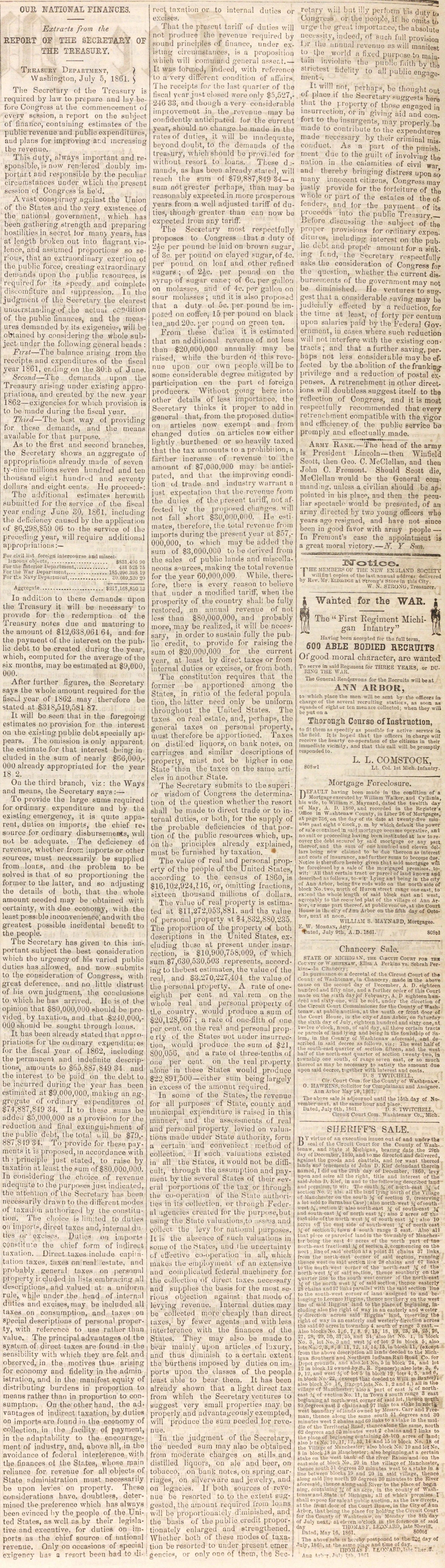

Our National Finances

Tkbasüky Department, ) Washington, July 5, 1861. The Secretary oi the Treasury is roquirod by luw to prepara and lay beforo Congrosa at ihe comnionoement of ëvepy scssion, ;i report on tho subject of financo, cootaining estinuitcs íf tho public revenue and public oxpenditures, and plans for iinproving and increasing tl) e re ven uo. This ciuty, nlwflys important and responsible, is now ronderod doubly importar, t and responsiblo by the peculiar circurr.stnnces uoder wl.ich the prescüt Bession of Congi'css is he'd. A vast oODspiraoy against tho Union of tho States and tlio vcry existence of the national governinent, which has been gathering strength and preparing hos'.ilities in secret ior rnair, years, has at lenglh b.rbkep out into flagrant violence, and assumed eo serous, that an extraordinary exerlion oí the public lorce', creating estraordioary demanda úpon tho public resources, is ■ required for :ts epeedy and cahipleto discomfitpre and suppression. Iu tho [judgmerit of ihe Sëcretary tbe olearest I unutrstandiug if iíe act u ai cCS'iiiion of the public finances, and the measures demanded by its exigencias, will bo obtained by considering tho whole subject undcr the folio wing genera] beads : First - The balance arising irom tbe receipts and expenditures of tbe fiscal year 1881, er.ding on the 3(kh oí' June. Second - Tho demar.ds upan the Treasury arising u rider existing appropriatioos, and created by the new year 1862 - exigencies for which provisión is to be made during the fiseul year, Thinl - The best way oí providing for these demanda, and the means available for tliat purpose. As to the first and eecond branches, the Secretary shows an aggregate of approprifitions airea dy made of sevon ty-riine milliona soven blind red and ten tnoúáand eight liumlr.i! and eeventy dollars, and eight cents. Ho proceedi-: The additiqnal estimules herewith subuiitted for the service of the fiscal year ending June 80, 1S61, including the defic'iency caused by the application of 6,298,859 06 to the service oí the preceding year, will reqüire additio.nal appropriatious:- For civil list forelgti intfreourse and miscel1 bcóqs objects $$:.] Tor the Aterior Dep.irtmunl, 431 525 75 ! wtuè w.ir Otpariment, Is5.a9e.3u8 la PÓfttt X:ivy Dt-paitmcut, c.009.52u 2) Aggrc;alo $2;T,lOS,8iO lo In addilion lo these demanda upon the Troasury it will bo necessary to provide for the redernpttoo ol " the 'i'reasury notes due and maturing to the amount oí $12,638,06164, and for the paynjeotof the interest on tbe public debt to be created during the year, which, computed for the average of' tho six montbs, may boestnnated at $9.000, 000. After furthor figures, the Secretary saya the whole amount required for the iiscd year of 1862 rnay thorofore bo stated at 818,519,581 87. It will be seen that in the fbregoing estimates no provisión fon the interest on tbe exi.Ming public debtspecially appears. The omission is only apparent tho estímate for that interest being ifl cluded in the suin of nearly Gü,000,000 airea dy approprialed ior the vear 18 2. On the third branch, viz: tho Ways and means, the Secretary says : - To provide the largo sums required for ordinary expenditure and by the existing ernergency, it is quite apparent, duties on importe, the ehief' re Bource lor ordinary disbursemefKs, wilt aot be adequate. The dt-ficiency ol revenue, whother írpití importa or otlier sourqes, must nectssarily be supplied from loacs, and the problera to be solved is that oí so proportioning the former to the lalter, and so acljusting the details of both, that tho whole amount ueeded rnay be obtained with cortainty. with due econotny, witb the least possible inconvenienco, andwith thu gr ea test posbible incidental benefit to the people. The Secretary has given to this important subject the best consideraticn wbich the urgen cy of bis varied public duties bas allovved, and now submits to the consideration of Congress, with great deforence, and nn little distrust of bis own judgrnent, the conclusión to wliioh he has arrived. lic is of the opinión that $80,000,000 should be provideci. by taxulioii, and that 240,000,OOOshould be souglit through loaus. It bas been alieady stated that appropriations for the oidinary expeiulitu.es i'or the fiscal year of 1802, iacluding the permanenfe and indefinite desci'iptions, amounto to 055.887, 8-19 34. and tho interest to bo paid on the debt to be incurred during the yeár has been estiniáted at $9,000,000,. making an aggregate of ordinary expenditures oí 74,887,849 34. Ii to these sums be addeii $5,000,000 as a provfcsioo (or tho reduction aud linal extinguihment of the public debt, the tota! , ill bo $79,887,819 34. To provide for the.se paymenta it ia proposed, in accordance with th : principie just t-tated, to ruiso by taxation at least the sum of $80,000,000. In considering the chóice of revenue adequato to tho purposes just indica tod, tho rittehlion of the Secrétury has bren necessari'y drawn to the difil-rent niod.es of taxadon aulhorized by the oonetitutiorf. Tho chpice i.s litfiited to duties ori imporls, direct tuXös and, iutenial du lies excise-, J)ii;i;s ,M importa fute tbe chief form of indirect laxation. Direct taxes inclu.ie capiiatation taxes, t.ixes on ren] estáte, and probably gener;.l taxes pn personal pioporty ii cluded in li-;s embracing al] descriptions, and valued at a uniform j rule, whihï under tho head of iitern.al duties and excises, may be included all taxes oti consumptir)n. and taxes on special descriptions of personal property, with reierencè to uso ratber iban ; valué. The principal advantages of tho system of direct taxes are found in the sensibility with wbich they are feit and observed, in tho motives thus arising for economy and fidelity in the admin istration, and in the manifest equity of diatributing burdens in proportion to means rather than in proportion to consumption. On the other hand, tho advantages of indirect taxation, by duties ! on imports are found iu the economy of colloction, in tho iacility of payment, in tho adaptability to the anco,ura,gement of industry, and, abovu all, in tho avoidance of federal interference with the linances of the Stf.tes, wbose main reliance for revenue for all objects of State üdministration must necessarily ■ bo npon levies on property. Theso , cotisiderations havo, donbtle-rs, detcrmincd the preferenco which has alwaya been evinced l;y the peoplo of the United States, as wdl aa by their legislativo and executive. for duties on mports as tho chief source of national revenue. Only on occasions of special eligency ba a resort been had to ! reet tnxation or to infernal du tica or excisés. That lbo pFoseul tariff of dut ios will not prodiie the revenue required bv Bouod principies oí Guaneo, iinder existing circiunstances, is a propositioo which wil! corninand general asser.t. I'. vvus iormed, indeed, vvith reference to a very different uondition of uffairsl The receipts tho lust qunrter of tho fiscal vear'jn&tcloged irereonly $5,527, 2-lü 33, and thoiigh a very considerable improvement in tho revean e niay bti confidentiy anttöpated for the eurrent yoar, should no change bo made in tho rafes of duties, t vill bo inadequate, bevond doubt, to the demande of the tre&bjUry, vvhiehshöuld bo provuted for without resort to iour.s. These d raands, as has boon already Btaied, will reach the ram of $79,887,849 34- a sum not . greater perhnps, than may be reasonably oxpected in more prospèroua years from a well idjiisted tarifF of duties, tbough greater than can np.w bo expected from :icy tnriff. i Tho Seeïetary most respeetfully i proposos to Congress tbat a dlíty o{ '2Ac per ponnd bo luid on brown sugar, of 3c. per pound on daver] sugar, of 4c. per pound on loai and other refined sugerí ; of 2c. per pound on tbe s', nip of Sugar enne; of 6c. per gallon on molasses, and of 4c. per gallon on Bour molasees ; and ie is also propossd th at a duty of So. per pound bc impóSOd on Cöffeflj 15 per ponnd on black I ie;,,and 20c. per popnd on green tija, From tliese tfuiiea it is estimated that an additioruil revenue of not less than 20,000,000 annually may be raised, white tho buiden oí this revenue upOD pur own people will bo to Borne considerable degree niitigated by participaron on tho part of foreign producers. Without going bere into other details of leas irnportanco, the Seeretary thinks it proper to add in general that, from the proposed dutie on anieles now exempt and fpom changed dutiea on articïea r.ow eithor ligbtly burthened or so heavily taxed that the tax amoHuta to aprohibiiion,a fartber incroaso of revenuo to the tmmint of 87,000,000 may bo antieipated, and tha; the improving oondition oí tradO and industry warrant a just expoctation that the revonue from tho duties of the present tariff, noL affected by the proponed chafigea wiB not fall "short 830,000,01)0. He estímate, therefore, the total revonue from importe during tbe present year at $57,000,000, to which may be added tho sum of 3,000,000 to be cjerived from the sales of public lands and miseollaneons S'urces, makin tbe total revenuo for the year 60,000,000. While, therefore, thero is every reason to believo that undor a rnodified tariff, when tho prospority of the country sh;;l! be fully restored, an annual revenue of not less than 880,000,000, and probably more, may be realized, it will be necessarv, in order to sustain fully the pub ie "credit, to provide fir raieiüg the sum ol $20,000,000 for the current year, at least by direct taxos or from interna] duües or excisos, or from both. The constitution requires that tho former bo apportioned among the States, in ratio of the federa! popula tioo, the latter néed only be uniform ihroughout the United States. The taxos on real estáte, and, perhaps, the general taxes on personal property, must therefore be apportioned. Taxes on distilied liquors, on bank notes, on carriages and similar descriptions of property', must not be high er in one State 'than the taxes on the samo uiticles in anothtr State. The Seeretary submits to thesuperi or wisdom of Congress tbe determination of thé (juestion whother tbc resort sball be made to direct trade or to intornal duties, or both, for the supply of the probable deficiencies oí that portion of the public resources which, upon tho principies already explained, must be furnished by taxation. The value of real and personal pi'operty of the people of the United States, according to the census of 1860, is Slü,102,9-24,116, or, omiiting fractions, t-ixteen tho'.isand miiüons of dollars. Tho value of real property is estimated at $11,272,053,881, and tha value of personal property nt 84,832,880,235, The proporüon of the property of both descriptions in the United States, excludiug thuso at present under i.nsurrection, is 10,900,758,009, of which sum 7,030,530,503 representa, according to tliebest estimatea, the vaiueof the real, and $8.270,227404 the value of tlio personal property. A rate of oneeighlh per cent ad val rem on the vvliolo real and personal property of tl.e country, would prodnoo u suiri of $20,128,Cö7 ; il raie of one-fifth of one per cent. on the rea' and personal property 'i the Stutes wot uuder inöuneption, would produce the suin of 821, 800,056, and a rate oí three-teoths oi óiie per cent. on the ïeal property alone in these States would produce 822,891,500- either sum being hirgely in excess oí' the amonnt required. In somo oi' the Staten, the revenue fot all purposes (;f State, county and municipal exhenditure is raised in this nnanner, and the assessments of real and personal property leviod on valuations made under Ölate authoritv. form a, certain and conveniont method of collection. It etfch vaiuations esisled in all tle fctatos, it would not be ditficult, through the assuinption and paymeni by tlie several States of their eeveral porporüons of the lax or through iha co-operation of the State authorities in i:s coMeeticn, or throngh Federal agencies created for the purpose,but using the State vaiuations, ti) ::s.s:í.-s and collecr. the levy for Datioonl purposes. It i the absence of nich valuiitipna in Bomeoi Uie States, und ihe uacertinty of effeoiive co-iij)eratiioo in uil, which malies the eibployiiieht of an extensiva and complicated federal machiuery for tlie ciilleeliou of direcL taxes Decessafy and BUpplies ihe basis for the most erioua objection against tbat mode of levving revenue. Interna! duties may bo collected more cheapjy than direct laxes, by fewer agenta and wïth ies intorferenco vvith the linances of the States. They may also bo made to bear mainly upon anieles of I'usurv, anti thus diminisb to a certain extent the burthens imposed by duties on imports upon tho classes of the people least able to bear them. It has been already shown that a ligbt direct tax from which tho Seeretary ventures to suggost very small properties may bo propcrly and advantagoously exempted, will produce the sum uceded for revonue. In the judgroent of tbo Socrotary, tho needed sum may also beobtaiued from moderate charges on stills and distilled liquors, on ale and beer, on tobáceo, on banl; notes, on spring carriages, on silvenvare and jewelry, and j on legacies. lf both sources of revenue be resorted to to the e.-itent suggested. the aïnount requïred from lo;ins will bo proportionalely d'cninished, and the basis of the public credit proportionately enlurged and sirengthened. Wbether both of these modes of taxation be resorted to under present umer genciea, or only onn of them, tbe retnry iij but Ily perfoitn his dutvto C'Qiigrese or the peop!o, t' he omita to the great importai:ce;tho absoluto -itv, iijdedd, of Buch full provisión l;r iliu tmouij reventte as will maniiest to tjio world , fixo! purpoíioíqinMa. tin nviolate tho public fi.ith bv the strietwt fidelity to al! public enaa! Mienta. ' e' IUvilH nof, pcrhapp, bc tfibnght out of place ,t the öecretaryshoÏÏ that tho poperty of thoso engaoC(] „ .nfumxtio„: of in giving &id and comfort to tho insurgente, may properlv !, made tó contribute to the expenditar made necessary by their criminal miscoudiict. As a part of tho p„njsf, ment d:ic to the guilt of involviDg tho nation in Ihe oaïamitiea of oivil war aml tbereby brirtging distrees upoaso ir.Liny innocent citizens, Cocgresa mav U8tly proviile for tho forfaiture of tho wHble or part of thé estates oi the of. fenders, mul lor the payment of tg proceeds into the public Tio;!Surv - Befpre dmcuesiog ihè subjöct of' the proper provipions for ordibnfy expendicines, inckidinr interest on the public dubt and prapër atnount. for a siribmg fi.nd, the Secretar? reepectfull? aske tho consideration of Congress for the q'.irstion, whether the current disbursnments of the goverfiment may not bo diniiiiisliud. Jle ventures to suj. gestthat a cojisiderablo suving may bo judicially effected by a reduction, for the tune at least, oí forty per centum upon salaries aid by the Federal Government, in caaes wbere such reduction will nol interfere with the esist ing contracta; and that a further saving, perhaps not Icís considerable may'bo effücted Ly tho ibolition of thefrankiDgprivilege and a reduction of postal expenses. A retrenchment in other directions wiU doubtleaasuggest itself to the reflection of Congress, and it is most respëctfully recominunded that every retrenchrfient compatible with the vigor and efficiency of the public service ba prumply and eftectually made.

Article

Subjects

Old News

Michigan Argus