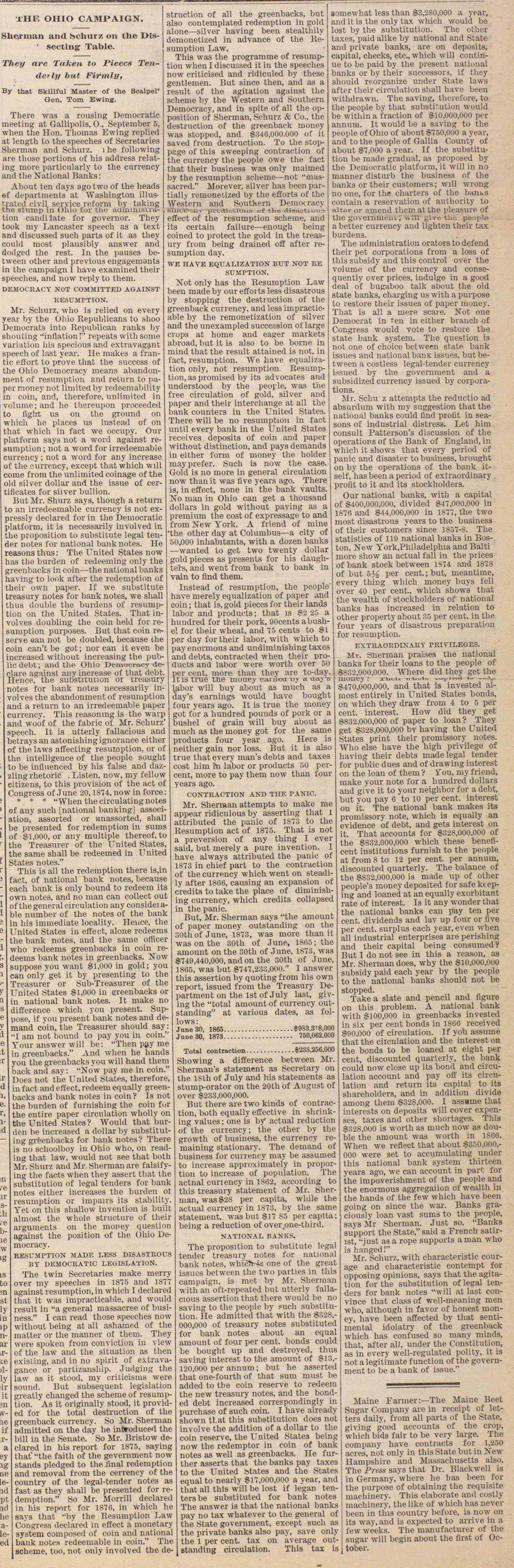

The Ohio Campaign

There was a rousing Democratie meeting at Gallipolis, O., September 5, when the Hon. Thomas Ewing replied at length to the speeches of Secretarles Sherman and Schuiz. i he following are those portions of his address relating more particularly to the currency and the National Banks : About ten days agotwo of the heads Of departments at Washington illusíiated civil servjee reform by taking the stump in ühio tor the umnnnsuation candi late for governor. They took my Lancaster speech as a text and discussed such parts of it as they could most plausibly answer and dodged the rest. In the pauses between other and previous engagemants in the campaign I have examined their speeches, and now reply to them. DEMOCRACY NOT COMMITTED AGAINST KESUMPTION. Mr. Schurz, who is relied on every year by the Ohio Republicans to ahoo Dernocrats into Republican ranks by shouting "'inflationl" repeats wilhsome variation his specious and extravagant speech of last year. He makes a frantic eftort to prove that the success of the Ohio Democracy means abandonment of resumption and return to paper money not limited by redeemability in coin, and, therefore, unlimited in volume ; and he thereupon proceeded to flglit us on the ground on which he places us instead of on that which in fact we occupy. Our platform says not a word against resumption ; not a word for irredeemable currency ; not a word for any increase of the currency, except that which will come from the unlimited coinage of the old silver dollar and the issue of certificates for silver bullion. But Mr. Shurz says, though a return to an irredeemable currency is not expressly declared for in the Democratie platform, it is necessarily involved in. the proposition to substitute legal tender notes for national bank notes. He reasons thus: The ITnited States now has the burden of redeeming only the greenbacks in coin - the national banks having to look after the redemption of their own paper. If we substitute treasury notes for bank notes, we shall thus doublé the buiden? of resumption on the United States. That invol ves doubling the coin held for resumption purposes. But that coin reserve can not be doubled, because the coin can't be got ; nor can it even be increased without increasing the public ueljt; and the Ohio Democincy declare against ar.y increase of that debt Ilence, the subsutivnon ot ireasury notes for bank notes necessarily involves the abandonment of resuniption and a return to an irredeemable paper currency. Tliis reasoning is the warp and woof of the fabric ot Mr. Schurz' speech. It is utterly fallacious and betrays an astonishing ignorance either of the laws affecting resurnption, or of the intelligence of the people sought to be influenced by his false and dazzling rhetoric . Listen, now, my f ellow citizens, to this provisión of the act of Congress of June 20, 1874, now in f orce : "When the circulating notes of any such [national banking] association, assorted or unassorted, shall be presented for redemption in sums of $1,000, or any multiple thereof, to the ïreasurer of the United States, the same shall be redeemed in United States notes." This is all the redemption there is,in fact, of national bank notes, because each bank is only bound to redeem its own notes, and no man can collect out of the general circulation any considei able number of the notes of the bank in his immediate locality. Henee, the United States in effect, alone redeems the bank notes, and the same officer who redeems greenbacks in coin redeems bank notes in greenbacks. Now suppose you want $1,000 in gold; you can only" get it by presenting to the Treasurer or Sub-Treasurer of the United States $1,000 in greenbacks or in national bank notes. It make no difference which you present. Suppose, if you present bank notes and demand coin, the Treasurer should say : "I am not bound to pay you in coin." Your answer will be: "Then p#y me in greenbacks." And when he hands you the greenbacks you will hand them back and say : "Now pay me in coin." Does not the United States, therefore, in fact and effect, redeem equally greenbacks and bank notes in coin? Is not the burden of furnishing the coin for the entire paper circulation wholly on the United States? "VVould that burden be increased a dollar by substituting greenbacks for bank notes? There is no schoolboy in Ohio who, on ing that law, would not see that Dotn Mr. Shurz and Mr. Sherman are f alsif ying the facts when they assert that the substitution of legal tenders for bank notes either increases the buiden ot resumptdon or impairs its stability. Yet on this shallow invention is built almost the whole strueture of their arguments on the morey quesüon against the position of the ühio Democracy. RESÜMPTION MADE LESS DISASTROUS BY PEMOCRATIC LEGISLA.TION. The twin Secretaries make merry over my speeches in 1875 and 1877 against resumption, in which I declared that it was impracticable, and would result in "a general massacree of business." I can read those speeches now without being at all ashained of the matter or the manner oí them. They were spoken from conviction in view of the law and the situation as then existiug, and in no spirit of extravagance or partizanship. Judging the law as it stood, my criticisuis were sound. But subsequent legislation greatly changed the scheme of resumption. As it originally stood, it provided for the total destruction of the greenback currency. So Mr. Sherman admitted on the day he introduced the bill in the Senate. So Mr. Bristow declared in his report for 1875, saying that' "the faith of the gevernment now stands pledged to the final redemption and removal from the cerrency of the country of the legal-tender notes as f ast as" they shall be presented for re demption." So Mr. Morrill declarei in his report for 1876, in which he aays that "by the Resumption Law Congress declared in effect a monetary system composed of coin and nationa bank notes redeemable in coin." The scheme, too, not only involved the struction of all the greenbacks, but alao conteinplated redemption in gold alone - silver having been stealthily demonetized in advance of the Resumption Law, This was the programme of resumption when I discussed it in the speeches now criticised and ridiculed by these gentlemen. But since then, and as a result of the agitation against the scheme by the Western and Southern Democracy, and in spite of all the opposition of Sherman, Schurz & Co., the destruction of the greenback money was stopped, and $346,000.000 of il saved from destruction. To the stoppage of this sweeping contraction of the currency the people owe the f act that their business was only maimed by the resumption scheme- not "massacred." Horever, silver has been partially rernonetized by the efforts of the Western and Southern Democracy effect of the resumption scheme, and its certain failure - enough being coined to protect tlie gold in the treasury from being drained ofl after resumption day. WE HAVE EQUALIZATION BUT NOT RE SUMPTION. Not only has the Resumption Law been made by our efforts less disastrous by stopping the destruction of the greenback currency, and less impracticable by the remonetization of silver and the unexampled succession of large crops at home and eager markets abroad, but it is also to be borne in mind that the result attained is not, in fact, resumption. We have equalization only, not resumption. Resumption, as promised by its advocates and understood by the people, was the free circulation of gold, silver and paper and their interchange at all the bank counters in the United States. There will be no resumption in iact until every bank in the United States receives deposits of coin and paper without distinction, and pays demands in either form of money the holder mayprefer. Such is now the case. Gold is no more in general circulation now than it was five years ago. There is, in effect, none in the bank vaults. No man in Ohio can get a thousand dollars in gold without paying as a premium the cost of expressage to and from New York. A f riend of mine 'the other day at Columbus - a city of 50,000 inhabitants, with a dozen banks - wanted to get two twenty dollar gold pieces as presenta f or his daughters, and went from bank to bank in vain to find them. Instead of resurnption, the people' have merely equalization of paper and . coin ; that is, gold pieces for their lands . labor and producís; that is $2 25 a hundred for their pork, 90cents abushel for their wheat, and 75 cents to $1 per day for their labor, with which to pay enormous and undiminishing taxes and debts, contracted when their pro aucts and labor were worth over 50 per cent, more than they are to-day. ltls true tne money emiiou dj oojtj Uibor will buy about as much as a day's earnings would have bought four years ago. It is true the money got for a hundred pouuds of pork or a bushei of grain will buy about as much as the money got for the same products four year ago. Here is neither gain nor loss. But it is also true that every man's debts and taxes cost him fn labor or products 50 percent, more to pay them now than four years ago. CONTRACTION AND THE rANIC. Mr. Sherman attempts to make me appear ridiculous by asserting that 1 attributed the panic of 1873 to the Resumption act of 1875. That is not a preversion of any thing I ever said, but merely a pure invention. I have always attributed the panic of 1873 in chief part to the contraction of the currency which went on steadily af ter 1866, causing an expansión of credits to take the place of diminishing currency, which credits collapsed in the panic. But, Mr. Sherman says "the amount of paper money outstanding on the SOthof June, 1873, was more than it was on the 30th of June, 1865 ; the amount on the 30th of June, 1873, was 8749,440,000, and on the 30th of June, 1865, was but $747,233,000." I answer this assertion by quoting f rom his own report, issued from the Treasury Department on the lst of July last, giving the "total amount of currency outstanding" at various dates, as follows: Jane 30, 1865 $933.3' 8,000 June 30, 1873 750,062.000 Total contraction $'233,256,000 Showing a difference between Mr. Sherman's statement as Secretary on the 18th of July and his statements as stump-orator on the 20th of August of over $233,000,000. But there are two kinds of contraction, both equally effective in shrinking values; one is by actual reduction of the currency; the other by the growth of business, the currency remaining stationary. The deinand of busmess lor currency may De assumeu to increase approximately in proportion to increase of population, The actnal cunency in 1862, aecording to this treasury statement of Mr. Sherman, was $28 per capita, while the actual currency in 1873, by the sarne statement, was but $17 85 per capita; being a reduction of over.one-third. NATIONAL BANKS. The proposition to substitute legal tender treasury notes for national bank notes, whicrf-is one of the great issues between the two parties in this campaign, is met by Mr. Sherman with an oft-repeated but utterly fallacious assertion that there would be no saving to tlie people by poeh substitution. He admitted that with the $328,000,000 of treasury notes substituted for bank notes about an equal amount of four per cent. bonds could be bought up and destroyed, thus saving interest to the amount of $13,120,000 per annum; but he asserted that one-fourth of that sum must be added to the coin reserve to redeem the new treasury notes, and the bonded debt increased correspondingly in purchase of such coin. I have already shown ttat this substitution does not involve the addition of a dollar to the coin reserve, the United States being now the redemptor in coin of bank notes as well as greenbacks. He further asserts that the banks pay taxes to the United htates and the States equal to nearly $17,000,000 a year, and that all this will be lost if legan tentersbe substituted for bank notes The answer is that the national banks pay no tax whatever to the general of the State government, except such as the private banks also pay, save only the 1 per cent. tax on average outstanding circulation. This tax is somewhat less than $3,280,000 a year, and it is the only tax which would be lost by the substitution. The other taxes, paid alike by national and State and private banks, are on deposita, capital, checks, etc., which will continue to be paid by the present national banks or by their successors, if they should reorganizo under State lawa after their ciretilation shall have been withdrawn. The saving, tberefore, to the people by that substitution would be withina fraction of $10,000,000 per annum. It would be a saving to the people of Ohio of iibout 750,000 a year, and to the people of Gallia County of about $7,000 a year. If the substitution be made gradual, as proposed by the Democratie platform, it will in no marmer distuxb the business of the banks or their customers; will wrong no one, for the charters of the bans contain a reservation of authority to altar or arnend them at the pleasure of the govenuiieiiL, srttl gtrejfeha peepla a better currency and lighten their tax burdens. The administration orators to defend their pet corporations from a loss of this subsidy and this control over the volume of the currency and consequently over prices, indulge in a good deal of bugaboo talk abont the old state banks, charging us with a purpose to restore their issues of paper money. That is all a mere scare. Not one Democrat in ten in either branch of Congress would vote to restore the state bank system. The question is not one of choice between state bank issues and national banK issues, but between a costless legal-tender currency iítsued by the government and a subsidized currency issued by corporations. Mr. Schu z attempts the reductio ad absurdum with my suggestion that the national banks could find proiit in seasons of industrial distress. Let him consult Patterson's discussion of the operations of the Bank of England, in which it shows that every period of panic and disaster to business, brought on by the operations of the bank itself , has been a period of extraordinary proflt to it and its stockholders. Our national banks, with a capital of $400,000,000, divided $47,000,000 in 1876 and $44,000,000 in 1877, the two most disastrous years to the business of their customers since 1857-8. The statistics of 119 national banks in Boston, New York.Philadelphia and Balti more show an actual f all in the pi ices of bank stock between 1874 and 1878 of but bi per cent.; but, meantime, everv thinsr which money buys feil over 40 per cent., which shows that the wealth of stockholders of national banks has increased in relation to other property about 86 per cent. in the four years of disastrous preparalion for resumption. EXTltAOKDINARY PRIVILEGES. Mr. Slierman praises tlie national banks for their loans to the people of $832,000,000. Where did they get the uioney r xiiix t, iii .f m - V 6470,000,000, and that is invested almost entirely in United States bonds, on whicli they draw from 4 to 5 per cent. interest. How did they get $832,000,000 of paper to loan ? They get $328,000,000 by having the United States print their promissory notes. Who else have the high privilege of having their debts made legal tender for public dues and of drawing interest on the loan of them 't 5Tou, niy f riend, make your note for a hundred dollars and gfve it to your neighbor for a debt, but you pay 6 to 10 per cent. interest on it. The national bank makes its promissory note, which is equally an evidence of debt, and gets interest on it. That accounts for $328,000,000 of the $832,000,000 which these beneflcent institutions furnish to the people at from 8 to 12 per cent. per annum, discounted quarterly. The balance of the $832,000,000 is made up of other people's money deposited for safe keeping and loaned at an equally exorbitant rate of interest. Is it any wonder that the national banks can pay ten per cent. dividends and lav up four or five per cent. surplus each year.even when all industrial enterprises are perishing and their capital being consumed? But I do not see in this a reason, as Mr. Sherman does, why the $10,000,000 subsidy paid each year by the people to the national banks should not be stopped. Take a slate and pencil and figure on this problem. A national bank with $100,000 in greenbacks invested in six per cent bonds in 1800 received $90,000 of circulation. If you assume that the ciiculation and the interest on the bonds to be loaned at eight per cent, discounted quarterly, the bank could now close up its bond and circulation account and pay off its circulation and return its capital to its shareholders, and in addition divide among them $328,000. I asswine that interest on deposits will cover expenses, taxes and other shortages. This $828,000 is worth as much now as doublé the amount was worth in 1800. When we reflect that about 000 were set to accumulatmg uncier this national bank systern thirteen years ago, we can account in part for the impoverishment of the people and the enormous aggregaiion of wealth in the hands of the few which have been going on since the war. Banks graciously loan vast sums to the people, says Mr Sherman. Just so. "Banks support the State," said a Frenen satirist, "just as a rope supports a man who is hanged I" Mr. Schurz, with characteristic courage and characteristic con tempt for opposing opinions, says that the agitation for the substitution of legal tenders for bank notes "will at last conviDce that classof well-meaning men who, although in favor of honest money, have been affected by that sentimental idolatry of the greenback which has confused so many minds, that, after all, under the Constitution, as in every well-regulated polity, it is not a legitímate f unction of the government to bu a bank of issue." Maine Farmer:- The Maine Beet Sugar Company are in receipt of letters daily, from all parts of the State, giving good accounts of the erop, which bids fair to be very large. The company have contracta for 1,250 acres, not only in this State but in New Hampshire and Massachuaetts also. The Press says that Dr. Blackwell is in Germany, where he has been for the purpose of obtaining the requisite nmehinery. This elabórate and costly machinery, the like of which has never been in this country before, is now on its way, and is expected to arrive in a few weeks. The manufacturar of the sugar will begin about the tirst of October.

Article

Subjects

Old News

Michigan Argus