valuation : the present equalized valuation and the equalized valuation which would result if the tax commissions figures were strictly carried out.

The table is as follows:

Assessed Accual Present Tax Commission

Valuation. Valuation. Equal. Val. Equal. Val

Ann Arbor city $7,270,143 $8,450,000 $5,750,000 $6,442,000

Ypsilanti city 3,025,275 3.929,000 2,585,000 2,994,000

Ann Arbor town 907,925 946,000 835,000 720,000

Augusta 653,850 1.108.000 519,000 845,000

Bridgewater 773,180 870,000 723,000 664,000

Dexter 558,120 620,000 490,000 473,000

Freedom 824,670 785,000 689,000 600,000

Lima 797,780 719,000 775,000 549,000

Lodi 1,016,400 1,320,000 880,000 1,005,000

Lyndon 458,950 581,000 361,000 443,000

Manchester 1,307,050 1,405,000 1,100,000 1,071,000

Northfield 832,100 671,000 687,000 512 000

Pittsfield 1,103,620 1,150,000 1,063,000 877,000

Salem 849,270 1,011,000 856,000 771,000

Saline 1,175,250 1,152,000 1,074,000 878,000

Scio 1,180,900 1,423,000 1.230,000 1,084,000

Sharon 874,200 760,000 712,000 579,000

Superior 1,054,220 1,053,000 912,000 803,000

Sylvan 1,154,025 1,518,000 1,030,000 1,157,000

Webster 861,590 706,000 810,000 538,000

York 1,279,225 1,375,000 1,011,000 1,048,000

Ypsilanti town 1,057,130 1,244,000 908,000 947,000

----------- ----------- --------- ---------

Total $29,002,973 32,796,000 25,000,000 25,000,000

Article

Subjects

Old News

Ann Arbor Argus-Democrat