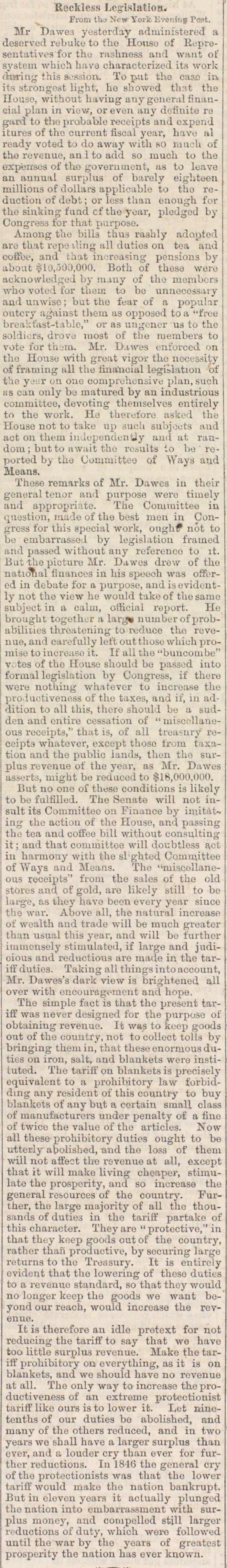

Reckless Legislation

Mr Dáwea yesteráay adniinístered a deaerved rebuke to tho Housu of Representativea for tho rnshness and want of systein whieh hava charactorized its worlc f this sosaion. Tojwt tho case in its strongest Light, he sbored that the House, without lmviug anygonera] Qnancial plan in view, oreren any doftnite re gtued to the probable receipta and expend itures of tho ourrent fisoal year, have al ready voted to do away with so muoh of tho revenue, un 1 to add so much to tho expenses of tbo government, as to leave an annuat surplus ot' barely eightuen millions of dollarè applicablo to thu reductiou of debt ; or less tlian enough for tho Binking f und cl' the year, plodgod by Congres.-, t'or that purposo. Among the bilis tlius rashly adaptod ig all dutiea on tea and cofioo, and that increasing pensions by about 110,500,000. Bothof thesa were acknowledged by :n.iuy of tho meiubors who voted for tuem to be unnecossury and uawiso ; but tho fuar of a populnr outcry against tlíem as opposod toa "freo iblo," or as ungener us to the Boldicrs, dvovo most of tbe raembera lo vote i'or th ;u. Mr. Dwes enforced on the House with great vigor the nor of Eraming 11 the íinanoial legislataou of the yei r on one oomprehensiva plan.such ::s can only bo matured by an industrious coinmittee, devoting themselves entiroly to tho work. He therefore asked the House not to t:ike u .íik'Íi subjoots and aot on them independen Üy an at random; butto await the resulta to be reported by thj Uowmitteo of W;iys aud Moans. ■i remarles of Mr. Dawes in their general tenor nn purpose were timely and appropriate. The Conitnittee i caestion, made of the best meil in Congress for ihis special work, ough? nót to be embairassej by legislation frained and passed without any roferenco to ít. liut the pioture Mr. Dawes drew of the natiotial finalices in bis speooh was offered in debate for a purpose, and isevidently not tho view he wuuld takeof the same ; i n a i;;ilii, ortieinl report. He brought together a largw nutnberofprobabiliiies thre.-itening to reduoe tho rovenue, and carefally left outthose whieh promise to incretiso it. If ali tho "buncoi v.tes of tho House should b(; passed into formal legislation by Oongress, if there were nothiny whatever to incroase tho productiventíss of the t.ixes, aud if, in addition to all this, thore should be ;i sudden and cntire cessation of " miscellaneous reoeipts," that is, of all treasnry receipts whatover, except thoso from taxaad the public land, then the surplus revenue of the year, as Mr. Dawes asïert !, might be reduoed to $16,000,000. But no one of these conditions is likoly to be fulülled. The Sonate will not insult its Cotnmitteo on Pinance by imítate in'j; che aotion of the House, and passing a and coffee bil! without consulting it ; and that couiinittoe will doubtless a,ct in harmony with the si ghted Cojnmittee of Vi ays and Mèans. The ons rocoipts trom tbc salea of tho old stores and of gold, aro likely still to bo large, i ave been every year since t!io war. Above all, the natural incroaso klth aii'l trade wijl be mnch il'eater than usual this year, and will bo linthor imiuensely stimnlated, if large and judioious and reductious are made in tlio tarifFduties. Taking all thingsinto account, Mr. Darrès's dark view is bnghtened all over with enooufasraient and hope. Tho simple faot is that the present tariff was never designod tor the purposo of obtaining revenue. It was to keep gooda out of the oountry, not to collect tolls by btinging tnem in, that these enoroious duii iron, salt, and blankets wero instituted. Tho tariii' on blankets is precisely equivalent to a prohibitory law forbidding any resident of this country to buy blanketg of any bit a certain sraall class of iuaiuitacturers under penalty oí' a fine of twice tlie valué of the articles. Xow all these prohibitory dutios ought to I"1 uttcrly abolished, and tho loss of them will not aö'ect tho rovenue at all, except that it will make living cheaper, stiraulate the prosperity, and so incroase the general resources of the country. Further, the large majority of all tho thousanda of dutiea in the tariff partake of this oharaeter. They are " protectivo," in that tliuy koep goods out of the country, rather thañ produotive, by securing large returns to the Treasury. It is entirely evident that tho lowering of thoso dutits to a i-evcuue standard, so that thev would no louger keep thu geoda wo want boyoiid our reach, would incroaso the rovenuo. It is thoreforo an idlo protext for not reducing thc tarift' to say that wo have too little surplus revenue. Mako the tarill' prohibitoñr on everything, as it is on blankots, and we shouïd have no rovenue at all. The only way to increaso thoproduetiveness oí' an extrome proteotionist turift' lik(! ours is to lower it. Let ninctenths of our duties bo abolishod, and many of the others reduced, and in two years we shall have a larger surplus than over, and ü loudor cry than ever for further reductions. In 181G thn general cry of tho protectionists was that the lowor tariíl' would maku tho nation bankiupt. But is eleven years it actually plungud the nation into eiabamssment with surplus money, and compollud stjll larger ductious of duty, whieh wero followyd until tho war by tho years of groatest prosperity tho nation has ever known.

Article

Subjects

Old News

Michigan Argus