The question at issue this fall is simpl...

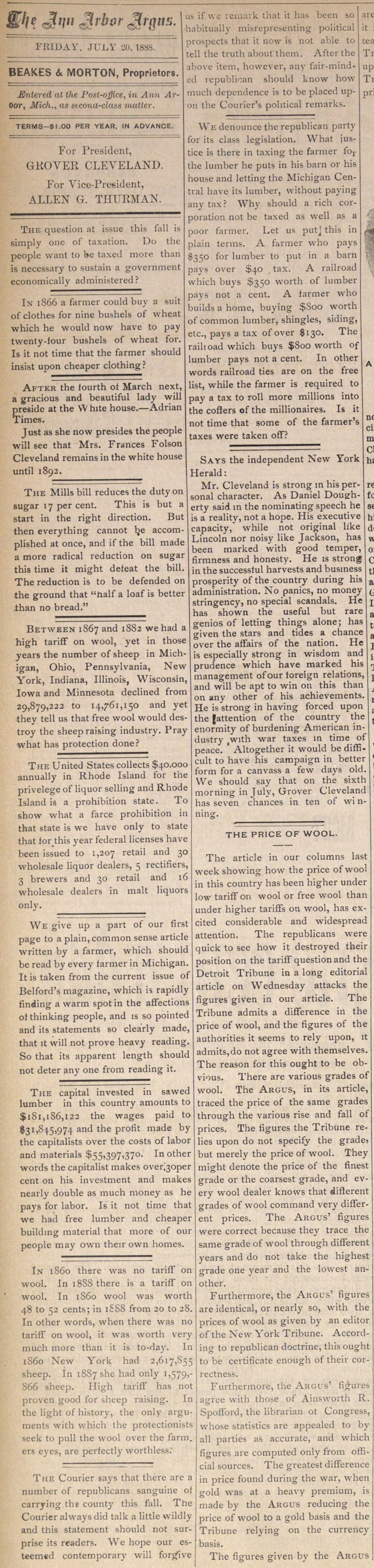

The question at issue this fall is simply one of taxation. Do the people want to be taxed more than is necessary to sustain a government economically administered? In 1S66 a farmer could buy a suit of clothes for nine bushels of vvheat which he would now have to pay twenly-four bushels of wheat for. Is it not time that the farmer should insist upon cheaper clothing? After the fourth of March next, a gracious and beautiful lady will preside at the W hite house. - Adrián Times. Just as she now presides the people ■will see that Mrs. Francés Folson Cleveland remains in the white house until 1892. The Mills bilí reduces the duty on sugar 17 per cent. This is but a start in the right direction. But then everything cannot tje accomplished at once, and if the bill made a more radical reduction on sugar this time it might defeat the bill. The reduction is to be defended on the ground that "half a loaf is better ihan no bread." Between 1867 and 1882 we had a high tariff on wool, yet in those years the number of sheep in Michigan, Ohio, Pennsylvania, New York, Indiana, Illinois, Wisconsin, Iowa and Minnesota declined from 29,879,222 to 14,761,150 and yet they teil us that free wool would destroy the sheep raising industry. Pray what has protection done? The United States collects $40.000 annually in Rhode Island for the privelege of liquor selling and Rhode Island is a prohibition state. To show what a farce prohibition in that state is we have only to state that for this year federal licenses have been issued to 1,207 retail and 30 wholesale liquor dealers, 5 rectifiers, 3 brewers and 30 retail and 16 wholesale dealers in malt liquors only. We give up a part of our first page to a plain, common sense article written by a farmer, which should be read by every farmer in Michigan. It is taken from the current issue of Belford's magazine, which is rapidly finding a warm spot in the affections of thinking people, and is so pointed and its statements so clearly made, that it will not prove heavy reading. So that its apparent length should not deter any one from reading it. The capital invested in sawed lumber in this country amounts to $i8i,iS6,I22 the wages paid to $31,84.5,974 and the profit made by the capitalists over the costs of labor and materials $55,397,370. Inother words the capitalist makes overloper cent on his invcstment and makes nearly doublé as much money as he pays for labor. Is it not time that we had free lumber and cheaper building material that more of 0111 people may own their own homes. In 1860 there was no tariff on wool. In 18SS there is a tariff on wool. In 1S60 wool was worth 48 to 52 cents; in 1SS8 from 20 to 2S In other words, when there was 110 tariff on wool, it was worth very much more than it is to-day. In 1860 New York had 2,617,855 sheep. In 1887 she had only 1,579,S66 sheep. High tariff lias not proven good for sheep raising. In the light of history, the only aiguments with which the protectionists seek to pull the wool over the farm. ers eyes, are perfectly worthlcss. The Courier says that there are a number of republicans sanguine o: carrying the county this feil. The Courier alvvaysdid talk a little wildly and this statement should not surprise its readers. We hope our esteemed contemporary will forg"ive us if wc remark that it has been so haiiitiuilly misrepresenting politica! prospects that it now is not able to teil the truth aboufthetn. After the above item, however, any fair-minded republioán should 1-cnow how much dependence is to be placed upon the Courier's pohtical remarks. We denounce the republican party tbr its class legislation. What justice is there in taxing the farmer for the lumber he puts in his bain or his house and letting the Michigan Central have its lumber, without paying any tax? Why should a rich corporation not be taxed as well as a poor farmer. Let us putj this in plain terms. A farmer who pays $350 for lumber to put in a barn pays over $40 tax. A railroad which buys $350 worth of lumber pays not a cent. A farmer who builds a home, buying $Soo worth of common lumber, shingles, siding, etc., pays a tax of over $130. The raihoad which buys $800 worth of lumber pays not a cent. In other words railroad ties are on the free list, while the farmer is required to pay a tax to roll more millions into the coflers of the millionaires. Is it not time that some of the farmer's taxes were taken off? Says the independent New York Herald: Mr. Cleveland is strong in his personal character. As Daniel Dougherty said in the nominating speech he is a reality, not a hope. His executive capacity," while not original like Lincoln nor noisy like Jackson, has been marked with good temper, firmness and honesty. He is strong in the successtul harvests and business prosperity of the country during his administration. No panics, no money stringency, no special scandals. He has shown the useful but rare genios of letting things alone; has given the stars and tides a chance over the affairs of the nation. He is especially strong in wisdom and prudence which have marked his management of our toreign relations, and will be apt to win on this than on any other of his achievements. He is strong in having forced upon the Jattention of the country the enormity of burdening American industry (with war taxes in time of peace. Altogether it would bedifficult to have his campaign in better form for a canvass a few days old. We should say that on the sixth morning in July, Grover Cleveland has seven chances in ten of vvi nning.

Article

Subjects

Ann Arbor Argus

Old News