Taxes For The Poorest

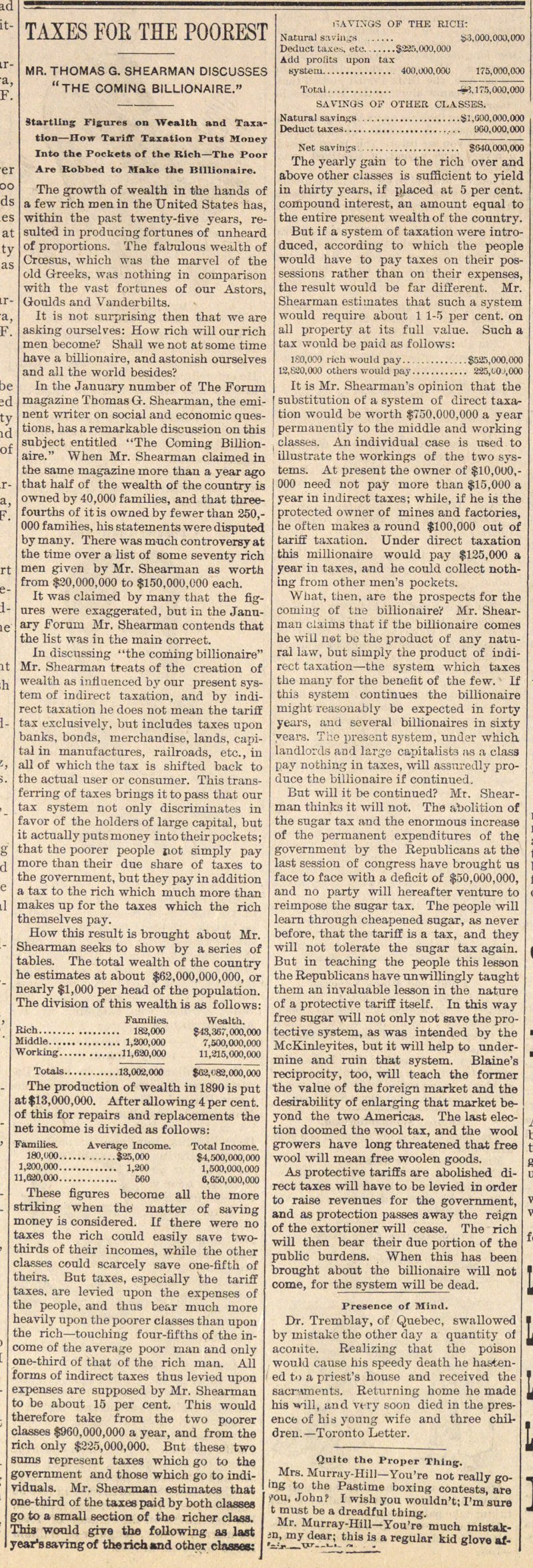

The growth of wealth in the hands of a few rich men in the United States has, within the past twenty-frve years, resulted in producing fortunes of unheard of proportions. The fabulous wealth of Crcesus, which was the marvel of the old G-reeks, was nothing in comparison with the vast fortunes of our Astors, Q-ouMs and Vanderbilts. It is not surprising then that we are asking ourselves: How rich will our rich men become'i Shall we not at some time have a billionaire, andastonish ourselves and all the world besides? In the January nnmber of The Forum magazine Thomas G. Shearman, the eminent writer on social and economie questions, has a remarkable discussion on this subject entitled "The Coming Billionaire." When Mr. Shearman claimed in the same magazine more than a year ago that half of the wealth of the country is owned by 40,000 families, and that threef ourths of it is owned by f ewer than 250,000 families, his statements were disputec by many. There was much controversy al the time over a list of some seventy rich men given by Mr. Shearman as worth from $20,000,000 to $150,000,000 each. It was claimed by many that the figures were exaggerated, but in the January Foruin Mr. Shearman contends that the list was in the main correct. In discussing "the coming billionaire" Mr. Shearman treats of the creation of wealth as intíuenced by our present system of indirect taxation, and by indirect taxation he does not mean the tariff tax exclusively, but includes taxes upon banks, bonds, merchandise, lands, capital in manufactures, railroads, etc, in all of which the tax is shifted back to the actual user or consumer. This transferring of taxes brings it to pass that our tax system not only discriminates in favor of the holders of large capital, but Lt actually putsmoney intotheirpockets; that the poorer people pot simply pay more than their due share of taxes to the government, but they pay in addition 3, tax to the rich which much more than makes up for the taxes which the rich themselves pay. How this result is brought about Mr. 3hearman seeks to show by a series of tables. The total wealth of the country ie estimates at about $62,000,000,000, or aearly $1,000 per head of the population. Fhe división of this wealth is as follows: Families. Wealth. Rich 188,000 $48,367, 000,000 Middle 1,800,000 7,500,000,000 Working 11,680,000 11,215,000,000 Totals 13,002,000 $02,;82,000,000 The production of wealth in 1890 is put at $13,000,000. Afterallowing4percent. of this for repairs and replacements the net income is divided as follows: Families. Average Income. Total Income 180,000 $25,000 $4,500,000,000 1,200,000 1,200 1,500,000,000 11,620,000 660 6,650,000,000 These figures become all the more striking when the matter of saving money is considered. If there were no taxes the rich could easily save twothirds of their incomes, while the other classes could scarcely save one-fifth of theirs. But taxes, especially 'the tariff taxes, are levied upon the expenses of the people, and thus be&r much more heavily upon the poorer classes than upon the rich- touching four-fif ths of the income of the average poor man and only one-third of that of the rich man. All forms of indirect taxes thus levied upon expenses are snpposed by Mr. Shearman to be about 15 per cent. This would therefore take trom the two poorer classes $960,000,000 a year, and from the rich only $225,000,000. Bnt these two sums represent taxes which go to the government and those which go to individuáis. Mr. Shearman estimates that one-third of the taxee paid by both classes go to a small section of the richer class. This would gire the following as last yeartsaviBgof the rich and other classes: l'AVIXGS OF THE RICIï: Natural savm-s $:3,000,00U,U00 Deduct Ui.ves, etu 3225,000,000 Acid proiits upon tax systeiu 40(1,000,000 175,000,000 Total -m, 175, 000, 000 SAVINGS OF OTHER CLASSES. Natural savinxs $1, 00,000,000 Deduct taxes 9CO,000,000 Net savitiss 8640,000,000 The yearly gain to the rich over and above other classes is sufficient to yield in thirty years, if placed at 5 per cent. compound interest, an amount equal to the entire present wealth of the country. But if a system of taxation were introduced, according to which the people would have to pay taxes on their possessions rather than on their expenses, the result would be far different. Mr. Shearman estimates that such a system would require about 1 1-5 per cent. on all property at its f uil valué. Such a tax would be paid as follows: 180,000 rich would pay $525,000.000 12,(00,000 othei-s would pay 225,00 J.OOO It is Mr. Shearman 's opinión that the substitutiou of a system of direct taxation would be worth $750,000,000 a year permauently to the middle and working classes. An individual case is med to illustrate the workings of the two systeins. At present the owner of $10,000,000 need not pay more than $15,000 a year in indirect taxes; whiie, if he is the protected owner of mines and factories, be often makes a round $100,000 out of tariif taxation. Under direct taxation this millionaire would pay $125,000 a year in taxes, and he could collect nothing from other rnen's pockets. Wliat, then, are the prospects for the coming of tüe billionaire'i Mr. Shearmau claims tliat if the billionaire comes he wiU nst be the product of any natural law, but simply the product of iDdirect taxation - -the system which taxes the niany for the benefit of the few. If thi3 system continúes the billionaire might reaaonabl}' be expected in forty years, and several billionaires in sixty yeara. The presant system, under which landlords and large capitalists as a class pay nofching in taxes, will assuredly produce the billionaire if continued.. But will it be continued? Mr. Shearman thiaka it will not. The abolition of the sngar tas and the enormous increase of the permanent expenditures of the governmeut by the Republicans at the last session of congress have brought us face to face with a deficit of $50,000,000, and no party will hereaf ter venture to reitnpose the sugar tax. The people will learn through cheapened sugar, as never before, that the tariff is a tax, and they will not tolérate the sngar tax again. But in teaching the people this lesson the Republicans have unwülingly taught them an invaluable lesson in the nature of a protective tariff itself . In this way free sugar will not only not save the protective system, as was intended by the McKinleyites, but it will help to undermine and ruin that system. Blaine's reciprocity, too, will teach the fonner the value of the f oreign market and the desirabiiity of enlarging that market beyond the two Americas. The last election doomed the wool tax, and the wool growers have long threatened that free wool will mean free woolen goods. As protective tariffs are abolished direct taxes will have to be levied in order ;o raise revenues for the government, and as protection passes away the reign of the extortioner will cease. The rich will then bear their due portion of the public burdens. When this has been Drought about the billionaire will not come, for the system will be dead.

Article

Subjects

Economics

Taxes

Tariffs

Old News

Ann Arbor Argus

Thomas G. Shearman