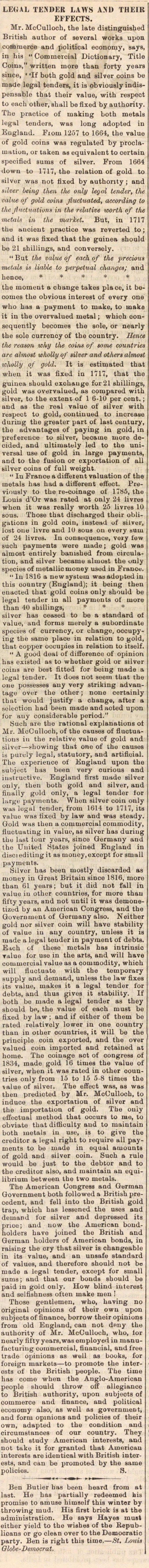

Legal Tender Laws And Their Effects

Mr. JYicCulloch, the late distinguished BritÍ8h author of several works upou commerce and political economy, saya, in his " Commercial Dictionary, Title Coina," written more than forty years siiice, ' 'If both gold aad silver coins be made legal tenders, it is obviously indispensable that their valuo, with respect to each otber, shall be fixed by authority. The practioe of making both metáis legal tenders, was long adopted in Kugland. Fioiu 1257 to 1664, the value of gold coins was regulated by proclamation, or taken as equivalent to certain spocified sums of silver. Frotn 1664 iown to 1717, the relation of gold to silvur was not iixed by authority ; and silver being then the only Ugal tender, the talue of gold coin fluctuated, according to tiie flncluation in tlte relative worth of tlie metate iu the market. But, in 1717 the ancieut praotice was reverted to ; and it wus iixed that the guinea should be 21 shilliugs, and conversely. "But the value of each of the precian metáis is Hable to perpetual chaage; and henee, the moment a change tukes place, it becomes the obvious interest of every one wlio has a payinent to make, to maka it in the overvalued metal ; which consequently becomes the sole, or nearly the sole currenoy of the country. Jlence the reason why the coins of tome countries are almost whoüy of Moer and others almost wliolly of gold. It is estimated that whrn it was fixed in 1717, that the guinea should exohaugo for 21 shilling, gold was overvalued, as compared with silver, to the extent of 1 6-10 per cent. ; and as the real value of BÜver with respect to gold, contiuued to increase during the greater part of last ceutury, the advautages of paying in gold, in prefereuce to silver, becauie more decided, and ultiumtely led to the universal use of gold in large payinents, and to the fusión or exportation of all bilver coins of full weight. " Iu France a diffeient valuation of the metáis has had a different effect, l'iuviously to the re-coinage of 1785, the Louis d'Or was rated at only 24 livres when it was really worth 25 livres 10 sous. Those that dischargod their obligutions in gold coin, instead of silver, lost oiiu hvre and 10 sous on every sum of 24 livres. In cousequenee, very few such payments were made ; gold was almost entirely bauished from eireulation, and silver becaine almost tbe uiily species of metallic mouey used iu Frauct. "In 1 S 113 a newsyatein was adopted iu this country (Bngland); it beiug then enacted that gold coius only should be legal tender iu all paytuouts of more than 40 sbillings, silver haa ceased to be a standard of value, and forms inerely a subordínate species of currency, or change, occupying the same place in relation to gold, that copper occupies in relation to itself. " A good deal of düi'uruncu of opinión has existed as to whether gold or silver coins are beet fltted for boiug made a legal tender. It does not seem tuat the one possesses auy very striking advantage over the other ; none certainly thut would justify a chaugs, after a seleotion had been made and aoted upon tor any considerable period." Such are the rational explanations oi Mr. McCulloch, of the causes of fluctuatious in the relative value of gold and silvur - showing that one of the causes is puiuiy lega!, statutory, and artificial. The experience of Knglaud upon the Bubjèot has been very curious and iustructive. Eugland first made silver only, then both gold and silver, and linally gold only, a legal tender tor large payinents. Whon silver coin only was logul tender, from 1614 to 1717, its vutue was iixed by law and was steady. Gold was then a commercial commodity, iluctuating in vitlue, as silver has during the last iour yoars, sinco Germany and the United States joined England in disciedi tingit as mouey, excopt for small payments. Silver has been mostly discarded as nioney in Great Britaiusince 1816, more tban 61 years ; but it did not fall in value in other countries, for more than fit'ty years, and not until it was demonetizod by an American Congress, and the Goverument of Germany also. Neither gold nor silver coin will have stability of value iu auy country, unless it is made a legal tender in payment of debts. Ktch of these metáis has intrinsic Talue for use in the arts, and will have commercial value as a commodity, which will fiuctuate with the temporary supply and demand, unless the law fixes its value, inakes it a legal tender for debts, and thus gives it stability. If both be made a legal tender as they should bn, the value of each must be fixed by law ; and if either of thein be rated relativoly lower in one country than in other oountries, it will be the principie coin exported, and the over valued coin imported and retained at home. The coiuage act of congress of 1834, made gold 16 times the value of silver, when it was rated in other oountries only from 15 to 15 5-8 timos the value of süvi.'i. The effect was, as was then predicted by Mr. McCullooh, to induce the exportation of silver and the importation of gold. The ouiy effectual uiethod that occurs to me, to obviate that difüculty and to niaintain both metáis iu use, is to give the creditor a legal right to require all payments to bu made in equal amounts of gold and silver coin. Such a rule would be just to the debtor and to the creditor also, and maintaiu au equilibrium between the two metáis. The American Congress and Gorman Government both foüowed a British precedent, and feil into the British gold trap, which has lessened the uses and deuiand for silver and depressed its pnce; and uow the American boudholders havo joiued the British and Germán holders of American bonds, in raising the cry that silver is changeable in its value, and an unsafe standard of values, and therefore should not be made a legal tender, except for small sums ; aud that our bonds should be paid iu gold only. Uow blind interest and selfishnoss oi'ten make men ! Those gentlemen, who, having no original opiuions of their owu upon subjeots of finance, borrow their opinions from old England, can not dmiy the authority of Mr. McCullocb, who, tor nearly fifty years, was employé! iu manufactuiing commercial, fiuancial, aud i'ree trade opinions as well as books, for foreign markets - to promote the interosts of the British people. The time has come when the Anglo-American people should throw o il' allegiance to British authority, upon subjeots of commerce and nuance, and political economy also, as well as goverument, and form opinions and policies of their own, adaptod to the condition aud circumstanoes of our country. They should study American interests, and not take it for granted that American interests are identical with British interests, and can be promoted by the same policies. S. Beo Butler bas been beard trom at last. He bas partially redeeined his promise to amuse hiinself tbis winter by throwing mud. His first briok is at the admiuiatration. He says Hayos must either yield to the wishes of the Republicana or go clean over to the Democratie party. Ben is right this time. - St. Louis Olobe-Democrat.

Article

Subjects

Old News

Michigan Argus