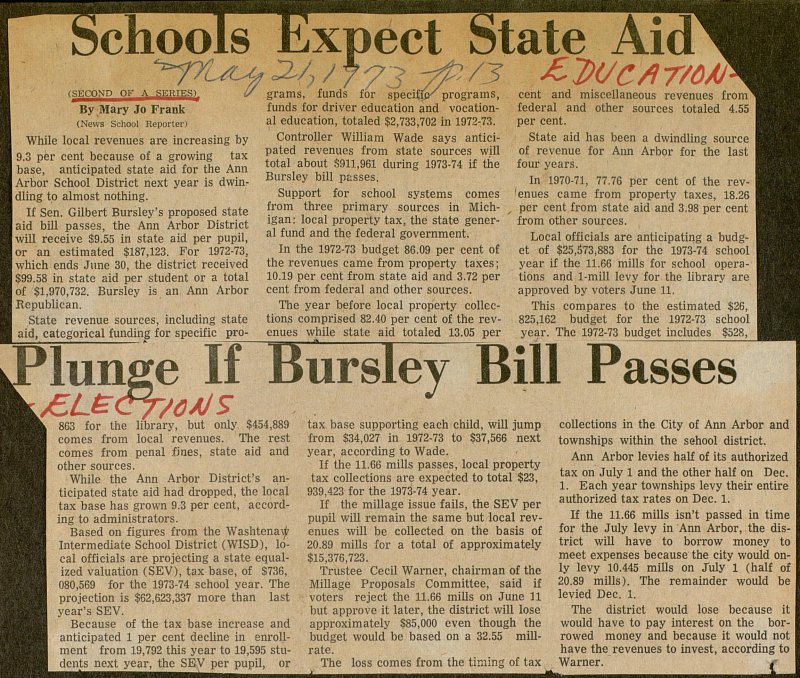

Schools Expect State Aid Plunge If Bursley Bill Passes

(SECOND OF A SERIES) While local revenues are increasing by 9.3 per cent because of a growing tax base, anticipated state aid for the Aim Arbor School District next year is dwindling to almost nothing. If Sen. Gilbert Bursley's proposed state aid bill passes, the Ann Arbor District will receive $9.5,5 in state aid per pupil, or an estimated $187,123. For 1972-73, which ends June 30, the district received $99.58 in state aid per student or a total of $1,970,732. Bursley is an Ann Arbor Republican. State revenue sources, including state aid, categorical funding for specific 1 j y - grams, funds for specifljy programs, funds for driver education and vocational education, totaled $2,733,702 in 1972-73. Controller William Wade says anticipated revenues from state sources will total about $911,961 during 1973-74 if the Bursley bill passes. Support for school systems comes from three primary sources in Michigan: local property tax, the state general fund and the federal government. In the 1972-73 budget 86.09 per cent of the revenues came from property taxes; 10.19 per cent from state aid and 3.72 per cent from federal and other sources. The year before local property collections comprised 82.40 per cent of the revenues while state aid totaled 13.05 per cent and miscellaneous revenues from federal and other sources totaled 4.55 per cent. State aid has been a dwindling source of revenue for Aiin Arbor for the last four years. In 1970-71, 77.76 per cent of the rev'enues came from property taxes, 18.26 per cent from state aid and 3.98 per cent from other sources. Local officials are anticipating a budget of $25,573883 for the 1973-74 school year if the 11.66 milis for school operations and 1-mill levy for the library are approved by voters June 11. This compares to the estimated $26, 825,162 budget for the 1972-73 school year. The 1972-73 budget includes $528, 863 for the library, but only. $454,889 comes from local revenues. The rest comes from penal fines, state aid and other sources. While the Ann Arbor District's anticipated state aid had dropped, the local tax base has grown 9.3 per cent, according to administrators. Based on figures from the Washtenav(' Intermedíate School District (WISD), local officials are projecting a state equalized valuation (SEV), tax base, of S736, 080,569 for the 1973-74 school year. The projection is $62,623,337 more than last year's SEV. Because of the tax base increase and anticipated 1 per cent decline in enrollment from 19,792 this year to 19,595 students next year, the SEV per pupil, or tax base suoporting each child, will jump from $34,027 in 1972-73 to $37,566 next year, according to Wade. If the 11.66 milis passes, local property tax collections are expected to total $23, 939,423 for the 1973-74 year. If the millage issue fails, the SEV per pupil will remain the same but local revenues will be collected on the basis of 20.89 milis for a total of approximately $15,376,723. Trustee Cecil Warner, chairman of the Millage Proposals Committee, said if voters reject the 11.66 milis on June 11 but approve it later, the district will lose approximately $85,000 even though the budget would be based on a 32.55 millrate. The loss comes from the timing of tax collections in the City of Ann Arbor and townships within the school district. Ann Arbor levies half of its authorized tax on July 1 and the other half on Dec. 1. Each year townships levy their entire authorized tax rates on Dec. 1. If the 11.66 milis isn't passed in time for the July levy in Ann Arbor, the district will have to borrow money to meet expenses because the city would only levy 10.445 milis on July 1 (half of 20.89 milis). The remainder would be levied Dec. 1. The district would lose because it would have to pay interest on the borrowed money and because it would not have the revenues to invest, according to Warner. f