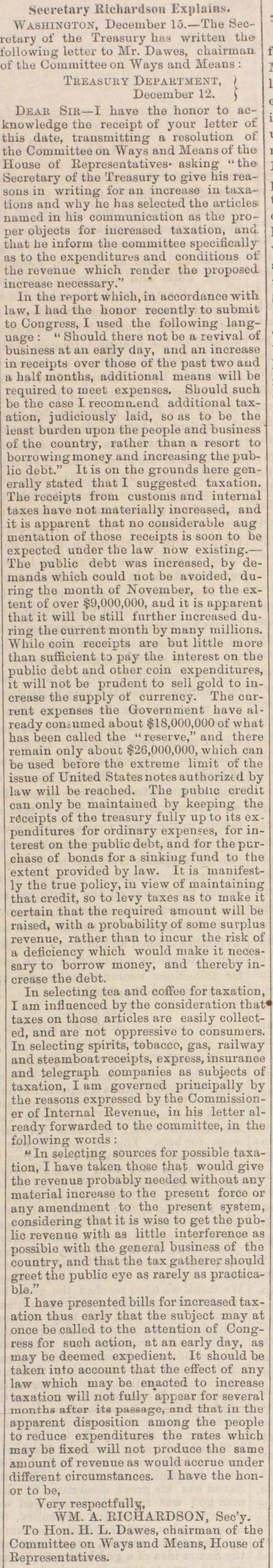

Secretary Richardson Explains

Washington, December 15. - The Seoetary of the Treasury haa writteu the ollowiug letter to Mr. Dawes, ohairman f the Committee ou AVays and Meaus : Treasuuy Department, ) December 12. f Deak Sik - I have the honor to acüiiowledge the receipt of your letter oL his date, trausmitting a resolution of he Committee on Ways and Meansof the louse of asking " the Secretary of the Xroasury to give his reaons in writiug for au increase in taxa,ions and why he has selected the articles. iam_d in his communication as the projer objects for iucreased taxation, and. ;hat he inform the committee specifically as to tho expenditurea and conditious ot' ,he revenue which render the proposed ncrease necessary."' In the report which, in accordance witli avv, I had the honor recently to subnut. ;o Congress, I used the following language : " Should there not be a revival of jusiness at an early day, and an increa.se in receipts over those of the past two aud a half uionths, additional means will be required to meet expenses. Sbould such ao the caso I recomn.end additional taxation, judiciously laid, so as to be the ieast burdon upon thepeoplö and business of the country, rather than a resort to borrowinsr monev and increasing the pub J t Ai A ■ BW ■ - , - w w J - - - - - ■ - I - I- - lic debt." It is ou the grounds here generally stated that I suggested taxation. The recëipts froui custouis and interual taxes have not materially increased, and it is apparent that no considerable aug mentation of thoso receipts is soon to be expected under the law now existing. - The public debt was increased, by demands which could not be avoided, during the month of November, to the extent of over $9,000,000, and it is apparent that it will bo still i'urther increased during the current month by many inillions. While coin recëipts are but little more than sufficient ta páy the interest on the public debt and other coin expenditures, it will not be prudent to sell gold to increase the supply of currency. The current expenses the Government have already coaaimed about $18,000,000 of what has been called the "reserve," and there remaiu only about $26,000,000, which can be used beiore the extreme limit of the issue of United States notes authoriztd by law will be reached. The public credit can only be maintaiued by keeping the rëceipts of the treasury fully up to its expenditures for ordinary expenses, lor in terest on the public debt, and for the pur chase of bonus for a sinking fund to th extent provided by law. It is manifesi ly the true policy, in view of maintainin that credit, so to levy taxes as to make ; certain that the required amount will b raised, with a probability of some suvplu revenue, rather than to incur the risk o a deíiciency which would make it necessary to borrow ínoney, and thereby increase the debt. ín seleoting tea and cofí'oe fortaxaticn, I am influenced by the consideration that tases on those articles are easily eollected, and are not oppressive to consumere. ín seleoting spirits, tobáceo, gas, railway and steamboatreceipts, express, insuranoe and telegraph companies as subjects of taxation, I atn governed principaliy by the reasons expressed by the Comrnissioner of Internal Eevenuo, in bis letter already forwarded to the coinmittee, in the following words : " ín seleoting sources for possible taxation, I havo taken those that would give the revenue probably noeded without any material increase to the present foroo or any araendment to the present system, considering that it is wise to get the public revenue with aa little interference as possible with the general business of the country, and that the tax gatherer should greet the public eye as rarely as practicable." I have presented bilis for increased taxation thus early that the subject inay at once be called to the attention of Congress for such action, at an early day, as rnay be deemed expedient. It should be taken into account that the effect of any law which inay be enacted to increase taxation will not fully appear for several months after its passage, and that iu the apparent disposition aruong the people to reduce expenditures the rates which may be íixed will not produce the same AUiount of revenue as would accrue under different circumstances. I have the honor to be, Very respBctfullv, WM. A. EICHAEDSON, Sec'y. To Hon. II. L. Dawes, chairman of the Committee on Ways and Means, House of Eepresen tatives.

Article

Subjects

Old News

Michigan Argus