"county Supervisor" Does A Little More Figuring

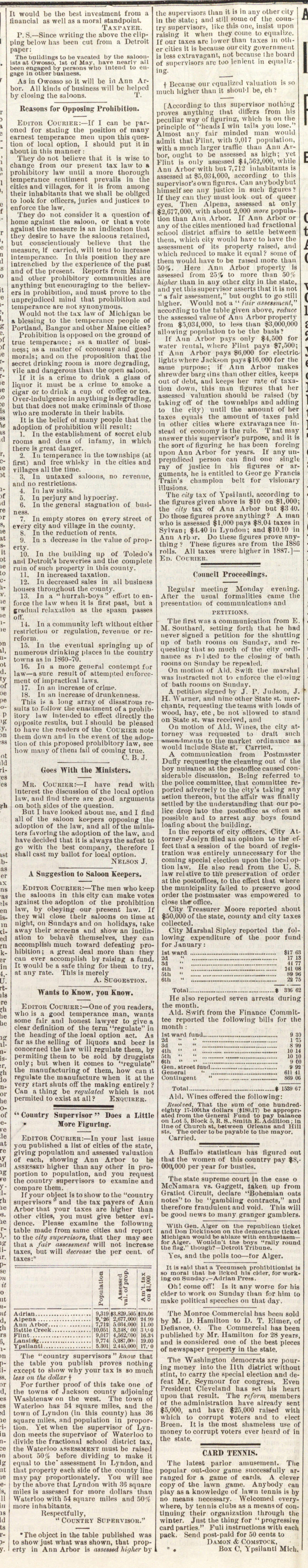

Kditor Courieu:- In your last issue you publi8hed a list of cities of the state, jrivini; populatiou and assessed valuatlon of each, showing Ann Arbor to be SSES8ki higher than auy other in proportion to populntlon, and you request the country supervisors to examine and compare them. If your object is toshow to the "country supervisors" and the tax payers of Ann Arbor tliat your taxes are higher than other i'ities, you must give better evidence. Please examine the following table made from same cities and report to the city suereigora, tliat they may see that a fair asessment will not increase taxes, hut will decreasc the per cent. of taxes: i The "country supervisors " know that - the table you publish proves nothing ¦ except to sliow why your tax is so miicï . less on the dollar f r For further proof of tliis take one of , the towi)8 of Jackson county adjoininjj i Va8htenaw on the west. The towii ol i Waterloo lias 54 square miles, and the i town of Lyiidou (n tliis county) has 3 : square miles, and population in propor¦ tiun. Yet when the supervisor of Lyni don meets the supervisor of Waterloo to ¦ divide the fractional school district tax, i the Waterloo asskssmknt must be raised i abont 50L before dividing to make it : eqnal to the' assessment In Lyndon, and l that property each skle of the county line s may pay proportionately. You will see by the above tliat Lyndon with 86 square , miles is assessed for more dollars than 1 Waterloo with 54 square miles and 50'í i more inhabitants. i Hespectfully, I " COUNTRY BUPIBVBOB." The object in the table publlshed was to show just what was shown, that property in Ann Arbor is ussessedhiijlierhy he supervisors thau it 9 n uuy otlicr ;ty n the state; and still somc of the connrv supervisors, like this onc, insist upon atalng it when thcy come to equalke. f our taxes are lower tliau taxes i II othr citics it is becau.se ourcity governmeut 3 less extravagant, iiot because ihe board of supervisors are too lonient in equallzf Because our cqualized valuution is 10 nucll higher thau it shouM be, ch ! [According to tlns supervisor nothing iroves anything that diflers from his eculiar way of ligurinsr, wblch is on the jrinciplc ofheadsl vvlu tails yon lose." Alraost any fair tninileil man would admit that Flint, with 3,01 7 popuktion, with a mach largor traflie tlian Aun Aibor, ouglit to be assessed as blffh; yet Flint is ouly asgessed $ 1,502,000, while Aun Albor with but 7,712 inhabitants is assessed at $5, 0;H, 000, according to tliis supervisor'sown figures. Can ftiiybodybut liitnselfsee any justicc in such íijíures? If they eau thcy must look out of ijueer eyes. Then Alpcua, assessed at only $2,077,000, with about 2,000 more population than Aun Arbor. If Ann Arbor or any of the citics montioneil had fractioual school district all'airs to settle between llicni, whicli city would have to have the assessinent of its property raised, and whicli redueed to make it cqual 'i sonie of thein would have to be raised more thau 50?í. Here Ann Arbor property is assessed from 2.V4 to more than 50'r hiíjlier thau in any other city in the state, and yet this supervisor asserts that it is not ' a fair aaaesnmnt," but oup;ht to j;o still hi;her. Would not a " fair asseismcnt," according to the tablegiven above, reduce thc assessed valué of Ann Arbor property from $"i,0."t 1,000, to les than $H,000,000 allowing popnlattoa to be the basis? If Ann Arbor pays only $4,500 for water rental, wliure Plint pays $7,500; if Ann Arbor pays $0,000 for electrice llghtd where Jnckron paysflO.OOO for the samo purpose; if Aun Arbor makes shrewder barg tina than other cilios, keeps out of debt, and keeps her rate of taxation down, this ni m liurcs that her assessed valuation should be raised (by tiiking oft' of the townships aDd adding to the city) ii ii til the ainount of her taxes equals the amount of taxes paid in other cities where extra vauance faitead of economy is the rule. Tliatmay answer this supervisor's purpose, and it is the sort offlga ring he has been forcing upou Ano Arbor for years. If any imprejudiced person can find one singlt ray of justice in his libares or arguments, he is entitled to George Krancis Train's champion belt for visionary illusions. The city tax of Ypsilauti, according to the figures given above is $10 on $1,000; the city tax of Ann Arbor but $3 40. Do those figures prove anything? A man who is assessed $1,000 pays $8.04 taxes iu Sylvan; $4.40 iu Lyndon; and $10.10 in Ann Arb r. Do these figures prove anything ? These figures are from the I880 rolla. All taxes were higher in 1887.] -

Article

Subjects

Ann Arbor Courier

Old News